Should risks rise further in coming weeks, the ECB could decide to increase the size of its monthly asset purchases from the current pace of EUR60bn. While leaving policy rates and its QE programme unchanged at today’s meeting, the ECB reinforced its easing bias, highlighting renewed downside risks to both economic growth and inflation. ECB staff forecasts were revised lower as a result of less favourable global growth conditions, including in China, as well as tighter financial conditions, including a stronger trade-weighted euro. Despite the revisions, downside risks remain. Should those risks rise further in the coming weeks, the ECB could decide to increase the size of its monthly asset purchases from the current monthly pace of €60bn, and/or make the duration of the QE programme explicitly conditional on the inflation outlook. The issue share limit for PSPP (Public Sector Purchase Programme) purchases was lifted from 25% to 33%, a relatively minor adjustment which may alleviate some concerns over scarcity of eligible securities, but one that also reflects ECB QE flexibility and that could indeed pave the way for potential expansion of the programme. Maximum flexibility, but no fresh action (yet) Going into September’s policy meeting, the main question had been how, rather than if, President Mario Draghi would strengthen the ECB’s easing bias.

Topics:

Perspectives Pictet considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Should risks rise further in coming weeks, the ECB could decide to increase the size of its monthly asset purchases from the current pace of EUR60bn.

- While leaving policy rates and its QE programme unchanged at today’s meeting, the ECB reinforced its easing bias, highlighting renewed downside risks to both economic growth and inflation.

- ECB staff forecasts were revised lower as a result of less favourable global growth conditions, including in China, as well as tighter financial conditions, including a stronger trade-weighted euro. Despite the revisions, downside risks remain.

- Should those risks rise further in the coming weeks, the ECB could decide to increase the size of its monthly asset purchases from the current monthly pace of €60bn, and/or make the duration of the QE programme explicitly conditional on the inflation outlook.

- The issue share limit for PSPP (Public Sector Purchase Programme) purchases was lifted from 25% to 33%, a relatively minor adjustment which may alleviate some concerns over scarcity of eligible securities, but one that also reflects ECB QE flexibility and that could indeed pave the way for potential expansion of the programme.

Maximum flexibility, but no fresh action (yet)

Going into September’s policy meeting, the main question had been how, rather than if, President Mario Draghi would strengthen the ECB’s easing bias. Indeed, recent comments from Vice-President Vítor Constancio and Chief Economist Peter Praet had made it plain that the Governing Council (GC) stands ready to ease its monetary stance further. “There should be no ambiguity on the willingness and ability of the Governing Council to act if needed,” Praet had said. This is exactly what Draghi repeated today and what was reflected in the ECB’s introductory statement and updated staff forecasts. To some extent, Draghi distinguished himself from other comments, including from Executive Board member Benoît Coeuré, who suggested that the ECB should look through volatility in financial markets and China, in particular.

Specifically, the ECB made a number of changes to its communication today, stressing “renewed downside risks” to its assessment of economic conditions. The ongoing eurozone recovery was said to be “somewhat weaker” than had been expected earlier, largely due to the slowdown in emerging markets. Meanwhile, lower oil prices and, to a lesser extent, a stronger effective exchange rate for the euro, up by 6% from its April lows, are expected to exert downward pressure on consumer prices.

During the Q&A session, Draghi added that inflation rates will remain “very low” and may even turn negative again in the near term, although this would not, in his view, qualify as outright deflation. As a result, the projections from the ECB staff were revised lower, especially over the next couple of years, with risks tilted to the downside (see below).

In the end, Draghi opened the door more explicitly to further monetary easing, stressing the GC’s “willingness, readiness and capacity” to act if necessary, “using all the instruments within its mandate”. The QE programme, in particular, would have enough flexibility to be adjusted in terms of size, duration and composition. The ECB intends to carry out asset purchases until September 2016 “or beyond, if necessary” – a subtle yet important addition to the introductory statement – and, in any event, until there is a “sustained adjustment in the path of inflation”.

Despite this extreme dovishness and flexibility, no fresh action was discussed at yesterday’s meeting beyond the increase in the issue share limit for PSPP purchases, from 25% to 33%, provided that the ECB avoids a blocking minority in the event of Collective Action Clauses. Still, Draghi reversing the burden of proof likely means that economic indicators and financial conditions would have to improve in the coming weeks for the ECB to avoid taking new easing steps. For now, market reaction to the press conference should please the ECB as the EUR/USD dropped by more than 1% closer to 1.11, and bond yields eased substantially as well.

Downward revisions to ECB staff forecasts

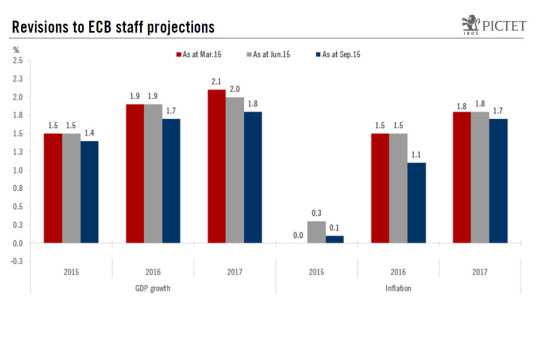

Unsurprisingly, recent external developments have taken their toll on ECB staff projections for economic growth and inflation. The median projection for real GDP growth was lowered to 1.4% for 2015 (from 1.5% in June), to 1.7% for 2016 (from 1.9%), and to 1.8% for 2017 (from 2.0%).

Similarly, forecasts for HICP inflation were revised down to 0.1% for 2015 (from 0.3% in June), to 1.1% for 2016 (from 1.5%), and to 1.7% for 2017 (from 1.8%). Although those changes to 2017 forecasts – the most relevant for the conduct of monetary policy – are not huge, they are not insignificant either.

Crucially, the overall balance of risks has been shifted to the downside – explicitly so for growth (whereas those risks were said to be “contained” in recent months), and more subtly for inflation (for which the ECB now indicates “there are” downside risks owing to recent moves in oil prices and exchange rates and, to a lesser extent, the reduced closing of the output gap).

Moreover, Draghi emphasised that downside risks to staff forecasts were amplified by the fact the cut-off date used to fix technical assumptions for oil prices and exchange rates was set at 12 August, i.e. before the latest bout of market turmoil. In the detailed document, the staff ran a sensitivity analysis suggesting that an alternative path for the exchange rate in particular, whereby the EUR/USD would appreciate up to 1.21 by 2017, would add downside risks to inflation projections to the tune of 0.1 to 0.5 of a percentage point. By contrast, the renewed decline in oil prices would only add “small downside risks” to the inflation projection, according to the ECB.

Either way, staff forecasts remain explicitly conditional on the ECB’s QE programme and other unconventional measures (TLTROs, with the next operation set to be allotted on 24 September) being fully implemented.

What next? Times are different – expect no bazooka

It is not the first time the ECB has come under pressure to ease more. There is a decent chance that yesterday’s dovish words will have to be followed by new concrete initiatives aimed at boosting inflation and inflation expectations over the medium term. In a not-so-Freudian slip, Draghi mentioned the “current” programme, as if it might have to be followed by another.

However, times are different in many respects. Prospects for domestic demand in the eurozone have been improving so far this year, just when external developments have turned less favourable. In particular, credit flows to the non-financial private sector have resumed expanding while the average cost of new loans has fallen sharply, including in stressed countries as Draghi mentioned. Real M1 growth, a rather reliable forward-looking indicator for economic activity, is running at a pace that, historically, would be consistent with real GDP growth of up to 4%. Traditional business surveys, meanwhile, have remained relatively resilient to the slowdown in foreign demand and consistent with quarterly GDP growth of ca.0.4% q-o-q. All this may not prevent the ECB from easing, but it should limit the scale of the policy response, barring a hard landing in China or a surge in the trade-weighted euro.

Assuming the ECB decides to make further tweaks to its QE programme, it could choose one or more options. A relatively easy step would involve quickening the monthly pace of asset purchases, from €60bn currently to, say, €80bn. In doing so, further technical changes to the PSPP features may eventually prove necessary to mitigate scarcity concerns, including a further increase in (some) issue/issuer share limits or even a deviation from the ECB’s capital keys used to ventilate purchases by countries. Meanwhile the composition of asset purchases could be adjusted further, adding corporate bonds, new agency debt or even more risky assets to the pool. A more radical option would be to make either the size of the QE programme or its duration (or both) more explicitly conditional on the inflation outlook, dropping the reference to the September 2016 end-date, with a regular review of the progress in achieving those goals (or lack thereof).

Lastly, a (deposit) rate cut was not discussed at yesterday’s meeting, but Draghi did not repeat his usual comments on the lower bound.