Recent foreign exchange movements pave the way for a cautious SNB monetary policy.In April, the EUR/CHF rate (1 euro in Swiss franc) hit its highest level since the Swiss National Bank (SNB) decided to lift its exchange rate floor in January 2015. Since then, the Swiss franc has appreciated by 5.8% against the euro, mainly driven by political uncertainty in Italy and concerns that Turkey’s economic troubles could impact European banks.Movements in the foreign exchange (FX) markets are scrutinised by the SNB. Recent developments tend to confirm the SNB’s view that the “situation in FX markets remains fragile”, and thus reinforce its conviction to maintain its ultra-loose monetary stance (via its two pillars strategy, namely negative interest rate and intervention in the FX markets when

Topics:

Nadia Gharbi considers the following as important: Macroview, SNB monetary policy, Swiss economy, Swiss franc appreciation

This could be interesting, too:

Investec writes Swiss economy stalls in second quarter of 2023

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Recent foreign exchange movements pave the way for a cautious SNB monetary policy.

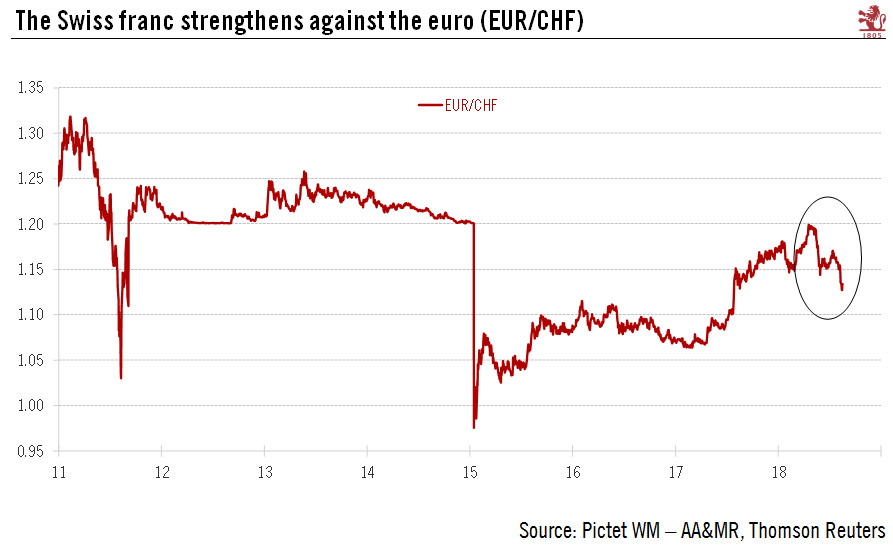

In April, the EUR/CHF rate (1 euro in Swiss franc) hit its highest level since the Swiss National Bank (SNB) decided to lift its exchange rate floor in January 2015. Since then, the Swiss franc has appreciated by 5.8% against the euro, mainly driven by political uncertainty in Italy and concerns that Turkey’s economic troubles could impact European banks.

Movements in the foreign exchange (FX) markets are scrutinised by the SNB. Recent developments tend to confirm the SNB’s view that the “situation in FX markets remains fragile”, and thus reinforce its conviction to maintain its ultra-loose monetary stance (via its two pillars strategy, namely negative interest rate and intervention in the FX markets when needed) to “keep the attractiveness of Swiss Franc investments low and ease pressure on the currency”.

The SNB does not communicate on its interventions in FX markets (except in its annual report), but looking at the weekly variations in sight deposits it holds (a proxy we use to gauge interventions), there is no evidence of FX market intervention by the SNB so far this year. The probability of SNB intervention would rise if the currency reached the 1.08-1.10 level against the EUR. Looking ahead, the SNB is likely to remain cautious regarding monetary policy normalisation. The central bank is likely to tie its policy rate decisions to the ECB’s tightening cycle and to start raising its policy rate in September 2019.