Christine Lagarde. Photo Credit: European Parliament On December 12, Christine Lagarde introduced her goals and vision in her first rate-setting meeting as the new President of the ECB. On the actual policy front, there were no surprises. She remained committed to the path set by her predecessor, Mario Draghi, and kept the current monetary stimulus unchanged. The central bank kept its deposit rate at the present record-low -0.5%, and pledged to continue its €20...

Read More »FX Daily, January 10: Jobs Friday: Asymmetrical Risks?

Swiss Franc The Euro has risen by 0.06% to 1.0813 EUR/CHF and USD/CHF, January 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The first full week of 2020 is ending on a quiet note, pending the often volatile US jobs report. New record highs US equities on the back of easing geopolitical anxiety is a reflection of greater risk appetite that is evident across the capital markets. Asia Pacific equities mostly...

Read More »USD/CHF Technical Analysis: Sellers hopeful on Doji formation below monthly trendline

USD/CHF portrays buyers’ exhaustion despite the absence of losses since Tuesday. December month low will be the key to watch. USD/CHF trades mostly unchanged around 0.9730 while heading into the European session on Friday. The pair formed a Doji candlestick on the daily (D1) chart by Thursday’s end after recovering for the two consecutive prior days. Considering the candlestick formation indicating the reversal of the previous trend, coupled with the pair’s sustained...

Read More »Swiss unions call for ‘social agenda’ in EU relations

Union federation chief Pierre-Yves Maillard and vice-president Vania Alleva, on Thursday. (Keystone / Marcel Bieri) Switzerland’s largest trade union group has repeated its warning that any framework deal reached with the European Union must respect measures to protect wages from cross-border competition. At the annual conference of the Swiss Trade Union Federationexternal link on Thursday, the objective of keeping wage measures in place was hammered home by group...

Read More »‘Farting archaeobacteria’ awarded Swiss energy prize

The methanation gas containers at Regio Energie Solothurn (Keystone) Flatulent bacteria, electric vehicles and a supply network for greenhouses are among the winners of this year’s Watt d’Or competitionexternal link organised by the Federal Office of Energy. “What is the link between flatulence and renewable energy?” the energy office asked. “The answer is Archie, the farting archaeobacteria.” Archie picked up the award in the “renewable energy” category, presented...

Read More »The Fed Can’t Reverse the Decline of Financialization and Globalization

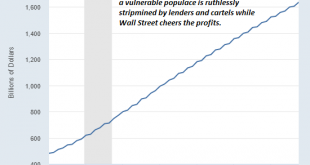

The global economy and financial system are both running on the last toxic fumes of financialization and globalization. For two generations, globalization and financialization have been the two engines of global growth and soaring assets. Globalization can mean many things, but its beating heart is the arbitraging of the labor of the powerless, and commodity, environmental and tax costs by the powerful to increase their profits and wealth. In other...

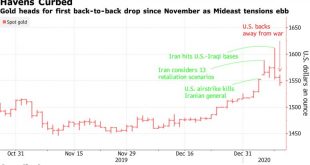

Read More »Gold Steadies After Falls As U.S., Iran Stepping Back From the Brink

◆ Haven demand ebbs as stocks climb with easing Mideast tensions ◆ Palladium retreats from fresh record but holds near $2,100 ◆ There’s still very strong demand for gold “due to a host of financial, geopolitical and monetary risks,” said Mark O’Byrne, research director at GoldCore Full article on Bloomberg Gold Posts First Loss in 11 Sessions as Trump’s Speech Ebbs Iran War Worries via Marketwatch ◆ Yellow metal falls from highest levels since 2013 ◆ Gold prices...

Read More »Dollar Builds on Gains as Iran Tensions Ease

Markets have reacted positively to President Trump’s press conference yesterday, while the dollar continues to gain traction The North American session is quiet in terms of US data Mexico reports December CPI; Peru is expected to keep rates steady at 2.25% German November IP was slightly better than expected but still tepid; sterling took a hit on dovish comments by outgoing BOE Governor Carney Israel is expected to keep rates steady at 0.25% China reported December...

Read More »FX Daily, January 9: Animal Spirits Roar Back

Swiss Franc The Euro has fallen by 0.07% to 1.0804 EUR/CHF and USD/CHF, January 9(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The S&P 500 recovered from a 10-day low to reach a new record high, which set the tone for the Asia Pacific and European markets today. The MSCI Asia Pacific Index jumped by the most in a month with the Nikkei’s 2% advance leading the way. More broadly, the markets in Taiwan,...

Read More »SNB – Devisenreserven der Nationalbank sinken

Per Ende des Berichtsmonats lag der Wert der Devisenreserven bei 770,80 Milliarden Franken, nachdem es Ende November noch 782,95 Milliarden Franken gewesen waren. Der Gesamtbestand der Reserven (exkl. Gold) erreichte Ende Dezember 776,62 Milliarden nach 788,76 Milliarden Franken im Vormonat, wie die SNB am Donnerstag auf ihrer Internetseite mitteilte. Die Daten sind gemäss dem sogenannten Standard zur Verbreitung von Wirtschafts- und Finanzdaten (Special Data...

Read More » SNB & CHF

SNB & CHF