Le 9 janvier 2012, le banquier central suisse démissionnait suite à une accusation de présomption de délit d’initié dans une affaire d’opérations de change sur sa fortune privée (Wikipédia), il devint dans la foulée vice-président du groupe Blackrock. Une réelle promotion dans le cadre d’un monde globalisé. Lorsqu’en septembre 2011, il arrima le franc suisse à l’euro de manière parfaitement anticonstitutionnelle, ce qui ne l’empêcha pas d’être récompensé quelques...

Read More »EM Preview for the Week Ahead

EM has been able to get some traction as markets basically shrugged off the risk-off sentiment after the Iran attacks. This week’s planned signing of the Phase One trade deal should help boost EM further, but we remain cautious. The Iran situation is by no means solved, and we see periodic bouts of risk-off sentiment coming from smaller skirmishes. The World Bank also sounded a warning bell last week with its downward revisions to its global growth forecasts....

Read More »Changes to the UBS Board of Directors

Zurich, 10 January 2020 – The Board of Directors of UBS Group AG announced today that it will nominate Nathalie Rachou and Mark Hughes for election to the Board at the Annual General Meeting on 29 April, 2020. David Sidwell and Isabelle Romy will not stand for re-election. David Sidwell will have completed a twelve year term of office and Isabelle Romy has decided to step down after eight years on the UBS Board. Nathalie Rachou (born 1957) has been a member of the...

Read More »Crypto determined to emerge from the shadows

Early bird WEF delegates will be learning about blockchain in the ski resort of St Moritz. (Keystone / Martin Ruetschi) Global politicians, regulators, financiers and technology pioneers will soon be gathering in Switzerland for the World Economic Forum. This has not been lost on the blockchain and crypto industry, which is redoubling efforts to engage with policy makers. Next week’s Crypto Finance Conferenceexternal link (CfC), in the up-market ski resort of St...

Read More »Swiss unemployment drops to new low

A meeting a a regional job centre, or RAV, in German, here in Thun (staged picture) (© Keystone / Gaetan Bally) The Swiss unemployment rate fell to 2.3% in 2019, according to the State Secretariat for Economic Affairs (SECO). That’s the lowest yearly rate for almost 20 years. SECO said in a statementexternal link on Friday that 106,932 people were registered with regional job centres in 2019, 9.5% less than in the previous year. The only blip: the rate rose to a...

Read More »“Low” Tax Rates Often Mask Much Larger Tax Burdens

Discussions about the incentive effects of taxes can be misleading. The focus is usually on the tax rates imposed. But one’s incentives are not best measured by tax rates, but by how much value created for others (reflected in consumers’ willingness to pay) is retained by the creator, which I refer to as take-home income. These two variables — tax rates and take-home income — are reciprocal in the sense that the higher the marginal tax rate, the smaller the take-home...

Read More »Nationalbank stellt zusätzliche Ausschüttung in Aussicht

Dank der hohen Ausschüttungsreserve stellt die Nationalbank zusätzliche Ausschüttungen an Bund und Kantone in Aussicht. Die Schweizerische Nationalbank (SNB) wird für das Geschäftsjahr 2019 nach provisorischen Berechnungen einen Gewinn in der Grössenordnung von 49 Mrd. Franken ausweisen. Wie die SNB am Donnerstag mitteilte, entfiel der Löwenanteil des Gewinns mit rund 40 Mrd. Franken auf Fremdwährungspositionen. Auf dem Goldbestand resultierte ein Bewertungsgewinn...

Read More »A Fearful Fed Keeps Pouring Money Into the Repo Market

The Fed announced on Thursday it is adding another 83 billion in "in temporary liquidity to financial markets" And, in a development that will surprise no cynic anywhere, the Fed also noted it "may keep adding temporary money to markets for longer than policy makers had expected in September." Specifically, this was another move to shore up and bailout the repo market, which has required the Fed's ongoing revival of quantitative easing (but don't call it...

Read More »Trump to attend World Economic Forum in Switzerland

It will be Trump’s first trip outside the US since becoming only the third American president to be impeached (Keystone) US President Donald Trump plans to attend the annual meeting of the World Economic Forum (WEF) in the Swiss mountain resort of Davos this month, making up for an appearance he cancelled during last year’s US government shutdown. White House press secretary Stephanie Grisham confirmed on Wednesday that Trump would attend the annual forumexternal...

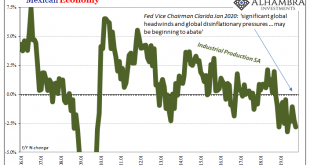

Read More »Global Headwinds and Disinflationary Pressures

I’m going to go back to Mexico for the third day in a row. First it was imports (meaning Mexico’s exports) then automobile manufacturing and now Industrial Production. I’ll probably come back to this tomorrow when INEGI updates that last number for November 2019. For now, through October will do just fine, especially in light of where automobile production is headed (ICYMI, off the bottom of the charts). Mexico is, as I’ve been writing this week, the presumed...

Read More » SNB & CHF

SNB & CHF