Developments in Brexit negotiations, a hawkish Bank of England, and the strong performance of blue chip stocks mean that we have been updating our forecasts for the UK.Although the UK macro outlook has not changed much in recent weeks and considerable uncertainty remains in terms of the Brexit negotiations, the BoE’s hawkish shift has led to a material repricing of UK assets, including the currency and rates. In addition to monetary policy considerations, another driver of improved market sentiment has been a subtle shift, amid all the noise, towards a political environment more supportive of a softer version of Brexit, or at least a transition period from March 2019.The UK government’s acceptance of a transition period and of paying into the EU budget during that time confirm that the

Topics:

Frederik Ducrozet considers the following as important: Brexit and UK financial markets, Macroview, UK economic forecast, UK economy, UK market forecast

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Developments in Brexit negotiations, a hawkish Bank of England, and the strong performance of blue chip stocks mean that we have been updating our forecasts for the UK.

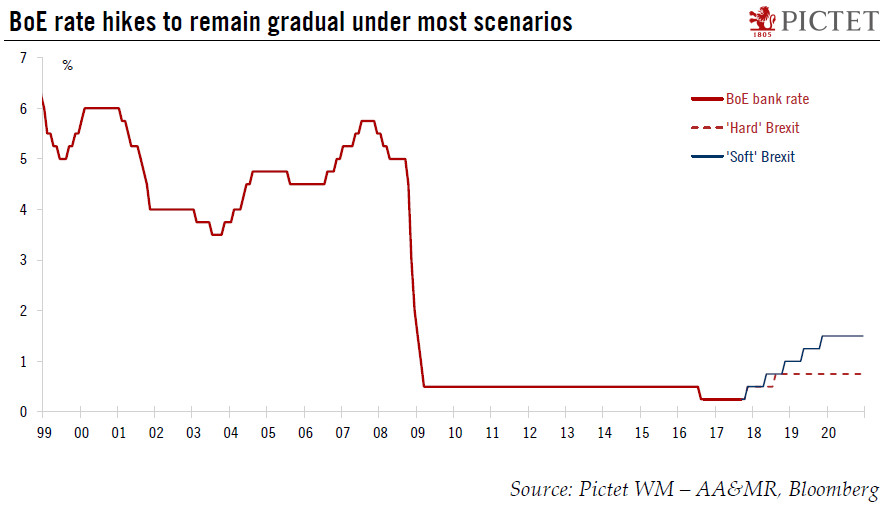

Although the UK macro outlook has not changed much in recent weeks and considerable uncertainty remains in terms of the Brexit negotiations, the BoE’s hawkish shift has led to a material repricing of UK assets, including the currency and rates. In addition to monetary policy considerations, another driver of improved market sentiment has been a subtle shift, amid all the noise, towards a political environment more supportive of a softer version of Brexit, or at least a transition period from March 2019.

The UK government’s acceptance of a transition period and of paying into the EU budget during that time confirm that the balance on the UK side is shifting against the ‘hard Brexiteers’. Although our baseline remains for the UK to leave the single market eventually, if only in 2021, there is a growing possibility that access will be maintained.

Our baseline scenario remains for a ‘hard’ version of Brexit in the sense that the UK is likely to lose access to the single market eventually, if only in 2021, leading to trade frictions, especially in the services sector. But, the ongoing shift in UK politics means that: 1) the likelihood of a smoother transitional deal maintaining the status quo has increased; 2) the post-Brexit framework could involve some form of ad hoc access to the customs unions at least, and it is not inconceivable that single market access will be maintained in a different form. If so, the market is likely to see the Brexit glass as half-full, even if the impact on economic activity remains negative.

To take stock of recent developments, we have updated our projections for UK growth, sterling, gilts and sterling.

GDP growth

We remain negative on UK macroeconomic prospects over both the short- and longer-term. We forecast GDP growth to slow from 1.8% in 2016, to around 1.5% in 2017 and 1.0% in 2018, below consensus expectations. Our best guess at this stage is that UK potential growth will converge towards 1.0-1.5%, similar to rates in the euro area.

Sterling

Overall, we think that recent events have brightened the outlook for sterling. On the political side, the increased likelihood of a soft transition period after March 2019 should reduce the negative impact of Brexit on the UK economy. Furthermore, the Bank of England, preoccupied by inflation, favours a tighter monetary policy. That said, market expectations are already consistent with (almost) two BoE rate hikes by the end of 2018. Given the unfavourable macroeconomic backdrop, we doubt that the BoE will be able to raise rates more than that, which suggests relatively limited upside potential for sterling from current levels.

Gilts

We anticipate that the 10-year gilt yield should remain at around 1.4% by end-2017, rising to 1.7% by end-2018. This expectation is based on the prospect for rate rises and, more importantly, the prospect of a transition period that would avoid a damaging cliff-edge scenario for the UK economy. Moreover, the inflation breakeven yield should remain high, in line with inflation above the BoE’s 2% target, and the inflation-linked yield should move upwards due to the perspectives of a less accommodative BoE.

Equities

The mining sector has been the main driver of the 25% 2017 earnings growth for UK equities. This contribution is expected to vanish in the years to come, with neither a strong commodity cycle nor strong currency depreciation in prospect. As a result, earnings are expected to grow by 6.5% in 2018 and 7.9% in 2019, i.e. below expectations for the euro area. The sole period in the past 15 years when UK equities traded at a premium was just after the Brexit vote, before earnings adjusted to the new environment. In the circumstances, it is sensible to keep assuming a valuation level in line with the rest of Europe, leaving therefore a smaller upside for UK equities, in line with earnings growth.