Employment growth in the euro area has been broadly spread and includes many countries that were hard hit by the crisis. Almost one third of the recovery in euro area employment has come from Spain. Today’s Eurostat data showed that euro area employment increased by 0.3% q-o-q (1.1% q-o-q annualised; 1.1% y-o-y) in Q3, thus posting its ninth quarter-on-quarter consecutive expansion. The Q2 figure was slightly revised up by 0.1pp to 0.4% q-o-q, the highest growth rate in more than seven years. After almost five years of uninterrupted job destruction, euro area employment has seen a rebound since the middle of 2013, increasing by over 2.7 million. Although, this is not enough to make up for the large losses recorded over the course of the recent economic crisis, the gap with the pre-crisis level has almost halved and is likely to be closed in Q1 2018 if the current average employment growth of 0.2% q-o-q continues. One development of note is that employment growth has been broadly spread and included many countries that were hard hit by the crisis. As an example, Spain has contributed almost one-third to the increase in euro area employment, albeit mostly from temporary contracts. At a sectorial level, job gains have been mainly concentrated in the services sector, whereas the construction sector is still losing jobs.

Topics:

Nadia Gharbi considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Employment growth in the euro area has been broadly spread and includes many countries that were hard hit by the crisis. Almost one third of the recovery in euro area employment has come from Spain.

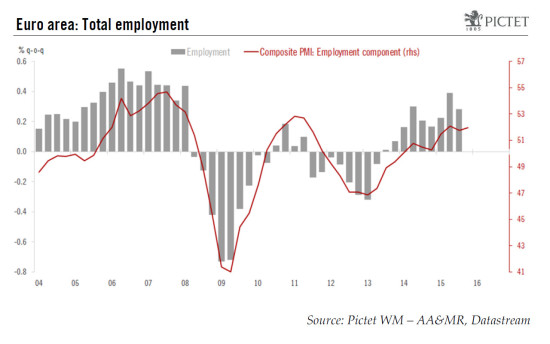

Today’s Eurostat data showed that euro area employment increased by 0.3% q-o-q (1.1% q-o-q annualised; 1.1% y-o-y) in Q3, thus posting its ninth quarter-on-quarter consecutive expansion. The Q2 figure was slightly revised up by 0.1pp to 0.4% q-o-q, the highest growth rate in more than seven years.

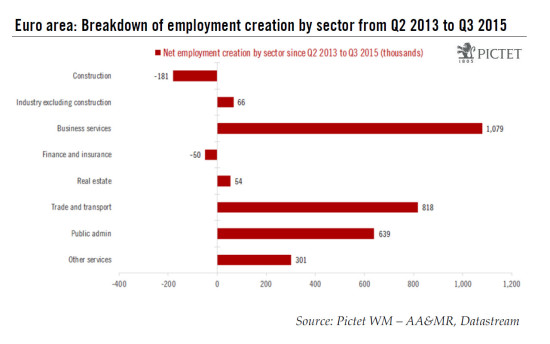

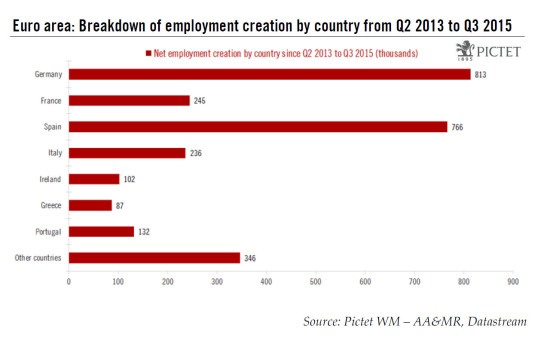

After almost five years of uninterrupted job destruction, euro area employment has seen a rebound since the middle of 2013, increasing by over 2.7 million. Although, this is not enough to make up for the large losses recorded over the course of the recent economic crisis, the gap with the pre-crisis level has almost halved and is likely to be closed in Q1 2018 if the current average employment growth of 0.2% q-o-q continues. One development of note is that employment growth has been broadly spread and included many countries that were hard hit by the crisis. As an example, Spain has contributed almost one-third to the increase in euro area employment, albeit mostly from temporary contracts. At a sectorial level, job gains have been mainly concentrated in the services sector, whereas the construction sector is still losing jobs.

Looking ahead, leading indicators point to further improvement in employment trends. A better labour market coupled with low inflation and more accommodative financing conditions will remain key supports for private consumption.

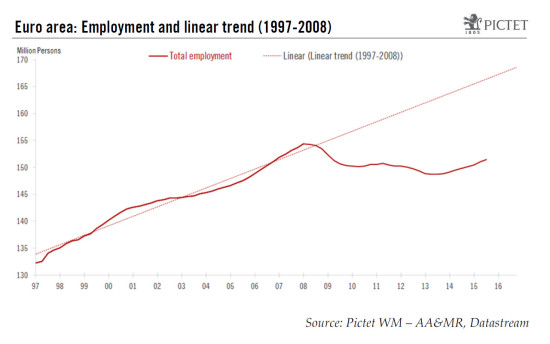

A lost decade in job growth trends

Recent economic crises took a heavy toll on the employment level in the euro area, with almost five years of uninterrupted employment losses. Between its pre-crisis peak in the first quarter of 2008 and the second quarter of 2013, euro area employment levels fell by 3.6%, reflecting a drop of more than 5.6 million in headcount employment. In addition to this figure, the crisis also halted the trend in employment growth in the euro area. Therefore, the absolute figure of five million jobs lost is at the lower end of the true loss.

Nevertheless, since hitting a low point in the second quarter of 2013, euro area employment has shown continued quarter-on-quarter expansion, posting a total increase of 2.7 million people and reaching almost half of the pre-crisis high. This represents a marked increase compared to the 2.2 million jobs created and commented on by the ECB in a box this week.

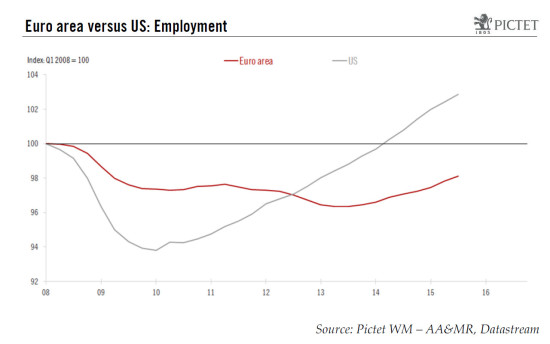

Muted recovery in the euro area compared to the US

In comparison with the US, the recovery in employment has been much more muted in the euro area. At its worst point in Q1 2010, the United States lost more than 8.5 million jobs (i.e. around 6% of the total since the pre-crisis peak). However, US employment has rebounded sharply since its low point, with more than 12.5 million jobs created. The employment level thus now exceeds its pre-crisis level by almost 3%.

In contrast, euro area employment level is still 2% below pre-crisis levels (see the chart below). If we assume that the current average rate of employment growth seen since the middle of 2013 of around 0.2% q-o-q will continue, the employment level could exceed its pre-crisis level in Q1 2018.

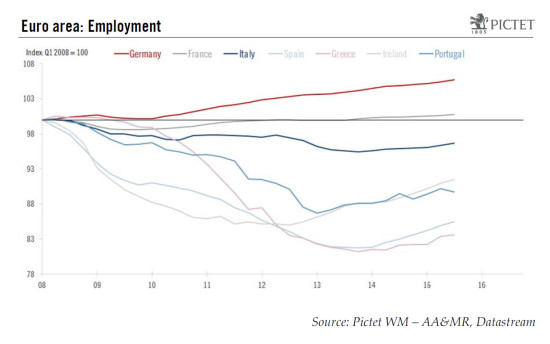

Employment recovery led by the periphery

With the exception of Portugal, all euro area member states posted a quarterly expansion in Q3. In Italy, Q3’s employment growth rate was the fastest since Q4 2010. One notable feature of the improvement in the euro area employment growth is that the increases have been mainly concentrated in some of the worst-hit labour markets, like Spain. In more detail, Germany and Spain have generated almost two-thirds of the total euro area increase seen between Q2 2013 and Q3 2015, with their respective employment rates expanding by 813,000 and 766,000. Over the same period, France and Italy’s employment levels were up by just 245,000 and 236,000, accounting for around 18% of the total euro area increase. In addition to Spain, Ireland, Greece and Portugal contributed around 12% together.

Still room for improvement

Looking ahead, there is still huge room for improvement in employment levels in most peripheral countries. The rebound in Spain appears particularly strong, but it offsets less than one-fifth of the total loss incurred over the course of the crisis, which amounted to 3.8 million in employment headcount. The Spanish employment level thus remains well below its pre-crisis level. The same applies for Italy, Ireland, Greece and Portugal. Among the core countries, Germany appears to be the outlier as it is the only country to have experienced a rise in its employment level between 2008 and 2013, and it is now well above its pre-crisis level.

Services concentrated most of jobs creation

At a sectorial level, job gains have been mainly concentrated in the services sector (see the chart below). In the industrial sector (excluding construction), after a long-term downsizing seen before the crisis, a slight reversal can be seen since Q4 2014. In contrast, the construction sector is still losing jobs. There are still significant differences between members’ state, partly as a result of the unwinding of earlier imbalances in the housing sector in some countries. In terms of contract types, employment growth in the euro area has mainly relied on temporary contracts (See the ECB in a box for further details).