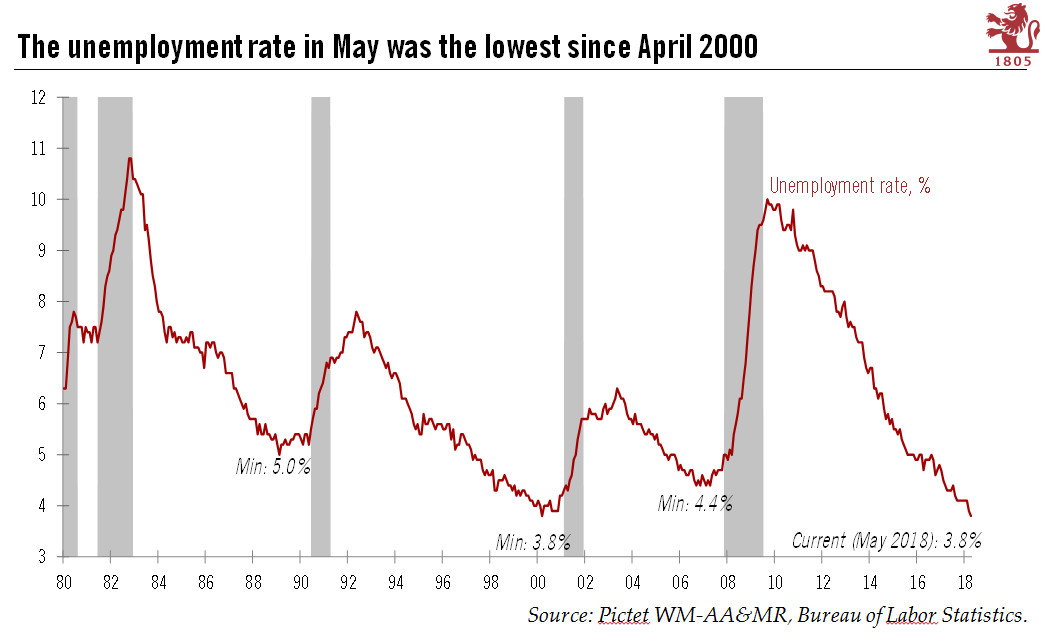

The May nonfarm report shows the labour market remains in fine fettle, even though wage gains are still not broad based.The May employment report showed that the US labour market – and the US economy more broadly – remains in great shape, with non-farm payrolls growing by 223,000 last month. The 2018 year-to-date average, at 207,000, is above last year’s 182,000. This strength is reassuring news, especially given the erratic course of US trade policy. The US labour market’s strength was echoed by a robust ISM manufacturing index for May, which rose to 58.7 from 57.3. While the unemployment rate dropped to 3.8% in May, the lowest since April 2000, the jury is still out when it comes to wage growth. The month-on-month wage print was solid at 0.3% but, crucially, the year-on-year reading of

Topics:

Thomas Costerg considers the following as important: Macroview, US employment, US labour market, US nonfarm payrolls, US wage growth

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The May nonfarm report shows the labour market remains in fine fettle, even though wage gains are still not broad based.

The May employment report showed that the US labour market – and the US economy more broadly – remains in great shape, with non-farm payrolls growing by 223,000 last month. The 2018 year-to-date average, at 207,000, is above last year’s 182,000. This strength is reassuring news, especially given the erratic course of US trade policy. The US labour market’s strength was echoed by a robust ISM manufacturing index for May, which rose to 58.7 from 57.3.

While the unemployment rate dropped to 3.8% in May, the lowest since April 2000, the jury is still out when it comes to wage growth. The month-on-month wage print was solid at 0.3% but, crucially, the year-on-year reading of 2.7% remained below the key 3% level and was only marginally above the 12-month average of 2.6%. Also, wage growth was not really broad based. Wages in manufacturing, for instance, rose only 1.5% year-on-year. By contrast, wage growth in finance was a strong 5.6% y-o-y, the highest rate since March 2007.

From the Federal Reserve’s perspective, the strength in the May employment report could assuage some fears about potential risks coming from Europe and President Trump’s trade policy. A rate hike on 13 June now appears almost certain. But some Fed doves may still want to wait for more improvement on wages before moving up their forecasts for future rate hikes (the ‘dots’). Overall, we maintain our view that the Fed will increase rates three more times this year, and twice next year.