U.S. index futures point slightly lower open. Asian shares rose while stocks in Europe fell as energy producers got caught in a downdraft in oil prices and reversed an earlier gain after Goldman unexpectedly warned that WTI could slide below absent "show and awe" from OPEC. The dollar rose, hitting a four-month high against ...

Topics:

Tyler Durden considers the following as important: Across the Curve, ASX 200, Bank of Canada, Bank of France, BOE, Boeing, Bond, Business, Canadian Dollar, Central Banks, China, Consumer Credit, Copper, Crude, Crude Oil, DAX 30, Deutsche Bank, Deutsche Bank Trade Weighted, economy, Equity Markets, European Central Bank, European Union, Eurozone, FBI, Federal Bureau of Investigation, Federal government, Finance, financial markets, fixed, Fixed income analysis, Foreign exchange market, France, FTSE 100, Futures contract, Gilts, goldman sachs, Hang Seng 40, Hang Seng China Enterprises, Hedge, Iran, Japanese Yen, Jim Reid, Market Conditions, Monetary Policy, Money, Netherlands, New Zealand, NFIB, Nikkei, Nikkei 225, OPEC, Open Market Operations, Organization of Petroleum-Exporting Countries, PDVSA, People's Bank Of China, Precious Metals, Profit Target BlueCrest Fund, renminbi, S&P 500, S&P/ASX 200, SSE 50, Stoxx 600, Topix, Turkey, U.S. Dollar Index, US government, Wholesale Inventories, Yen, Yuan, Zurich

This could be interesting, too:

investrends.ch writes Fluggesellschaften steuern auf Rekordgewinne zu

investrends.ch writes Bloomberg: DWS stoppt Private-Credit-Geschäft in Asien

investrends.ch writes Deutsche Bank bleibt auf Rekordkurs

investrends.ch writes Neuer Vertriebsleiter bei Goldman Sachs kommt von Invesco

U.S. index futures point slightly lower open. Asian shares rose while stocks in Europe fell as energy producers got caught in a downdraft in oil prices and reversed an earlier gain after Goldman unexpectedly warned that WTI could slide below $40 absent "show and awe" from OPEC. The dollar rose, hitting a four-month high against the yen and bonds and top emerging market currencies were back under pressure on Tuesday, following last week’s hawkish rhetoric from central bankers.

Nonetheless, driven by expectations for solid earnings growth, MSCI's 46-country All World share index was up for a third day running, although it started to slip as Europe's bourses lost their footing early on. According to Bloomberg, the early European focus was on the overnight rally in USD/JPY toward 114.50 after tripping stops through 114.37 high from May; strong 5Y JGB auction also supports as curve steepens. The USD held small gains against G-10 through the European morning, GBP/USD pushes higher through 1.29 in thin liquidity; EMFX underperforms markedly. USTs sell off in tandem with the move in USD/JPY and see further pressure after bund and gilt futures open. European equity markets open higher before reversing; FTSE 100 underperforms with retail sector lagging after Marks and Spencer (-3.8%) trading update. Auto sector rallies after latest China vehicle sales numbers.

Overnight, all eyes were on the BOJ, and whether it would intervene again as it did on Friday for longer-term debt maturities, to stem the ongoing rise in JGB yields following a five-year bond auction. However, Kuroda was spared intervention for the second time in one week after the five-year bond auction saw a jump in buyside demand in the form of the highest bid-to-cover ratio since August 2014. Still, the Japanese currency dropped to 114.48 per dollar, its weakest level since mid-March. According to the Deutsche Bank Trade Weighted Index, the yen stands at its lowest since February 2016, a reflection of Japan’s monetary policy divergence versus other major central banks, according to traders in Europe. According to Bloomberg, while the yen’s haven status keeps it in vogue in the longer-term, as shown by risk reversals, the fact that the BOJ looks behind the curve compared to other major central banks in normalizing policy is sending the currency into defensive mode.

Also overnight, China’s central bank resumed its open-market operations for the first time in 13 days, ending the longest pause since April, offering 40 billion yuan in reverse repos. The net effect on the financial system was neutral, as the amount of injections matched maturities for the day. The PBOC hasn’t added cash on a net basis for 16 days in a row. The weighted average 7- day repo rate climbed 8 basis points to 2.80% as of 5:30 p.m. in Shanghai; the overnight cost rises 9 basis points to 2.62%. Japan’s Topix Index climbed 0.7 percent. Hong Kong’s Hang Seng Index strengthened 1.6 percent, heading for its first back-to-back gain in three weeks. The Hang Seng China Enterprises Index soared 2.1 percent, its biggest advance since March 16. The Shanghai Composite Index was down 0.3 percent after a short-lived advance mid-afternoon local time. Other indexes on the mainland were also lower.

Meanwhile, the bond selloff continued with bunds opening lower following Treasuries, as Germany's 10-year yield edged up 2 basis points to 0.56% having more than doubled over the last few weeks, with losses extending as gilts slumped before the 2056 I/L syndication; bonds touched day’s low as bidding opened on the Netherlands 30y sale, before paring losses after the sale. Bund futures dipped to day’s low of 160.48 (46 ticks) as bidding opened on the Netherlands 01/2047. Long-end French bonds outperformed core, with OAT/bund spread tighter by 1-1.5bps across the curve. The outperforming 15-20y sector has previously been highlighted as the preferred spot for domestic real money investors.

Roger Webb, Head of European Credit at Aberdeen Asset Management said the slightly stronger-than-expected global growth numbers had boosted expectations of higher interest rates.

"I think the increased hawkishness we have seen from the central banks has led to a fear that we could see a mini-taper tantrum. I don't think there is too much alarm. I think the move to slightly higher yields in Europe and the U.S., UK and elsewhere is probably understandable."

The shift in sentiment was enough to propel the dollar higher against the basket of currencies including hitting a four-month high of 114.43 yen on the back of the past fortnight's 25 basis-point rise in 10-year U.S. government bond yields. The pound added 0.3 percent to $1.2917 while the euro traded little changed. The New Zealand dollar fell to its lowest since June 23 meanwhile after an earthquake hit the country's South Island. The Canadian dollar was down slightly too against its U.S. counterpart as investors awaited a Bank of Canada interest rate decision on Wednesday. The South African rand, Turkish lira and Russia rouble all dropped around 0.8 percent as the emerging market selling resumed too.

In commodities, crude oil slipped back after pushing higher overnight in Asia. Increased drilling activity in the United States and uncertainty over Libyan and Nigerian production cuts clouded the future supply outlook, leaving U.S. crude down a third of a dollar at $44.13 a barrel and Brent at $46.57. A bearish Goldman note did not help. Spot gold edged lower too, dipping to $1,212.13 an ounce and back near a four-month low touched in the previous session. Spring wheat rose 1.6 percent to $8.1250 a bushel on the Minneapolis Grain Exchange, surging 51% this year amid concerns drought in U.S. Northern Plains will curb output to a 15-year low.

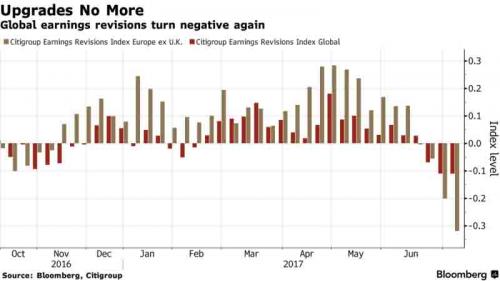

More ominously, the one thing that has kept stocks near all time highs even as the global economic outlook has grown increasingly cloudly, corporate earnings appears to be turning over. Following recent mixed macro data and a drop in commodity prices, analysts have started to cut their forecasts for company earnings, raising concerns over elevated valuations and prices near all-time highs.

Bulletin Headline Summary from RanSquawk

- Asian equities traded with little in the way of firm direction, filtering into European trade, with energy underperforming

- FX markets saw USD/JPY continue its ascent, reaching 4-month highs as GBP position taking is evident ahead of delayed BoE speakers

- Looking ahead, highlights include US JOLTS, APIs, BoE's Haldane, Broadbent, ECB's Coeure, Constancio, Fed's Brainard and Kashkari

Market Snpashot

- S&P 500 futures down 0.03% to 2,423.00

- STOXX Europe 600 down 0.2% to 380.79

- MXAP up 0.7% to 154.41

- MXAPJ up 0.8% to 506.52

- Nikkei up 0.6% to 20,195.48

- Topix up 0.7% to 1,627.14

- Hang Seng Index up 1.5% to 25,877.64

- Shanghai Composite down 0.3% to 3,203.04

- Sensex up 0.4% to 31,825.40

- Australia S&P/ASX 200 up 0.08% to 5,728.93

- Kospi up 0.6% to 2,396.00

- US 10Y yield rose

- German 10Y yield rose 2.0 bps to 0.56%

- Euro down 0.03% to 1.1396 per US$

- Italian 10Y yield fell 6.2 bps to 1.985%

- Spanish 10Y yield rose 0.9 bps to 1.68%

- Brent Futures down 0.6% to $46.59/bbl

- Gold spot down 0.2% to $1,211.43

- U.S. Dollar Index up 0.09% to 96.11

Top Overnight News

- Trump will nominate Randal Quarles Fed vice chair of supervision

- Trump Jr. was told before meeting of Kremlin effort to aid campaign: NYT

- Oil erased earlier gains to trade near $44 a barrel in New York after Goldman warned it could drop below $40

- F-35 Program Costs Jump to $406.5 Billion in Latest Estimate

- Trump Will Nominate Quarles as Fed’s Top Wall Street Regulator

- Trump’s FBI Pick Faces Questions on Independence Versus Loyalty

- Trump’s Son Sucked Into Russia Probe After Meeting With Lawyer

- U.K. June BRC like-for-like retail sales 1.2% vs 0.8% estimate

- China should keep interest rates stable in 2H: Securities Journal

- Australia June NAB business conditions index highest since 2008

- Banks Heed Carney’s Call to Tackle Risks of Climate Change

- Fed’s Williams says forecasts of one more 2017 rate hike seem reasonable

- Sanofi to Buy U.S. Vaccine Maker for Up to $750 Million

- Worldwide Semiconductor Revenue to Reach $400b in ’17: Gartner

- BioMarin Hemophilia Therapy Reduces Bleeding in Phase 1/2 Study

- Google-Backed Mobvoi Aiming for U.S. or HK IPO Within Two Years

- Cigna Names Arthur Cozad as CEO of Zurich Insurance Middle East

- Microsoft Funds Faster Internet for U.S. Heartland to Bridge Gap

- Getty Realty Prices 4.1m Shares at $23.15 Each

- Delta Cancels Flights Amid Air Traffic Control Center Evacuation

- AAR Names Michael Milligan CFO, Succeeds Timothy Romenesko

- Citrix Names Henshall CEO as Tatarinov Leaves; Reaffirms 2Q

- Venezuelan Prosecutor Charges Two Over PDVSA Contracting

- J.C. Penney Names Interim CFO After Edward Record Steps Down

- Alexander & Baldwin Names James Mead CFO, Succeeds Paul Ito

- Myokardia Files 9.2m- Share Shelf for Holder Third Rock Ventures

- Cypress Semiconductor Says Director Resigned Over Disagreement

Asian equities saw a lack of firm direction overnight amid quiet newsflow. This was despite a resumption in the PBoC's open market operations with a CNY 40bIn injection for the first time in 13 days (however, was net neutral with CNY 40bIn of prior injections maturing). The Nikkei 225 (+0.4%) failed to find any firm direction, while ASX 200 (-0.1%) was choppy and failed to hold on to the early material and energy led advances. Chinese bourses yet again traded in mixed fashion with broad based gains keeping the Hang Seng (+1.0%) afloat, while the Shanghai Comp (-0.2%) treaded water. In fixed income markets, the Japanese 10Y held around 0.1%, owing to last week's pledge by the BoJ to buy unlimited amounts in the 10yr and cap yields. However, further upside in yields could test the BoJ's tolerance, and a slight concession was seen in the Japanese 5Y, subsequently leading to its outperformance amid today's auction. PBoC injected CNY 30bIn and CNY 10bIn through 7-day and 14-day reverse repos; first injection for 13 days. PBoC set the CNY mid-point at 6.7983 vs. Prey. 6.7964. Chinese vehicle sales rose 4.6% for June according to the Chinese Passenger Car Association

Top Asian News

- China Hedge Funds Return 13% to Rank Near the Top Globally

- Pakistan’s Key Stock Index Heads for Biggest Drop Since 2009

- Foreign Banks Said to Seek Relief From India’s Derivatives Rule

- China Likely to Extend Tax Exemption for Electric Cars: CAAM

- China’s ‘Hottest Commodity’ Surges as Steel Seizes the Limelight

- HSBC Upgrades China, Russia to Overweight, Cuts Turkey Exposure

- China Is Likely to Extend Tax Break on Electric Cars, Group Says

- Korea Aerospace Wins 641.2b Won Order From Boeing

The majority of European bourses trade lower, following a slightly higher open, with the materials sector the only Stoxx 600 sector trading in the green. M&S lag amid misses in its Q2 food, clothing and home LFL sales. However, positive broker moves for UK grocers/retailers; Tesco & Morrisons have provided some reprieve for the supermarket names, both trading up in early market trade. The Dax does trade in the green however, as ThyssenKrupp (TKA GY) leads, following a decision to reduce up to 2500 admin jobs in a move that could save EUR 400mln. European paper has grinded lower throughout the session, slowly chipping away at yesterday's marginal games, with range bound trade evident, as participants await a week of speech, with Yellen the highlight tomorrow. News does remain light in markets, with the break of 0.50% bund yield seen last week now acting as support for the yield.

Top European News

- Pearson to Sell 22% Stake in Penguin Random House to Bertelsmann

- Italy’s Production Rises More Than Expected, Boosting Outlook

- Italian Banks’ Big vs Small Divide to Widen, Goldman Sachs Says

- Italy May Industrial Production +0.7% M/m; Est. +0.5%

- M&S Quarterly Sales Dip in Setback to Rowe’s Turnaround Plan

- Thyssenkrupp to Cut Up to 2,500 Staff to Help Meet Profit Target

- BlueCrest Fund Manager Shorting U.K. Property Tips Spanish Peers

- Glencore Is Said to Draw Liberty House Bid for Australian Mine

In currencies, FX markets have been subdued with all anticipation on central bank speech, with Yellen the headlight tomorrow and Kashkari and Brainard expected today. BoE speech will be the key risk event for the day, with a GBP bid being seen early in the session, as investors will await Haldane and Broadbent. Hawkish positioning, accompanied by hawkish speech, could potentially spark some direction into the GBP. GBP/USD has indicated a bearish trend of late, after the rejection of the 1.3140 area, however, clear bids at the bottom of the range (1.27 — 1.28) do indicate buyers in the market, a break through 1.3140 will indicate a change in direction in the pair and could push us toward august 2016 levels. Overnight, movement was seen in NZD, the widely touted 'over-valued' currency did lose some ground, NZD/USD was the main catalyst of the move, after selling renewed in NZD/USD, tripping stops through 0.7250. JPY also continued to lower against its major counterparts, as USD/JPY did trade through the key 114.38 level, now residing around this resistance level, as a mini bidders vs. sellers battle is clear. A risk tone has been clear in currencies, with a weaker JPY being joined by a weaker CHF. EUR has benefited, with EUR/JPY firmly through 130.00 and EUR/CHF finding some early buyers as it looks like the pair will see its 13th green day in two weeks, likely to test the 1.11 area seen in April 2016.

In commodities, oil continues to highlight the commodities sector, seeing selling pressure following the European open, once again WTI rejecting the USD 44.90 area, looking to retest USD 43.60. Fundamental factors do continue to weigh on oil, with supply continuing to pick up, as Nigeria and Libya are now producing an additional 1mIn BPD between them, a huge dent in the 1.8mln combined OPEC agreement. The countries may be asked to cap their oil output following the slowdown of rebel problems resulting in a ramp, however, with Nigeria and Libyan officials not potentially attending the meeting, this could pave difficult. Reports early in Asia did state that Libyan and Nigerian officials may attend the joint meeting between OPEC and non-OPEC nations later this month as oil producers look for ways to cap rising production, however, with Barkindo stating that further cuts will not be discussed, source reports did state this could be in November, the agenda does remain unclear. Precious metals have suffered throughout Asian and European trade, all down for the session, Gold grinds lower, looking increasingly bearish, a break below July's low (1204.87) is likely to lead to a test of 1195.00. Copper has seen some slight reprieve, following hitting a two-week low being hit on an inventory rise and Chinese data yesterday. Metals suffered late yesterday, with small bounces clear, likely profit taking, as Aluminium also saw its biggest intra-day drop in over two months. Iran said it is currently producing 3.8mln bpd of oil, according to its Deputy Oil Minister.

Look at today's events, it is another quiet day: we will only see the NFIB small business optimism number for June (103.8, below the 104.4 expected vs. 104.5 previous) followed by JOLTS job openings and final wholesale inventories data for May (no revision expected ). In terms of Fedspeak, we will hear from Williams and Brainard speak today. The calm before the potential storm with Yellen scheduled to speak over the next two days.

US Event Calendar

- 6am: NFIB Small Business Optimism, est. 104.4, prior 104.5

- 10am: JOLTS Job Openings, est. 5,950, prior 6,044

- 10am: Wholesale Inventories MoM, est. 0.3%, prior 0.3%; Wholesale Trade Sales MoM, prior -0.4%

- 12:30pm: Fed’s Brainard Speaks on Monetary Policy in New York

DB's Jim Reid concludes the overnight wrap

After a very dull 24 hours I thought it might be an opportune moment to recap our bigger picture thoughts on government bond yields given the sell-off of the last two weeks. As we discussed in our Long-Term Study last September we think 2016 will likely be seen as the inflection point and the end of the 35 year bull market for bonds. It won't be a straight line reversal and perhaps the issue will eventually be more for future real returns over nominal returns. The reason for picking out 2016 was that this was the year that 1) voters in the bottom half of the income scale effectively won two landmark national votes and 2) endless extreme monetary policy for the first time started to impact the plumbing of the financial system. The impact of the first point is that it likely means politicians now have to steer policy specifically to this poorer income group to ensure that their electoral chances are enhanced. This likely means more fiscal policy and less austerity. The recent UK election reinforces this theme here and we think the theme will slowly spread.

With regards to the second point, 2016 was the year that negative rates cascaded like wildfire along the government bond curve in Europe. The problem being that the correlation between falling yields and poor EU bank equity performance is very strong and the correlation between bank equity and bank lending suggests that had the trends of 2016 continued much further then the real economy could have actually suffered by the negative yields actually aimed to support growth. However the fact that the BoJ and ECB pulled back from full-on QE in the last 4 months of last year suggested they appreciated that monetary policy had perhaps gone too far for now and was having some negative consequences. As such a slow reversal of the ultra low yield environment should have and should continue to follow. The risk being that at some point a government spends big and yields start to rise faster. This could still be many quarters ahead but if and when it does happen central banks might have to intervene and cap nominal yields to avoid carnage in a heavily indebted world. Then we move towards helicopter money - a story for another day. The problem with this view is that it's as much to do with gut feel, a change in the political wind, and second guessing policy makers as it is to do with spreadsheet based analysis of the current available facts. As such it makes it much more difficult to prove! Anyway this is likely to be a slow moving story for now but generally since last year we've thought the general bias on yields is higher.

Yesterday wasn't the day for this trend to continue though as government bond markets saw some relief as yields dropped after the big sell-off over the past 2 weeks. US Treasuries (2Y: -1bp; 10Y: -1bp) and German Bunds (2Y: -1bp; 10Y -3bp) saw yields fall across all maturities. UK Gilts (2Y: -3bps; 10Y: -3bps), French OATs (2Y: -1bps; 10Y: -3bps) and Italian BTPs (2Y: -2bps; 10Y: -7bps) saw similar moves lower.

With limited newsflow and data yesterday, global risk markets exhibited a mild risk-on tone. Equity markets were broadly positive as the US (S&P500 +0.1%) and Europe (STOXX +0.4%) ticked up, with technology stocks among the top gainers in both indices. In the UK the FTSE gained +0.3% on the day, while German (DAX +0.5%), French (CAC +0.4%) and Italian (FTSE MIB +0.8%) equities posted even higher returns. Currencies, credit and commodities were fairly range bound. Asian equities are generally following the firmer picture, again on low volumes. The Hang Seng is 1.1%, the Nikkei +0.5% but with Chinese equities a little more mixed (Shanghai Comp -0.2%). Treasury yields are back up 1bps and pretty much where they were this time yesterday now.

Taking a look at yesterday’s calendar, it was a fairly quiet day in terms of data. In Europe we saw German trade numbers for May where both the current account surplus and trade surplus came in above expectations at 17.3bn (vs. 15.4bn expected) and 22bn (vs. 18.7bn expected). Both exports and imports grew more than expected at 1.4% (vs. 0.3% expected; 0.9% previous) and +1.2% (vs. 0.3% expected; 1.2% previous). Following that we saw some sentiment data with the latest Bank of France business sentiment reading that disappointed at 103 for June (vs. 106 expected) and the July Sentix investor confidence reading for the Eurozone that clocked a tick above expectations at 28.3 (vs. 28.1 expected).

Over in the US it remained quiet post-payrolls with the only data of note being the June labour market conditions index that rose by 1.5 points in June but still disappointed relative to expectations of a 2.5 point increase. Consumer credit numbers were slightly higher than expected but didn't really move the dial. Of more interest was Mr Trump's intention to nominate Randal Quarles to be the banking watchdog at the Fed. This was anticipated but the feeling is that this will ease regulation for the sector.

Perhaps more interesting was the latest ECB CSPP data out yesterday. It was a strong week for the CSPP programme as purchases settled last week (€2.29bn) implied an average daily run rate of € 457mn, which was well above the average since inception of €366mn. With PSPP purchases at a more lowly €14bn, the CSPP/PSPP ratio was 16.3% which is above the average of 13.6% in Q2 (post QE trimming) and well above the pre-April average of 11.6%. Further on this the average monthly run rate (assuming 21 business days per month) of CSPP since April 2017 (after QE was trimmed) has been €7.7bn (vs. €7.7bn before April). The numbers have been all over the place of late and the ECB may be front-loading and preparing for illiquid summer credit markets but at face value we now have to think about as to whether the CSPP has been tapered at all so far.

Today’s calendar is also very quiet with no major releases of note in Europe. Over in the US we will only see the NFIB small business optimism number for June (104.4 expected vs. 104.5 previous) followed by JOLTS job openings and final wholesale inventories data for May (no revision expected ). In terms of Fedspeak, we will hear from Williams and Brainard speak today. The calm before the potential storm with Yellen scheduled to speak over the next two days.