The BoJ remains the last major central bank still firmly committed to large-scale monetary easing.After its Monetary Policy Meeting of December 21, the Bank of Japan (BoJ) announced its intention to keep its current monetary easing programme intact. The BOJ will continue with its “Quantitative and Qualitative Monetary Easing with Yield Curve Control ”, aiming to achieve and overshoot the core inflation target of 2%.The reason for the BoJ deciding to stay put is the stubbornly low inflation rate in Japan. After five years of unprecedented monetary easing, core inflation in Japan (all CPI items excluding fresh food) remains below 1%, less than half of the BoJ’s target of 2%.These decisions by BoJ are in line with market consensus as well as our own expectations. With no change to its

Topics:

Dong Chen considers the following as important: Bank of Japan, BoJ monetary policy, Macroview

This could be interesting, too:

Marc Chandler writes Trump’s Tariff Talks Wobble Forex Market, Close Neighbors Suffer Most

Marc Chandler writes Markets do Cartwheels in Response to Traditional Pick for US Treasury Secretary

Marc Chandler writes Higher Yields Help Extend the Dollar’s Gains

Marc Chandler writes Eurozone Growth Surprises, Lifts Euro, while UK Budget is Awaited

The BoJ remains the last major central bank still firmly committed to large-scale monetary easing.

After its Monetary Policy Meeting of December 21, the Bank of Japan (BoJ) announced its intention to keep its current monetary easing programme intact. The BOJ will continue with its “Quantitative and Qualitative Monetary Easing with Yield Curve Control ”, aiming to achieve and overshoot the core inflation target of 2%.

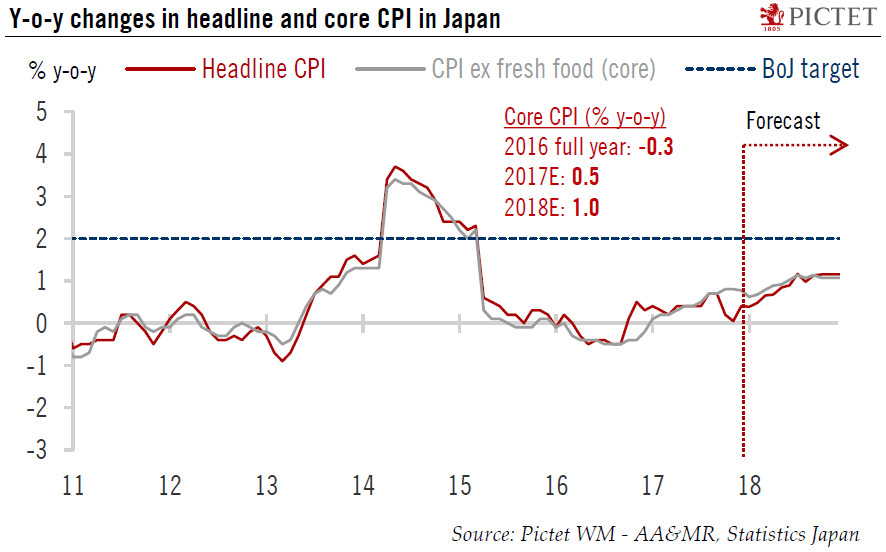

The reason for the BoJ deciding to stay put is the stubbornly low inflation rate in Japan. After five years of unprecedented monetary easing, core inflation in Japan (all CPI items excluding fresh food) remains below 1%, less than half of the BoJ’s target of 2%.

These decisions by BoJ are in line with market consensus as well as our own expectations. With no change to its monetary policies, the BoJ now becomes the only major central bank in the world that is still firmly committed to monetary easing of almost the same magnitude as in the most aggressive days, without even hinting at an exit.

In the short term, therefore, we do not expect the BoJ to make any significant changes to its policies. The only thing that may vary is the quantity of Japanese government bonds (JGBs) that the BoJ will buy, because it is becoming apparent that to control the yield curve, the BoJ no longer has to buy as many JGBs as it did before.

In the longer term, however, we believe BoJ will have to adjust its policies even if it fails to achieve the inflation target, whether due to practical constraints (e.g., the depletion of JGBs available for purchase on the market) or the changing global economic environment (e.g. significantly increased interest differentials between Japan and other major economies).