Having set out our expectations for the global economy in 2018, we add here a number of potential surprises. None of them are included in our baseline projections.In the US, we include first a ‘Texas boom’ due to rising oil prices. US oil investment could see a major uptick and Texas could accelerate, in turn lifting US growth.Secondly, we include a hawkish shift at the Fed. While Trump has preferred continuity in the Fed’s leadership with his nominee as Fed Chair, Jerome Powell, he could still put more hawkish officials on the Fed Board.The third possible surprise for the US is that Chicago defaults on its bonds, creating turmoil on the muni market. While US growth remains favourable, many US cities and states, including Chicago, are facing budget difficulties, particularly as pension

Topics:

Team Asset Allocation and Macro Research considers the following as important: 2018 outlook, global macro, Macroview, World economy

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Having set out our expectations for the global economy in 2018, we add here a number of potential surprises. None of them are included in our baseline projections.

In the US, we include first a ‘Texas boom’ due to rising oil prices. US oil investment could see a major uptick and Texas could accelerate, in turn lifting US growth.

Secondly, we include a hawkish shift at the Fed. While Trump has preferred continuity in the Fed’s leadership with his nominee as Fed Chair, Jerome Powell, he could still put more hawkish officials on the Fed Board.

The third possible surprise for the US is that Chicago defaults on its bonds, creating turmoil on the muni market. While US growth remains favourable, many US cities and states, including Chicago, are facing budget difficulties, particularly as pension costs continue to escalate.

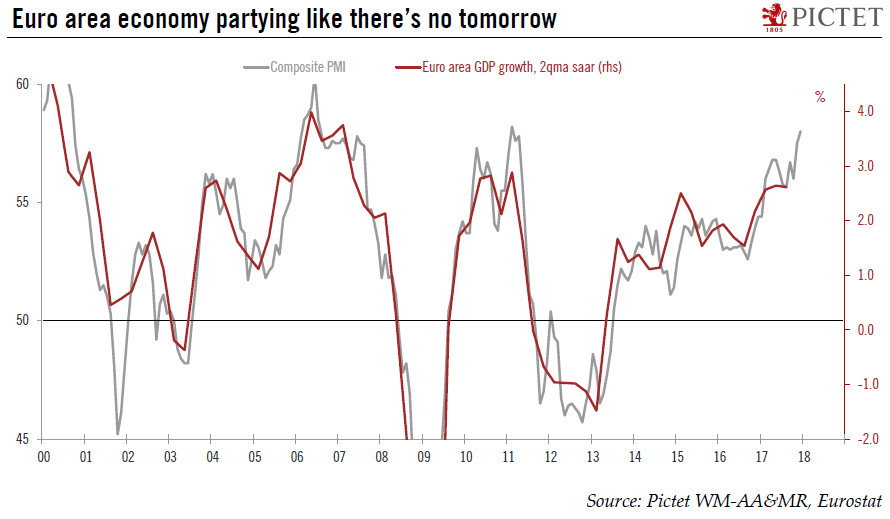

In Europe, we picked a ‘Eureflation’. Risks remain tilted to the upside, most importantly in terms of credit-fuelled investment spending. A revival of animal spirits in those countries with the largest investment gap relative to pre-crisis trends could lift GDP growth above 3% on a sustained basis.

At the ECB, a possible surprise would be the nomination of Frenchwoman Hélène Rey as the next president (taking over from Mario Draghi in 2019). The implications for markets would likely be positive overall, as any non-German ECB president would be perceived as less hawkish, at least initially.

In the UK, Jeremy Corbyn may get the keys to 10 Downing Street, leading the most left-wing UK government since the 1970s.

In Switzerland, we include renewed easing pressure on the SNB. If inflation surprises significantly on the downside, it may force the SNB to maintain, if not to ease, its already accommodative monetary stance.

In Japan, inflationary pressure is quietly building up as capacity constraints continue to tighten, especially in the labour market. If inflation were to surprise to the upside, the BoJ may surprise the market by adjusting its yield curve control earlier than expected.

In China, we picked a positive growth surprise. After a strong 2017, China could beat growth estimates again with solid exports and domestic consumption. Strong real growth and high inflation could lead to double-digit growth in nominal GDP for the second year in a row, allowing China’s debt-to-GDP ratio to exhibit a sustained decline for the first time since the global financial crisis.

Asia could see an upsurge in geopolitical tensions, including the territorial dispute between Japan and China over Senkaku Islands, or the contest for dominance between the US and China in South China Sea. On North Korea, a dramatic shock would come with China joining forces with Russia, the US and South Korea to invade North Korea.