In spite of the relatively weak headline jobs number, wage growth and household income figures were quite upbeat. We therefore maintain our forecast of 2.5% GDP growth for the second quarter. Read full article here April’s US employment report was mixed. Job creation was relatively soft and the unemployment rate remained stable for ‘bad’ reasons. However, in the current economic context, employment growth remains healthy overall. Wage numbers were relatively upbeat, and the proxy for household income was quite strong. In light of the figures released today, we continue to expect 2.5% GDP growth in the US in Q2 2016. Our main scenario remains that the Fed will probably remain on hold in June and hike rates only once this year, most likely in September. Non-farm payroll employment rose by a moderate 160,000 m-o-m in April, below consensus expectations (200,000). Moreover, numbers for the previous two months were revised down by a cumulative 19,000. The unemployment rate remained stable at 5.0%, but did not rise only because the participation rate fell back, following six consecutive months of increase. After falling relatively regularly for a few years, the rate has stabilised over the past 6-8 months and at 5.0%, the unemployment rate is at the top of the range that the Fed feels corresponds to full employment (4.7%-5.0%).

Topics:

Bernard Lambert considers the following as important: Macroview, US employment report, US second-quarter GDP, US wages

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

In spite of the relatively weak headline jobs number, wage growth and household income figures were quite upbeat. We therefore maintain our forecast of 2.5% GDP growth for the second quarter.

April’s US employment report was mixed. Job creation was relatively soft and the unemployment rate remained stable for ‘bad’ reasons. However, in the current economic context, employment growth remains healthy overall. Wage numbers were relatively upbeat, and the proxy for household income was quite strong.

In light of the figures released today, we continue to expect 2.5% GDP growth in the US in Q2 2016. Our main scenario remains that the Fed will probably remain on hold in June and hike rates only once this year, most likely in September.

Non-farm payroll employment rose by a moderate 160,000 m-o-m in April, below consensus expectations (200,000). Moreover, numbers for the previous two months were revised down by a cumulative 19,000. The unemployment rate remained stable at 5.0%, but did not rise only because the participation rate fell back, following six consecutive months of increase. After falling relatively regularly for a few years, the rate has stabilised over the past 6-8 months and at 5.0%, the unemployment rate is at the top of the range that the Fed feels corresponds to full employment (4.7%-5.0%). However, with the economy approaching full employment, a gradual slowdown in job creation should occur during the course of this year, hopefully accompanied by some improvement in productivity growth.

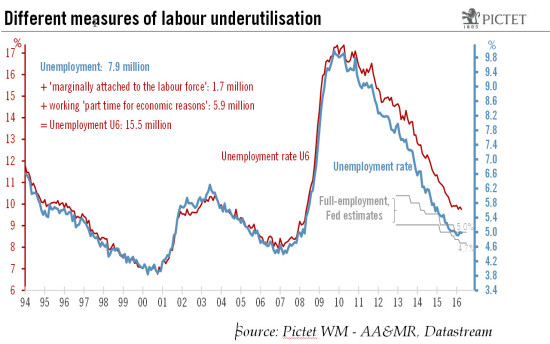

The rest of the US employment report was more upbeat. The U6 rate, a wider measure of unemployment, inched down to 9.7% in April . U6 has fallen heavily over the past few years. On this yardstick too, full employment does not look far away (see chart).

In addition, wages, and ‘aggregate weekly payrolls’ (a proxy for household income) grew by a strong 0.8% in April. On a year-over-year basis, wage increases inched up from 2.3% in March to 2.5% in April. However, the quarterly Employment Cost Index (ECI) – a more reliable measure of wages and salaries – is not pointing to any noticeable acceleration in wage increases (see our Flash note published on 29 April), although we continue to expect wage increases to gradually pick up over the coming few quarters.