Our 2018 scenario of a deceleration in US economic activity and a slightly less accommodative Bank of Japan should weigh on the dollar versus the yen.From 6 November to 28 November, the Japanese yen gained 2% against the US dollar, outperforming all G10 currencies but the euro.In our view, the key driver of the USD/JPY rate is the 10-year real rate differential, especially since the introduction of the yield-curve-control (YCC) framework by the Bank of Japan (BoJ) on 21 September 2016.In Japan, although the new monetary policy framework announced on 21 September 2016 also included a commitment to overshooting its 2% inflation target, the BoJ is likely to gradually normalise its very accommodative monetary policy before the 2% target is reached. In our view, the BoJ could revise upward its

Topics:

Luc Luyet considers the following as important: Japan yield curve control, Macroview, yen dollar exchange rate, yen dollar forecast, yen scenario

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Our 2018 scenario of a deceleration in US economic activity and a slightly less accommodative Bank of Japan should weigh on the dollar versus the yen.

From 6 November to 28 November, the Japanese yen gained 2% against the US dollar, outperforming all G10 currencies but the euro.

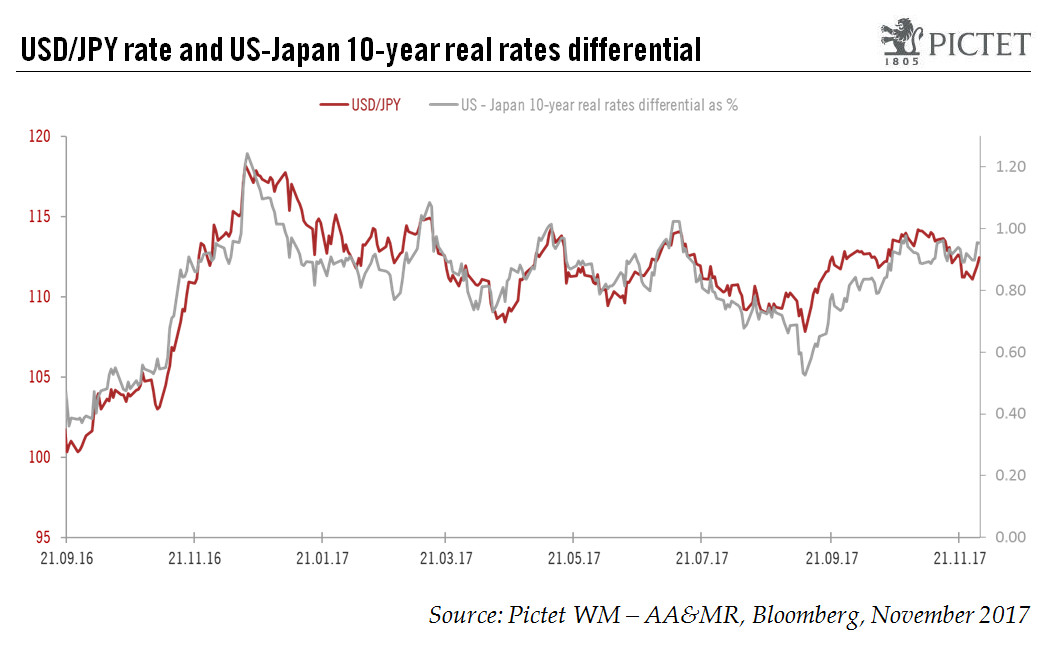

In our view, the key driver of the USD/JPY rate is the 10-year real rate differential, especially since the introduction of the yield-curve-control (YCC) framework by the Bank of Japan (BoJ) on 21 September 2016.

In Japan, although the new monetary policy framework announced on 21 September 2016 also included a commitment to overshooting its 2% inflation target, the BoJ is likely to gradually normalise its very accommodative monetary policy before the 2% target is reached. In our view, the BoJ could revise upward its target for the 10-year JGB yield when consumer price inflation (ex fresh food) reaches 1% (September CPI was 0.70% year on year). As our inflation projections suggest that this threshold could be reached around the middle of 2018, the BoJ is unlikely to change the parameters of its YCC before then. Consequently, in the first half of 2018, the Japanese 10-year real interest rate is likely to decline slightly given a stable nominal rate and the slow rise in inflation.

With the Japanese nominal 10-year yield unlikely to change in the next few months, its US equivalent is more likely to determine the fate of the USD/JPY rate. In our opinion, strong economic activity in the US should favour a rise in the US 10-year rate towards 2.6% in 2018 (compared to 2.38% at present), setting the scene for potential US dollar outperformance relative to the Japanese yen. That being said, our central scenario of a deceleration in the US economy in the second half of 2018 should limit the rise of the US 10-year yield.

Putting all these factors together, we see scope for the yen to weaken towards JPY119 per US dollar in the next six months (from JPY112 at November 29), when it will suffer from upward pressure on long-term US yields and the BoJ’s unchanged monetary policy. Further out, the likely deceleration in US activity and a less accommodative BoJ should improve the relative attractiveness of the undervalued yen. Our 12-month projection is for a rate of JPY115 per USD.