Chinese GDP slightly above expectations in Q2. We maintain our forecast of 6.5% growth this year. China’s GDP growth came in at 6.7% year-on-year in Q2 2016, unchanged from Q1 and slightly better than expectations. A detailed breakdown of the GDP number released on 15 July is still unavailable, but we can gain a better understanding of the state of the Chinese economy by looking at some other indicators that have been published recently.First, household consumption is becoming ever more important for China’s overall growth. Final consumption represented 73% of Chinese growth in the first half (4.9% of total 6.7% GDP growth in that period), compared with 68% in 2015 as a whole.The rebound in auto sales that started earlier this year continued in June, with sales climbing 15% compared with a year earlier, the highest growth in six months. Sales of SUVs, a typical symbol of the middle class’s aspirations, grew by 41% in June over a year earlier. By contrast, growth in fixed-asset investment (FAI) continues to moderate. FAI growth slowed to 7.3% year-on-year in June (vs. 7.4% in May). Investment growth in both the manufacturing and property sectors has also continued to slow. The only sector that has held up well is infrastructure, where spending is supported by the government.The external front remains challenging for China. The decline in exports quickened to -4.

Topics:

Dong Chen considers the following as important: China GDP, China growth, Chinese economy, Chinese rebalancing, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Chinese GDP slightly above expectations in Q2. We maintain our forecast of 6.5% growth this year.

China’s GDP growth came in at 6.7% year-on-year in Q2 2016, unchanged from Q1 and slightly better than expectations. A detailed breakdown of the GDP number released on 15 July is still unavailable, but we can gain a better understanding of the state of the Chinese economy by looking at some other indicators that have been published recently.

First, household consumption is becoming ever more important for China’s overall growth. Final consumption represented 73% of Chinese growth in the first half (4.9% of total 6.7% GDP growth in that period), compared with 68% in 2015 as a whole.

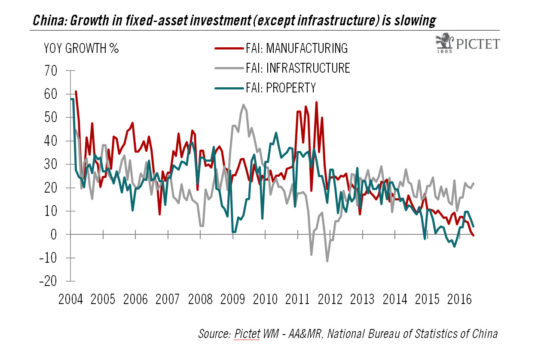

The rebound in auto sales that started earlier this year continued in June, with sales climbing 15% compared with a year earlier, the highest growth in six months. Sales of SUVs, a typical symbol of the middle class’s aspirations, grew by 41% in June over a year earlier. By contrast, growth in fixed-asset investment (FAI) continues to moderate. FAI growth slowed to 7.3% year-on-year in June (vs. 7.4% in May). Investment growth in both the manufacturing and property sectors has also continued to slow. The only sector that has held up well is infrastructure, where spending is supported by the government.

The external front remains challenging for China. The decline in exports quickened to -4.8% year-on-year in June from -4.1% in May. Given the sluggish global growth environment and the added uncertainties of Brexit, significant improvement in China’s export performance seems unlikely in the near term.

Recent data releases from China have been consistent with our view that the Chinese economy will likely continue to muddle through in 2016. The headline growth may grind slightly lower towards 6.5% for the rest of the year as the monetary stimulus launched late last year runs its course. At the same time, we expect to see the shift in the structure of China’s economy to continue. As personal income grows, household consumption can be expected to play an increasingly important role in driving China’s growth going forward. Fixed-asset investment, on the other hand, will likely fade as a factor in economic growth in the years to come.