Swiss Franc The Euro has fallen by 0.32% to 1.0993 EUR/CHF and USD/CHF, October 31(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The equity and bond rally in North America yesterday carried over into today’s session. With some notable exceptions, like China, Taiwan, Australia, and Indonesia, most bourses in Asia Pacific and Europe traded higher. US shares are little changed in early Europe after the S&P...

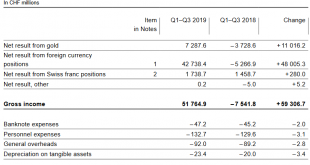

Read More »The Swiss National Bank reports a profit of CHF 51.5 billion for the first three quarters of 2019

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Good years of the Credit Cycle This trend was stopped in 2016, even without the need for a cap on the franc. But one should consider that we are in the good years of the credit cycle now. Bad quarters...

Read More »SNB erzielt in den ersten 9 Monaten 2019 Gewinn von über 50 Milliarden Franken

Insgesamt verdiente die Nationalbank in der Periode von Januar bis September 2019 51,5 Milliarden Franken, wie sie am Donnerstag mitteilte. Nach einem Plus von 38,5 Milliarden in der ersten Jahreshälfte kamen damit im dritten Jahresviertel nochmals 13,0 Milliarden dazu. Der Löwenanteil des Neunmonats-Gewinns stammt wie schon zum Halbjahr von den Fremdwährungspositionen mit 42,7 Milliarden Franken. Auf dem Goldbestand der SNB resultierte derweil ein Bewertungsgewinn...

Read More »Credit Suisse results impress despite damaging spy scandal

Thiam says the bank is well positioned to achieve future profitable growth. Credit Suisse CEO Tidjane Thiam has reiterated that he had nothing to do with the spying scandal that recently rocked the bank. Thiam insisted that the debacle has not damaged business as the bank presented better than expected third quarter results. The bank doubled profits for the period to CHF881 million ($886 million) compared to Q3 2018. Its International Wealth Management division,...

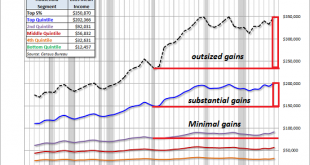

Read More »The Political Parties and the Media Have Abandoned the Working “Middle Class”

Where is the line between “working class” and “middle class”? Maybe there isn’t any. Defining the “middle class” has devolved to a pundit parlor game, so let’s get real for a moment (if we dare): the “middle class” is no longer defined by the traditional metrics of income or job type (blue collar, white collar), but by an entirely different set of metrics: 1. Household indebtedness, i.e. how much of the income is devoted to debt service, and 2. How much of the...

Read More »FOMC Preview

The FOMC begins a two-day meeting today with the decision due out tomorrow afternoon. The Fed is widely expected to cut rates 25 bp for the third meeting in a row. What’s next? RECENT DEVELOPMENTS US data have undeniably softened in September. Weakness in the manufacturing sector appears to have spread to the wider economy. ISM PMI, jobs, CPI, PPI, and retail sales all came in weaker than expected. So too have inflation expectations. October data is just...

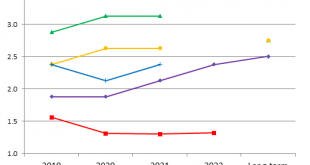

Read More »Incrementum 2019 Gold Chart Book

The Most Comprehensive Collection of Gold Charts Our friends at Incrementum have just published their newest Gold Chart Book, a complement to the annual “In Gold We Trust” report. A download link to the chart book is provided below. The Incrementum Gold Chart Book is easily the most comprehensive collection of charts related to or relevant to gold available anywhere. It contains everything from a wealth of economic to monetary data, to charts detailing sources of...

Read More »FX Daily, October 30: All About Perspective

Swiss Franc The Euro has fallen by 0.13% to 1.1026 EUR/CHF and USD/CHF, October 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The global capital markets are mostly treading water ahead of the Federal Reserve meeting. Asia Pacific and European equities drifted lower. The MSCI Asia Pacific Index appears to have snapped a four-day advance, while the Dow Jones Stoxx 600 was trading slightly lower for the second...

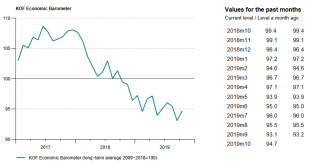

Read More »KOF Economic Barometer: Stabilization at a low level

The KOF Economic Barometer has halted its downward movement, at least for the time being. At 94.7 points, however, the barometer is still well below its long-term average. The Swiss economy is therefore likely to grow with below-average rates in the upcoming months. In October, the KOF Economic Barometer rose by 1.6 points, from 93.1 points in September (revised from 93.2 points) to 94.7 points. This increase is attributable in particular to bundles of...

Read More »USD/CHF technical analysis: Clings to 23.6 percent Fibo, eyes on Swiss ZEW, Fed

USD/CHF stays above 21-day EMA amid bullish MACD. A daily closing beyond the monthly trendline will trigger fresh upside. Given the monthly falling resistance line and 21-day EMA confusing USD/CHF traders on a key day, the quote seesaws near 0.9940 during pre-European session on Wednesday. Adding to the odds of pair’s run-up are bullish signals from the 12-bar Moving Average Convergence and Divergence (MACD) indicator. However, buyers need a sustained break above a...

Read More » SNB & CHF

SNB & CHF