We are sceptical that Trump’s tax proposals will make much headway and that what tax cuts are enacted will add much to US growth.President Trump’s ambitious tax plan, just unveiled, aims to simplify and lower tax rates for households and corporates, with the statutory tax rate for the latter to be reduced to 20% from 35%.We remain sceptical that this plan will see its way through Congress given opposition from Democrats and even some Republicans wary about sharp increases in the deficit. The stated timetable of having a law signed before year-end is highly unrealistic in our view, and thereafter it risks running into preparations for mid-term congressional elections.There is a chance that limited corporate tax cuts could come out of the congressional debate, but a couple of percentage

Topics:

Thomas Costerg considers the following as important: Macroview, Trump tax proposals, US corporate tax, US overseas earnings, US tax reform

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

We are sceptical that Trump’s tax proposals will make much headway and that what tax cuts are enacted will add much to US growth.

President Trump’s ambitious tax plan, just unveiled, aims to simplify and lower tax rates for households and corporates, with the statutory tax rate for the latter to be reduced to 20% from 35%.

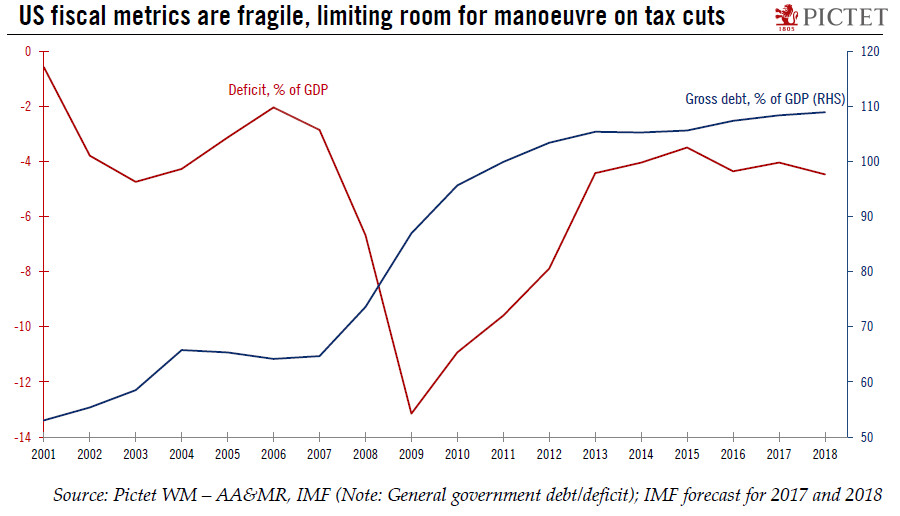

We remain sceptical that this plan will see its way through Congress given opposition from Democrats and even some Republicans wary about sharp increases in the deficit. The stated timetable of having a law signed before year-end is highly unrealistic in our view, and thereafter it risks running into preparations for mid-term congressional elections.

There is a chance that limited corporate tax cuts could come out of the congressional debate, but a couple of percentage points off headline corporate tax rates are unlikely to make a difference to US growth in 2018-19, in our view. One reason is that the effective tax rate that companies pay is already much lower than the statutory rate due to a host of tax deductions. The average tax rate that Dow Jones companies actually pay is 25.8%, almost 10% lower than the statutory one. It remains unclear whether the effective tax rate will move up or down under the Trump proposals.

Major tax reform and more infrastructure spending, of the sort that Trump promised at the beginning of his presidency, would be a welcome development in 2018-19, when we think US growth could be dented by cyclical downturns in car sales and construction, as well as decelerating momentum in the energy sector. But, so far, the Trump Administration’s initiatives have produced meagre results and its recent attempts at healthcare reform turned into a debacle.

Also, the plan is frustratingly short on detail, including the extent to which the deductibility of interest for corporates is to be curtailed, and the tax rate (and modalities of payment) for corporate cash piles held offshore.

While we are still bullish in the short term (our 2017 GDP growth forecast is 2.2%), we remain cautious about 2018 growth prospects. But since we have modest expectations for Trump’s ability to deliver, we are maintaining our prudent forecast of 1.7% growth next year. If we are wrong and material tax cuts are enacted before year-end for both households and corporations, then we would raise our 2018 growth forecast by a few tenths of a percentage point.

Washington DC’s inability to deliver also leads us to believe the Federal Reserve might pause the rate-hiking cycle some time in mid-2018. We expect only two further quarter-point rate hikes in this cycle, one in December and one in March. However, in the event that major tax cuts are actually enacted, leading to a major fiscal stimulus, we think that the Federal Reserve could be more hawkish and raise rates higher.