The improvement and better access to credit bodes well for investment spending in the euro area as we move into 2018.Small and medium-sized entreprises (SMEs) are crucial for the euro area economy. They constitute about 99% of all euro area firms, employ around 70% of the workforce, and generate around 60% of value added. Their economic importance is above the euro area average in Italy, Spain, Portugal and Greece. Unlike large firms, which have access to alternative sources of finance, such as bond or equity finance and are generally more profitable, SMEs are highly dependent on banks for their external financing.After difficulties in obtaining funds during the financial crisis, surveys suggest that obtaining funds is not a problem for SMEs in the euro area anymore. Indeed, the latest

Topics:

Nadia Gharbi considers the following as important: European bank credit, European corporate financing, European financing needs, European small business lending, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The improvement and better access to credit bodes well for investment spending in the euro area as we move into 2018.

Small and medium-sized entreprises (SMEs) are crucial for the euro area economy. They constitute about 99% of all euro area firms, employ around 70% of the workforce, and generate around 60% of value added. Their economic importance is above the euro area average in Italy, Spain, Portugal and Greece. Unlike large firms, which have access to alternative sources of finance, such as bond or equity finance and are generally more profitable, SMEs are highly dependent on banks for their external financing.

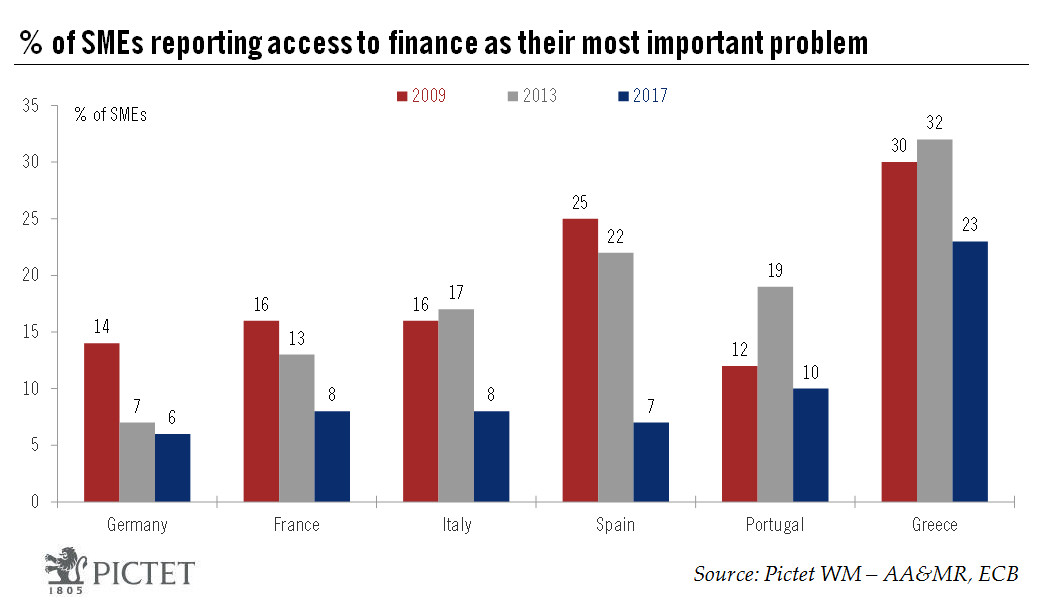

After difficulties in obtaining funds during the financial crisis, surveys suggest that obtaining funds is not a problem for SMEs in the euro area anymore. Indeed, the latest survey on the Access to Finance of Enterprises, published this week and covering the period from April to September 2017, showed that accessing finance is SMEs’ least-pressing problem at present. The percentage of SMEs signalling access to finance as their most important problem has never been lower since the survey began in 2009 (see Chart). Moreover, with SMEs also reporting an increase in profits for the first time since the beginning of the survey, their financial situation is also improving.

The share of SMEs applying for a bank loan declined as a greater share of SMEs indicated they had sufficient funds of their own. This partly explains why the volume of banking credit has been moderate since the beginning of the year despite the strengthening of growth in the euro area. However, the latest data on loans to non-financial corporations suggest that bank lending might be turning upward, which offers further room for investment spending to grow.