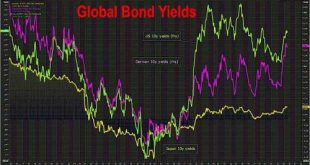

Lately, one of my biggest duds of a call has been for the yield curve to steepen. Sure, I have all sorts of fancy reasons why it should steepen, but reality glares back at me in black and white on my P&L run. Sometimes fighting with the market is an exercise in futility. Now I know many of your eyes glaze over when I start talking about different parts of the yield curve flattening or steepening, but I urge you to...

Read More »Bond Selloff Returns As EM Fears Rise; Oil Slides; BOJ Does Not Intervene

U.S. index futures point slightly lower open. Asian shares rose while stocks in Europe fell as energy producers got caught in a downdraft in oil prices and reversed an earlier gain after Goldman unexpectedly warned that WTI could slide below $40 absent "show and awe" from OPEC. The dollar rose, hitting a four-month high against the yen and bonds and top emerging market currencies were back under pressure on Tuesday, following last week’s hawkish rhetoric from central bankers. Nonetheless,...

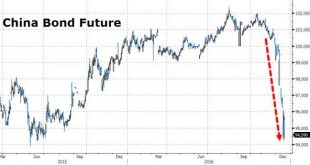

Read More »Bonds Have Best Day In Over 3 Months Amid China Carnage, Turkey Terror, & Berlin Bloodbath

Despite considerably weaker than expected Services PMI, an assassination in Turkey, a terrorist attack in Zurich, and a bloodbath in Berlin, stocks rallied... As a reminder - Chinese bonds crashed overnight again.. Hong Kong stocks tumbled into correction (red for 2016)... And Italian banks all crashed (led by BMPS)... First things first in The US - the market broke today and stocks loved it... The Dow still has not had two down days in a row since before the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org