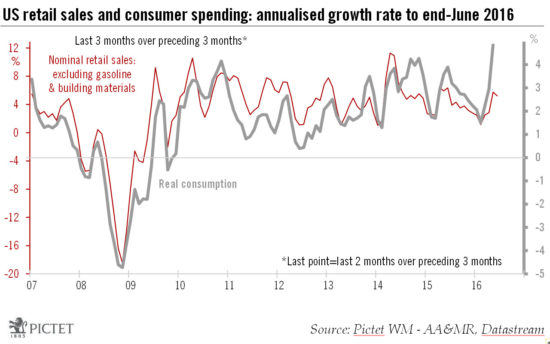

Macroview Upbeat consumer spending figures and other data mean we maintain our forecast of 2.5% GDP growth for the US in the second quarter. Core retail sales in the US increased by 0.5% month-on-month in June, above consensus expectations. Moreover, April and May numbers were revised up by a cumulative 0.1%. The result was that core retail sales grew by a very strong rate of 7.4% quarter-on-quarter (q-o-q) annualised in Q2 2016, much higher than the 2.8% rise seen in Q1.Together with auto sales data published at the start of the month, the data released on 15 July on retail sales suggest household consumption didn’t lose much momentum at the end of the second quarter. Indeed, various indicators of consumer spending in the US have been quite strong overall, so that we believe annualised personal consumption growth may easily have topped 4.0% in Q2 2016.We continue to expect personal consumption growth in the US to remain solid in the second half of this year, at around 2½%. Employment growth seems to be slowing down but should nevertheless remain relatively healthy, while we believe wage increases are likely to pick up gradually. In spite of recent rises in fuel prices, in June these were still 6.3% lower than they were on average in Q4 last year. And cheaper energy prices usually have a lagged positive effect on household consumption.

Topics:

Bernard Lambert considers the following as important: Macroview, US consumer spending, US growth forecast, US retail sales, US second-quarter GDP

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Upbeat consumer spending figures and other data mean we maintain our forecast of 2.5% GDP growth for the US in the second quarter.

Core retail sales in the US increased by 0.5% month-on-month in June, above consensus expectations. Moreover, April and May numbers were revised up by a cumulative 0.1%. The result was that core retail sales grew by a very strong rate of 7.4% quarter-on-quarter (q-o-q) annualised in Q2 2016, much higher than the 2.8% rise seen in Q1.

Together with auto sales data published at the start of the month, the data released on 15 July on retail sales suggest household consumption didn’t lose much momentum at the end of the second quarter. Indeed, various indicators of consumer spending in the US have been quite strong overall, so that we believe annualised personal consumption growth may easily have topped 4.0% in Q2 2016.

We continue to expect personal consumption growth in the US to remain solid in the second half of this year, at around 2½%. Employment growth seems to be slowing down but should nevertheless remain relatively healthy, while we believe wage increases are likely to pick up gradually. In spite of recent rises in fuel prices, in June these were still 6.3% lower than they were on average in Q4 last year. And cheaper energy prices usually have a lagged positive effect on household consumption. As a result, part of the windfall from past declines in oil prices has probably still not been spent by US consumers, instead showing up in a savings rate that is still relatively high. However, the savings rate may well decline further over the coming months.

Other economic data published in the week to 15 July were also relatively upbeat. Industrial production in the US bounced back significantly in June and the NFIB small businesses survey was relatively upbeat. Our forecast that US GDP grew at 2.5% q-o-q annualised in Q2 remains unchanged, as do our projections for yearly average growth of 1.8% in 2016 and 2.0% in 2017.