Swiss Franc The Euro has fallen by 0.10% to 1.0827 EUR/CHF and USD/CHF, January 7(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Without fresh escalation, investors cannot maintain a heightened sense of geopolitical anxiety. The recovery of US shares yesterday set the tone for today’s rebound in Asia and Europe. All the equity markets in the Asia Pacific region rallied today, led by a 1.6% rally in Japan and a...

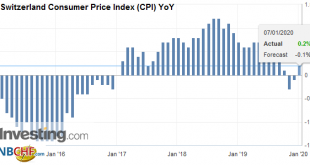

Read More »Swiss Consumer Price Index in December 2019: +0.2 percent YoY, +0.4 percent MoM

07.01.2020 – The consumer price index (CPI) remained stable in December 2019 compared with the previous month, remaining at 101.7 points (December 2015 = 100). Inflation was +0.2% compared with the same month of the previous year. The average annual inflation reached +0.4% in 2019.These are the results of the Federal Statistical Office (FSO). The average annual inflation for 2019 corresponds to the rate of change between the annual average of the CPI for 2019 and...

Read More »USD/CHF Technical Analysis: Inside descending channel below 200-HMA

USD/CHF clings to 23.6% Fibonacci retracement of the pair’s downpour from Christmas to December 31. The falling channel, 200-HMA will challenge the Bullish MACD. The current month top will lure the buyers during further upside. The USD/CHF pair’s latest recovery seems to struggle around 0.9690 during early Tuesday. A short-term falling trend channel and prices below 200-Hour Moving Average (HMA) seem to question the recently bullish MACD. As a result, buyers will...

Read More »Hoher Gewinn der SNB weckt Begehrlichkeiten

Die SNB wird am Donnerstag voraussichtlich einen Gewinn von rund 50 Milliarden Franken vermelden. (Bild: Shutterstock.com) Am nächsten Donnerstag publiziert die Schweizerische Nationalbank (SNB) ihr Finanzergebnis für das Jahr 2019. Sie dürfte gemäss den Berechnungen der UBS für das Gesamtjahr einen Gewinn von rund CHF 50 Mrd. erzielt haben, im Schlussquartal resultierte hingegen ein Verlust von rund CHF 1 Mrd. Bund und Kantone können mit einer Auszahlung von CHF 2...

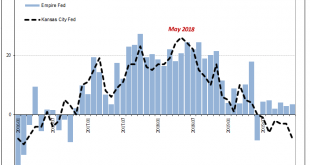

Read More »Manufacturing Clears Up Bond Yields

Yesterday, IHS Markit reported that the manufacturing turnaround its data has been suggesting stalled. After its flash manufacturing PMI had fallen below 50 several times during last summer (only to be revised to slightly above 50 every time the complete survey results were tabulated), beginning in September 2019 the index staged a rebound jumping first to 51.1 in that month. Subsequent months of data had continued the trend. By November, the PMI registered 52.6...

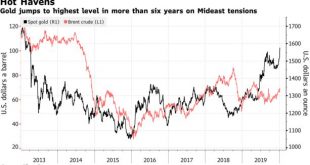

Read More »Gold Surges To Test $1,600/oz, Oil Over $70, Stocks Fall on Risks of World War In Middle East

◆ Gold has surged to test $1,600 per ounce, up 4% so far in 2020 and building on the stellar near 18.9% gain in 2019 ◆ Gold is testing it’s highest levels since 2013 as investors diversify into gold; Goldman, Citi and other gold analysts are advocating gold bullion as important hedge in crisis ◆ Oil prices have surged with Brent crude reaching $70 per barrel; concern over oil supplies from Iran, Iraq and other nations as U.S. State Department warns of attacks on...

Read More »Conservation in the Free Market

[This essay is chapter 9 of Egalitarianism as a Revolt against Nature, and Other Essays] It should be no news by this time that intellectuals are fully as subject to the vagaries of fashion as are the hemlines of women’s skirts. Apparently, intellectuals tend to be victims of a herd mentality. Thus, when John Kenneth Galbraith published his best-selling The Affluent Society in 1958, every intellectual and his brother was denouncing America as suffering from undue and...

Read More »WTF: What The Fed?! – Mike Maloney, Chris Martenson, Grant Williams, Charles Hugh Smith, A. Taggart

Watch the full event free at https://www.peakprosperity.com/wtf-what-the-fed/ “The plain truth is… we are in the middle of QE4 right now” – Grant Williams during WTF: What the Fed. The Federal Reserve looks to be pumping a healthy patient of full of drugs… Something is not adding up. And Mike Maloney agrees… He recently recorded a free event dedicated exclusively to the topic of the Fed’s recent actions... to help you understand what it’s...

Read More »WTF: What The Fed?! – Mike Maloney, Chris Martenson, Grant Williams, Charles Hugh Smith, A. Taggart

Watch the full event free at https://www.peakprosperity.com/wtf-what-the-fed/ “The plain truth is… we are in the middle of QE4 right now” – Grant Williams during WTF: What the Fed. The Federal Reserve looks to be pumping a healthy patient of full of drugs… Something is not adding up. And Mike Maloney agrees… He recently recorded a free event dedicated exclusively to the topic of the Fed’s recent actions... to help you understand what it’s doing and what it means to your wallet. It’s...

Read More »WTF: What The Fed?! – Mike Maloney, Chris Martenson, Grant Williams, Charles Hugh Smith, A. Taggart

Watch the full event free at https://goldsilver.com/wtf “The plain truth is… we are in the middle of QE4 right now” – Grant Williams during WTF: What the Fed. The Federal Reserve looks to be pumping a healthy patient of full of drugs… Something is not adding up. And Mike Maloney agrees… He recently recorded a free event dedicated exclusively to the topic of the Fed’s recent actions... to help you understand what it’s doing and what it...

Read More » SNB & CHF

SNB & CHF