ISM figures for April, together with robust auto sales, suggest some pick up in US growth during the month Read full report here The US ISM Manufacturing survey for April 2016, published on May 2, dropped back a little, from 51.8 in March to 50.8, below consensus expectations (51.4). However, the level recorded in March was an eight-month high. And the April figure is well above the lows registered at the turn of the year (48.0 in December 2015, 48.2 in January 2016). The New Orders sub-index – the most forward-looking component of the survey – eased back from 58.3 in March to 55.8 in April. But the reading for new orders recorded in March was the highest since November 2014. The ISM Non-Manufacturing survey for April was published on May 4. The headline index to 55.7 rose from 54.5 in March, above consensus expectations. However, the rebound of the past two months followed a sizeable fall over the previous few months. Taken together, the two ISM indices suggest that overall economic growth bounced back between Q1 and April. Nevertheless, although ISM surveys are timely and useful indicators of the strength of the economy, they are not very reliable at forecasting GDP growth in the short run. Indeed, ISM indices had been pointing to 1.9% GDP growth in Q1 whereas the first estimate published on 28 April for this was 0.5%.

Topics:

Bernard Lambert considers the following as important: ISM April, Macroview, US auto sales, US ISM surveys, US Q2 growth

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

ISM figures for April, together with robust auto sales, suggest some pick up in US growth during the month

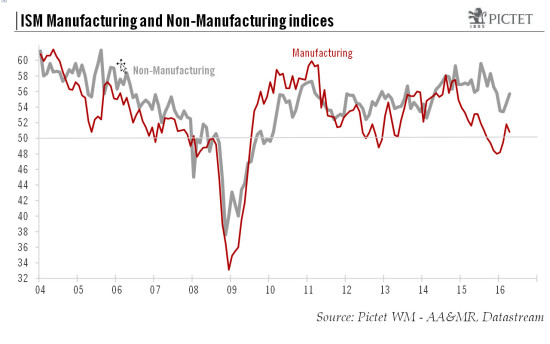

The US ISM Manufacturing survey for April 2016, published on May 2, dropped back a little, from 51.8 in March to 50.8, below consensus expectations (51.4). However, the level recorded in March was an eight-month high. And the April figure is well above the lows registered at the turn of the year (48.0 in December 2015, 48.2 in January 2016). The New Orders sub-index – the most forward-looking component of the survey – eased back from 58.3 in March to 55.8 in April. But the reading for new orders recorded in March was the highest since November 2014.

The ISM Non-Manufacturing survey for April was published on May 4. The headline index to 55.7 rose from 54.5 in March, above consensus expectations. However, the rebound of the past two months followed a sizeable fall over the previous few months.

Taken together, the two ISM indices suggest that overall economic growth bounced back between Q1 and April. Nevertheless, although ISM surveys are timely and useful indicators of the strength of the economy, they are not very reliable at forecasting GDP growth in the short run. Indeed, ISM indices had been pointing to 1.9% GDP growth in Q1 whereas the first estimate published on 28 April for this was 0.5%.

Importantly, data for auto sales in April, published on 3 May, showed that sales bounced back sharply m-o-m, following their surprisingly marked fall in Q1. Auto sales rose by 5.1% m-o-m in April to an annualised pace of 17.4 million units, and between Q1 and April they grew by 6.8% annualised.

These encouraging data on auto sales bring some support to our view that consumer spending growth will accelerate in Q2. Our scenario that US GDP growth will pick up to 2.5% annualised in Q2 – and settle at rates slightly above 2.0% in both Q3 and Q4 – remains unchanged.