Summary:

The dollar-euro is the most actively traded currency pair in the world. It is often what is meant when people ask where is the dollar trading. Dollar bullish sentiment prevailed in 2015, but many large banks doubt that it will continue in 2016. This Great Graphic from the Wall Street Journal shows the euro forecasts of eleven major banks. Indeed, it appears that only one of the eleven banks expect the euro to finish next year below parity (.00). Three banks, HSBC, UBS and JP Morgan have the euro closing next year above .10. We suspect some economists had been looking for a greater euro decline this year and some may be correcting for this. Our forecasts did not have the euro falling below parity until toward the middle of 2016. We are not convinced that the ECB has exhausted its scope for easing, and suspect it will be revisited in late Q2 16. Our longer-term views are not far from Goldman Sachs and Deutsche Bank. We anticipate that before the Obama dollar rally is over, the euro will approach its historic lows.

Topics:

Marc Chandler considers the following as important: Featured, FX Trends, Great Graphic, newsletter

This could be interesting, too:

The dollar-euro is the most actively traded currency pair in the world. It is often what is meant when people ask where is the dollar trading. Dollar bullish sentiment prevailed in 2015, but many large banks doubt that it will continue in 2016. This Great Graphic from the Wall Street Journal shows the euro forecasts of eleven major banks. Indeed, it appears that only one of the eleven banks expect the euro to finish next year below parity (.00). Three banks, HSBC, UBS and JP Morgan have the euro closing next year above .10. We suspect some economists had been looking for a greater euro decline this year and some may be correcting for this. Our forecasts did not have the euro falling below parity until toward the middle of 2016. We are not convinced that the ECB has exhausted its scope for easing, and suspect it will be revisited in late Q2 16. Our longer-term views are not far from Goldman Sachs and Deutsche Bank. We anticipate that before the Obama dollar rally is over, the euro will approach its historic lows.

Topics:

Marc Chandler considers the following as important: Featured, FX Trends, Great Graphic, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

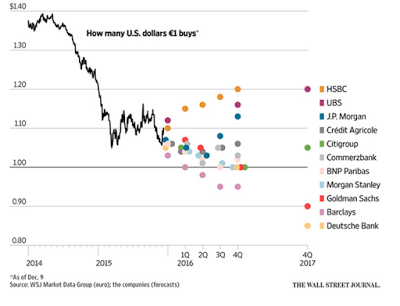

The dollar-euro is the most actively traded currency pair in the world. It is often what is meant when people ask where is the dollar trading.

Dollar bullish sentiment prevailed in 2015, but many large banks doubt that it will continue in 2016. This Great Graphic from the Wall Street Journal shows the euro forecasts of eleven major banks.

Indeed, it appears that only one of the eleven banks expect the euro to finish next year below parity ($1.00). Three banks, HSBC, UBS and JP Morgan have the euro closing next year above $1.10.

We suspect some economists had been looking for a greater euro decline this year and some may be correcting for this. Our forecasts did not have the euro falling below parity until toward the middle of 2016. We are not convinced that the ECB has exhausted its scope for easing, and suspect it will be revisited in late Q2 16. Our longer-term views are not far from Goldman Sachs and Deutsche Bank. We anticipate that before the Obama dollar rally is over, the euro will approach its historic lows.