Trade, inflation expectations and economic data could well spark ‘insurance’ rate cuts by the Fed in the coming months.We now believe that the Federal Reserve (Fed) could deliver two ‘insurance’ rate cuts of 25bps in coming months (up to now, we expected rates to be on hold in 2019-2020). We see three drivers that could dictate the exact timing of these cuts: 1) a continuation of President Trump’s pro-tariff stance (with the risk of dampening business sentiment and therefore investment); 2) confirmation from data in coming months that business investment is indeed slowing; and 3) broader financial conditions, including the crucial role of inflation expectations. With these considerations in mind, the Fed Open Market Committee (FOMC) meeting later this month could pave the way for subtle

Topics:

Laureline Chatelain and Thomas Costerg considers the following as important: Fed policy, Fed policy regime, Fed rate cuts, Macroview, US Treasury forecast

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Trade, inflation expectations and economic data could well spark ‘insurance’ rate cuts by the Fed in the coming months.

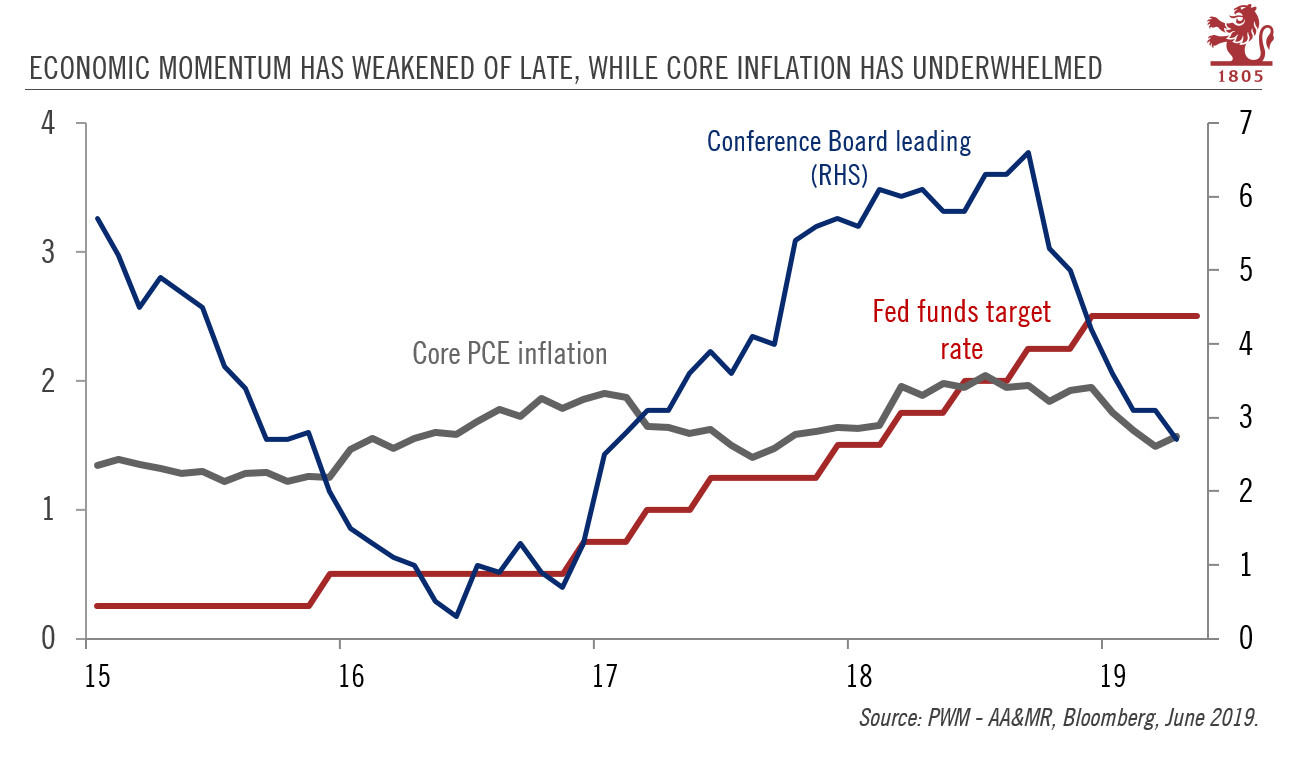

We now believe that the Federal Reserve (Fed) could deliver two ‘insurance’ rate cuts of 25bps in coming months (up to now, we expected rates to be on hold in 2019-2020). We see three drivers that could dictate the exact timing of these cuts: 1) a continuation of President Trump’s pro-tariff stance (with the risk of dampening business sentiment and therefore investment); 2) confirmation from data in coming months that business investment is indeed slowing; and 3) broader financial conditions, including the crucial role of inflation expectations.

With these considerations in mind, the Fed Open Market Committee (FOMC) meeting later this month could pave the way for subtle changes in rhetoric, opening the door for cuts later on. In the very near term, the fallout from the G20 summit in Osaka at the end of June could be pivotal to any policy initiative.

Importantly, we think the Fed could overlook a mild tariff-induced inflationary boost in the very near term, as it focuses more on the weakening medium-term growth outlook. With these considerations in mind, we believe the conditions for cutting rates could be met in Q4 2019 with the possibility of another cut in Q1 2020.

These rate cuts would be the continuation of the Fed’s dovish regime shift in December 2018, when it abruptly abandoned plans to hike rates, and in early 2019, when it stopped its plans to shrink its balance sheet. They would also fit within our view of a broader ‘debt dominance’ Fed policy regime, with the central bank particularly concerned about financial conditions due to high corporate debt in the system. The other characteristic of this regime is the Fed’s very proactive business-cycle management as it is fundamentally afraid of a recession and seeks to extend the business cycle (including through more policy accommodation).

Our revised Fed rate scenario means we are again revising down our central year-end forecasts for the 10-year US Treasury yield from 2.8% to 2.5%. We remain neutral on US Treasuries given the comparatively high yields they offer and the low risk of a sharp rise in yields in the coming months.