Taking into account last December’s fiscal reforms in the US, we have revised up our end-of-the year target for the 10-year Treasury yield.Given our expectations of a rebound in core inflation, accelerating growth and a faster rise in the Fed funds rate this year, we now expect the 10-year US Treasury yield to rise from 2.7% as of 29 January to 3.0% by the end of 2018 (our previous forecast for end-2018 was 2.6%). This rise is likely to be driven by both inflation expectations and TIPS yields creeping higher. In this central scenario of ours, the US yield curve (10-year – 2-year Treasury yield) should continue to flatten, as we saw in 2017, but at a slower pace.Thanks to fiscal reforms, we expect US growth to accelerate, with GDP rising by 3.0% this year and another 2.4% in 2019. Quicker

Topics:

Laureline Chatelain considers the following as important: Macroview, Ten-year Treasury yield, US Treasury yield

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

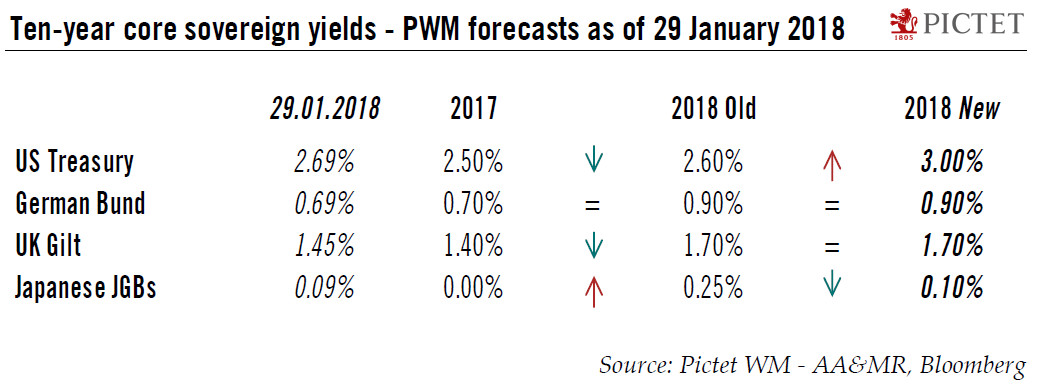

Taking into account last December’s fiscal reforms in the US, we have revised up our end-of-the year target for the 10-year Treasury yield.

Given our expectations of a rebound in core inflation, accelerating growth and a faster rise in the Fed funds rate this year, we now expect the 10-year US Treasury yield to rise from 2.7% as of 29 January to 3.0% by the end of 2018 (our previous forecast for end-2018 was 2.6%). This rise is likely to be driven by both inflation expectations and TIPS yields creeping higher. In this central scenario of ours, the US yield curve (10-year – 2-year Treasury yield) should continue to flatten, as we saw in 2017, but at a slower pace.

Thanks to fiscal reforms, we expect US growth to accelerate, with GDP rising by 3.0% this year and another 2.4% in 2019. Quicker growth should push the 10-year Treasury yield higher.

Core US inflation should accelerate during the year, but in our central scenario we expect it to remain slightly below the Fed’s target of 2.0% for 2018 as a whole (1.9%). We expect US core inflation to reach the Fed’s target only during the second half of 2018 as improving economic growth and full employment are likely to take time to feed through into higher wages and then higher core inflation.

Should core PCE pick up durably above 2% — fuelling fears that the Fed is “behind the curve“ — the US yield curve could steepen again, as the bar is high for the Fed to hike more than once each quarter. The 10-year Treasury yield could rise to 3.5% on the back of the strong inflationary pressures caused by the fiscal stimulus. We attribute a 25% risk to this alternative scenario.