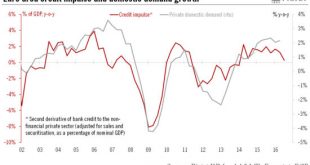

Relatively strong credit data for October were not enough to prevent the credit impulse from continuing to soften.Euro area bank credit flows to non-financial corporations rebounded strongly in October, by EUR11 bn in adjusted terms. Bank loans to households continued to expand at a healthy pace (+EUR10 bn). The slowdown in annual growth of the broad monetary aggregate M3, from 5.1% to 4.4% year on year in October, was largely due to base effects.The rebound in credit flows to the private...

Read More »Disappointing credit flow figures in the eurozone

Data pose a downside risk for GDP forecast and strengthens case for additional ECB intervention.Euro area bank credit flows to non-financial corporations (NFC) were pretty disappointing in September (coming in flat after a decline of EUR 1bn in August). On a country by country basis, NFC flows were positive for the four biggest economies, but not enough to bring the 3-month average back into positive territory in Italy and Spain. On a brighter note, credit flows to euro area households rose...

Read More »Credit conditions improve in the euro area

Banks see QE and negative deposit rates as contributing to lending volumes—but also hurting their net interest income. Released on 18 October, the ECB’s third-quarter Bank Lending Survey– the first one to fully capture the effects of the 23 June Brexit referendum – remained broadly consistent with improving credit conditions. The BLS is of special significance in the current environment where commercial banks remain under a lot of pressure from all sides, whether from regulation,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org