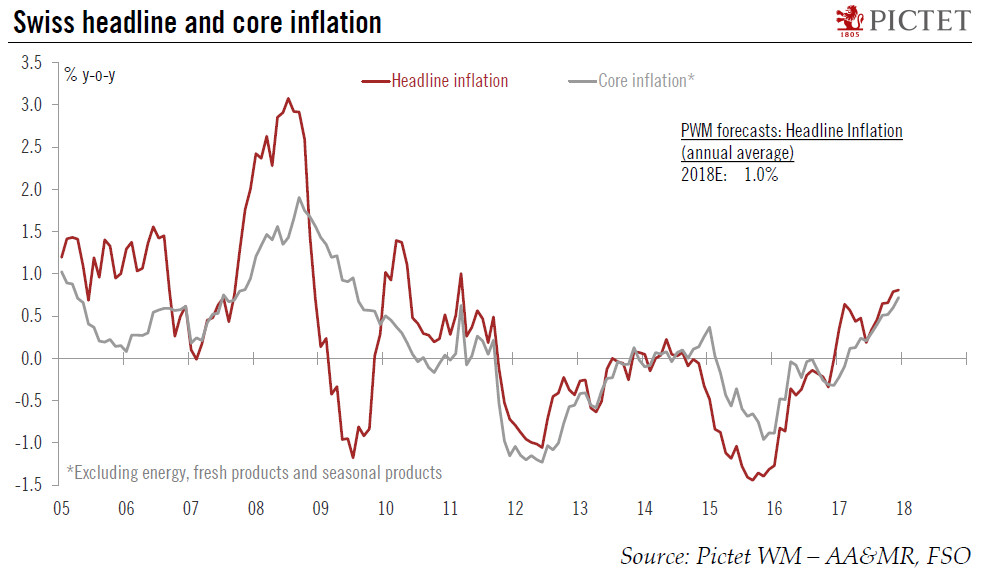

Swiss inflation remained at its highest rate in almost seven years in December. We expect average headline inflation to continue to move higher in 2018.According to the Swiss Federal Statistical Office (FSO), consumer prices in Switzerland remained broadly stable at 0.8% year on year (y-o-y) in December, in line with consensus expectations. Core inflation (headline CPI excluding food, beverages, tobacco, seasonal products, energy and fuels) increased slightly to 0.7% y-o-y in December.In all, average annual inflation reached 0.5% in 2017, after -0.4% in 2016 and -1.1% in 2015. This was the first year of positive average inflation since 2011.We expect average headline inflation of 1.0% in 2018 after 0.5% in 2017. However, our inflation forecast for this year is tilted to the down side

Topics:

Nadia Gharbi considers the following as important: Macroview, SNB rate hike, Swiss core inflation, Swiss headline inflation, Swiss inflation outlook

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Swiss inflation remained at its highest rate in almost seven years in December. We expect average headline inflation to continue to move higher in 2018.

According to the Swiss Federal Statistical Office (FSO), consumer prices in Switzerland remained broadly stable at 0.8% year on year (y-o-y) in December, in line with consensus expectations. Core inflation (headline CPI excluding food, beverages, tobacco, seasonal products, energy and fuels) increased slightly to 0.7% y-o-y in December.

In all, average annual inflation reached 0.5% in 2017, after -0.4% in 2016 and -1.1% in 2015. This was the first year of positive average inflation since 2011.

We expect average headline inflation of 1.0% in 2018 after 0.5% in 2017. However, our inflation forecast for this year is tilted to the down side given factors such as a cut in the VAT rate and base effects stemming from energy price inflation.

Given the outlook for inflation is still contained, the Swiss National Bank (SNB) is likely to remain cautious and true to its current ‘two-pillar’ strategy (negative interest rates and commitment to intervene in the FX market if needed). We expect a window of opportunity for a first SNB rate hike in Q4 2018.