The latest ECB credit report confirmed that credit flows in the euro area remains strong. But reliance on bank credit is falling in Europe.The ECB’s M3 and credit report for August published this week was pretty strong overall and confirmed the ongoing improvement in lending dynamics in the euro area. Bank credit flows to the private sector (adjusted for seasonal effects and sales and securitisations) amounted to €17bn in August, lower than the July figure of €39bn. In y-o-y terms, private-sector lending increased by 2.7% in August, close to its fastest rate since 2009 and up from 2.6% in July.Taking those numbers into account, our credit impulse (see Chart), a three-month rolling sum of private-sector credit flows as a percentage of GDP, remained positive in August, but was still

Topics:

Nadia Gharbi considers the following as important: euro area credit demand, euro area credit flows, euro area credit impulse, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The latest ECB credit report confirmed that credit flows in the euro area remains strong. But reliance on bank credit is falling in Europe.

The ECB’s M3 and credit report for August published this week was pretty strong overall and confirmed the ongoing improvement in lending dynamics in the euro area. Bank credit flows to the private sector (adjusted for seasonal effects and sales and securitisations) amounted to €17bn in August, lower than the July figure of €39bn. In y-o-y terms, private-sector lending increased by 2.7% in August, close to its fastest rate since 2009 and up from 2.6% in July.

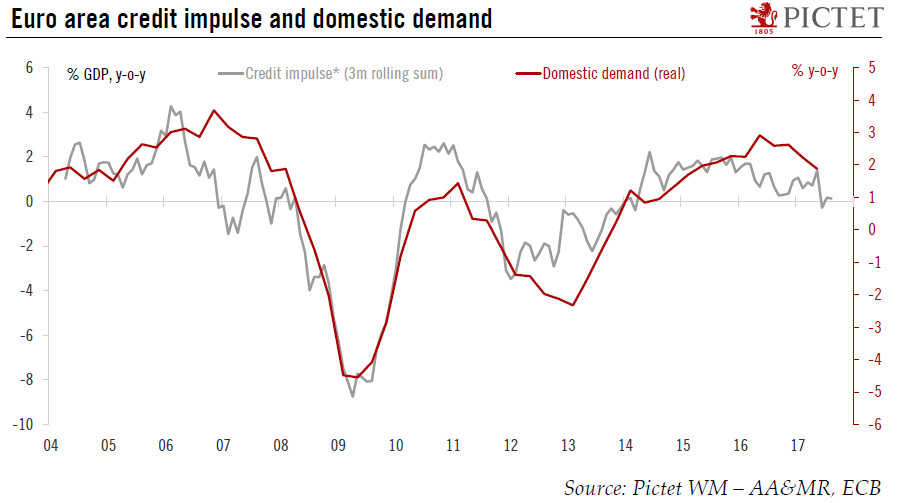

Taking those numbers into account, our credit impulse (see Chart), a three-month rolling sum of private-sector credit flows as a percentage of GDP, remained positive in August, but was still somewhat weak. While positive base effects should soon push the credit impulse sharply higher in the short term, the link between the credit impulse and domestic demand has diminished since mid-2015. Part of this divergence is explained by the decreasing dependence of non-financial corporations on bank credit, as suggested by increasing debt issuance and record high amounts of cash on their balance sheets.

Overall, we remain confident about the outlook for the euro area. The credit picture continues to gradually improve, reflecting a strong domestic-led recovery and relaxed lending conditions. We continue to see a number of headwinds that could lead to a slight slowdown in the pace of economic expansion in the quarters ahead, but growth should nonetheless remain comfortably above potential. We are maintaining our GDP growth forecast of 2.1% for 2017 and 1.7% for 2018 in the euro area.