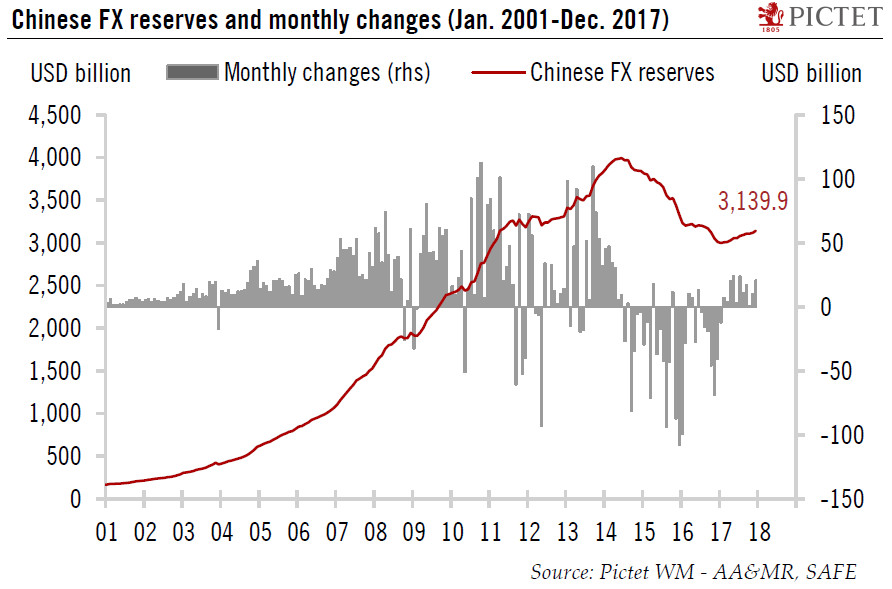

The decline in capital outflows may suggest that investors’ sentiment towards China is improving.According to the Chinese State Administration of Foreign Exchange, China’s FX reserves amounted to USD3.14 trillion at end-December 2017, up USD20.7 billion from the previous month. This marks the 11th consecutive monthly increase in Chinese FX reserves since February 2017. In full-year 2017, Chinese FX reserves increased by USD129.4 billion, in contrast with a drop of USD512.7 billion in 2015 and USD320 billion in 2016.After the massive outflows in the wake of China’s devaluation of its currency in August 2015, capital outflows abated quite significantly from the second quarter of 2016 on. We estimate that the total capital outflows from China in 2017 amounted to USD166 billion, down from

Topics:

Dong Chen considers the following as important: Chinese capital flows, Chinese economy, Chinese FX reserves, Chinese investment, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The decline in capital outflows may suggest that investors’ sentiment towards China is improving.

According to the Chinese State Administration of Foreign Exchange, China’s FX reserves amounted to USD3.14 trillion at end-December 2017, up USD20.7 billion from the previous month. This marks the 11th consecutive monthly increase in Chinese FX reserves since February 2017. In full-year 2017, Chinese FX reserves increased by USD129.4 billion, in contrast with a drop of USD512.7 billion in 2015 and USD320 billion in 2016.

After the massive outflows in the wake of China’s devaluation of its currency in August 2015, capital outflows abated quite significantly from the second quarter of 2016 on. We estimate that the total capital outflows from China in 2017 amounted to USD166 billion, down from USD761 billion in 2015 and USD500 billion in 2016.

In our view, the decline in capital outflows primarily reflects the effectiveness of strengthened capital controls over the past two years. Measures have included cracking down on underground money transfers, restricting large overseas M&A by Chinese corporations and fixing various loopholes in capital account transactions (such as buying investment-type insurance policies in Hong Kong using UnionPay bank cards issued in mainland China).

Reduced capital outflows may also reflect improving domestic and foreign investor sentiment towards China. In the first nine months of 2017, the Chinese economy expanded by 6.9% year-over-year, and very likely managed full-year growth of 6.8%, significantly above the consensus forecast at the start of the year. The perceived risk of a hard landing has dropped substantially.

Rising interest rates and widening yield differentials contributed to the Chinese yuan’s appreciation of over 6% against the dollar in 2017, one of the biggest surprises of the year, also leading to a significant improvement in sentiment. Concerns about another round of yuan depreciation seems to have largely dissipated.

The recent surge in foreign direct investment inflows (FDI) to China is another sign of improving sentiment. In November, the monthly inflow of FDI to China amounted to USD18.8 billion, the highest since data were first made available in late 2002 and 90% higher than a year before.

However, not all of the fund inflows categorised under FDI may actually involve real investments. Some could be portfolio investments disguised as FDI to circumvent the restrictions on accessing China’s capital markets, which are still only partially open to foreign investors. But this still means that foreign investors are starting to become more bullish about China again.