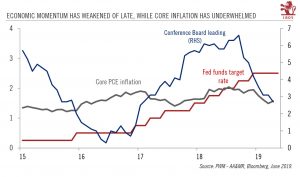

Trade, inflation expectations and economic data could well spark ‘insurance’ rate cuts by the Fed in the coming months.We now believe that the Federal Reserve (Fed) could deliver two ‘insurance’ rate cuts of 25bps in coming months (up to now, we expected rates to be on hold in 2019-2020). We see three drivers that could dictate the exact timing of these cuts: 1) a continuation of President Trump’s pro-tariff stance (with the risk of dampening business sentiment and therefore investment); 2) confirmation from data in coming months that business investment is indeed slowing; and 3) broader financial conditions, including the crucial role of inflation expectations. With these considerations in mind, the Fed Open Market Committee (FOMC) meeting later this month could pave the way for subtle

Read More »Articles by Laureline Chatelain and Thomas Costerg

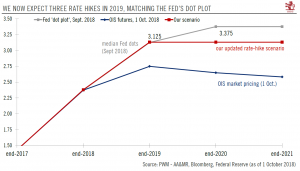

Taking the Fed’s dots at face value

October 1, 2018We now expect the Fed to raise rates three times next year instead of two.The Federal Reserve (Fed) is subtly turning more hawkish, mostly due to its increased confidence in the US outlook. While the Fed’s ‘dot plot’ chart (which illustrates the central bank’s rate hike projections) was unchanged in September from June, we think the chart’s message that there will be three Fed rate hikes next year should be taken more seriously by the market.Consequently, we are revising up the number of rate hikes we expect in 2019, from two to three. We believe the Fed is likely to deliver on its dot plot projections given Fed’s confidence about prospects for the US economy, with Fed chairman Jerome Powell saying the economy is “running at a healthy clip”.In addition, the Fed appears to be stepping back

Read More »