Extension of quantitative easing (QE) along with changes to how QE works may be in the offing, but an announcement might wait until December. Ahead of its 8 September policy meeting, the European Central Bank (ECB) has expressed its “concerns” over the lack of upward momentum in core inflation. In our view, it is not a question of whether the ECB will ease (QE extension is a given, and more could be needed at some stage in the future), but more about getting the sequence right in order to maximise the impact of the additional measures we expect.We see both fundamental and tactical reasons for the ECB to delay its next policy response until December. In particular, the resilience of recent data suggests there will be few changes to staff forecasts this month. And the median projection for inflation in 2018 is likely to remain unchanged at 1.6%. Meanwhile, more time is needed to acknowledge and address the scarcity issue facing asset purchases.Our baseline scenario is for the ECB to act in December by extending its asset-purchase programme to September 2017 (if not beyond) while making a number of technical changes. Ideally, Mario Draghi would telegraph those changes to the market as soon as next week, for instance by setting up task forces to study QE (and TLTRO) ‘recalibration’ options.

Topics:

Frederik Ducrozet considers the following as important: ECB monetary policy, ECB quantitative easing, ECB staff forecasts, European Central Bank, Macroview

This could be interesting, too:

Dirk Niepelt writes Panel on “Will the digital euro take off?,” CEPR, 2023

Dirk Niepelt writes Conference on “The Macroeconomic Implications of Central Bank Digital Currencies,” CEPR/ECB, 2023

Dirk Niepelt writes “A Macroeconomic Perspective on Retail CBDC and the Digital Euro,” EIZ, 2023

Dirk Niepelt writes “Why the Digital Euro Might be Dead on Arrival,” VoxEU, 2023

Extension of quantitative easing (QE) along with changes to how QE works may be in the offing, but an announcement might wait until December.

Ahead of its 8 September policy meeting, the European Central Bank (ECB) has expressed its “concerns” over the lack of upward momentum in core inflation. In our view, it is not a question of whether the ECB will ease (QE extension is a given, and more could be needed at some stage in the future), but more about getting the sequence right in order to maximise the impact of the additional measures we expect.

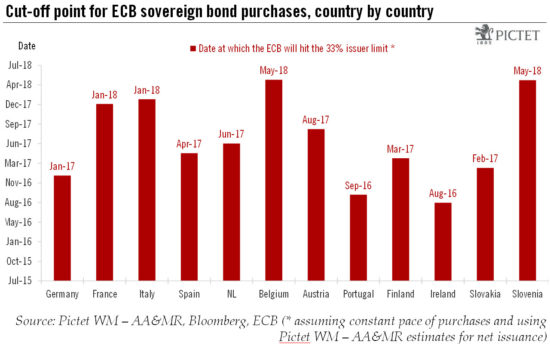

We see both fundamental and tactical reasons for the ECB to delay its next policy response until December. In particular, the resilience of recent data suggests there will be few changes to staff forecasts this month. And the median projection for inflation in 2018 is likely to remain unchanged at 1.6%. Meanwhile, more time is needed to acknowledge and address the scarcity issue facing asset purchases.

Our baseline scenario is for the ECB to act in December by extending its asset-purchase programme to September 2017 (if not beyond) while making a number of technical changes. Ideally, Mario Draghi would telegraph those changes to the market as soon as next week, for instance by setting up task forces to study QE (and TLTRO) ‘recalibration’ options.

Looking ahead, the ECB remains fundamentally concerned about subdued underlying inflation dynamics. Those concerns have been reflected in a flurry of recent staff papers. In short, the output gap could be larger than previously expected, the link between unemployment and inflation could be weaker, and inflation expectations could be at risk of being dis-anchored. All in all, we expect the ECB to err on the dovish side even if the economy continues to surprise on the upside.