The US employment report on the first Friday of December usually marks the unofficial end of the year. The desks are often lighter and dealers are loath to jeopardize the year’s bonuses in thin and often erratic markets. This year is an exception. Next week features the first ECB meeting with Lagarde at the helm and the final FOMC meeting of the year. The UK and China have their monthly data dumps—a concentration of high-frequency data. The US reports both CPI and retail sales. After the employment data, US inflation and consumption are arguably the most important data points. Investors appear increasingly confident that the UK Tories will score a victory sufficient to allow Brexit to finally take place. Sometime toward the end of the week, President Trump

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, China, ECB, Featured, Federal Reserve, Japan, newsletter, Russia, tariffs, Turkey, U.K.

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The US employment report on the first Friday of December usually marks the unofficial end of the year. The desks are often lighter and dealers are loath to jeopardize the year’s bonuses in thin and often erratic markets. This year is an exception. Next week features the first ECB meeting with Lagarde at the helm and the final FOMC meeting of the year. The UK and China have their monthly data dumps—a concentration of high-frequency data. The US reports both CPI and retail sales. After the employment data, US inflation and consumption are arguably the most important data points. Investors appear increasingly confident that the UK Tories will score a victory sufficient to allow Brexit to finally take place. Sometime toward the end of the week, President Trump will likely make a decision about the tariff threat on about $160 bln of Chinese goods.

The latter two, the UK election, and Trump’s tariff decision, have the greatest potential to surprise the market. The polls suggest that Tory support has slipped as the election draws near. It is still ahead of Labour by near double-digits, but this was also the pattern in 2017 when many had expected the Conservatives to hold its majority. There is a sense of Brexit fatigue. People just want it to be over. Sterling has rallied to seven-month highs against both the dollar and euro as the market anticipates the outcome and leaves the market vulnerable to a “buy the rumor, sell the fact” type of activity.

If the Tories win a majority and pass the Brexit bills, the UK will enter a standstill period until the end of 2020, while a new trade agreement is negotiated with the EU. Barring further delays, it is still possible that at the end of next year, the UK and EU have not reached an agreement, and the departure reduces an important trade relationship to WTO standards.

In addition, once the election is passed, investors’ attention will shift to the economy. Two members of the Monetary Policy Committee dissented in favor of an immediate rate cut at the November meeting. Nevertheless, the market is pricing in less than a 10% chance of a cut in when it meets again on December 19. The data out next week include October GDP, services, industrial output, and trade balance.

The economy finished Q3 on a particularly soft note, which may have overstated the case. It is possible that the tax cuts and spending increases promise in the heat of the campaign do, in fact, materialize, which would take pressure off monetary policy. Governor Carney is stepping down at the end of January, and speculation of his successor will likely increase after the election results are digests.

US-Chinese trade negotiations have been Brexited (verb: to repeatedly delay and obfuscate). The equity markets wobbled when President Trump suggested, apparently off-the-cuff that maybe a trade deal is better after next November’s elections. Many think that China is more desperate for an agreement, but it was US officials that reassured the market that progress toward a deal continued. The critical issue seems to be how much of a share of the Chinese market should be earmarked for US farmers in exchange for how much should the tariffs be rolled back.

The US has threatened to slap a 15% tariff on roughly $160 bln of Chinese imports, with many consumer goods among the targets, on December 15. There was a set of tariff increases that the US had threatened for October that were suspended after having been delayed first. What appears to be the third tariff truce is holding, and new tariffs would signal its end. Investors do not seem positioned for an end to the truce.

The escalation would likely trigger sharp declines in equity markets and risk assets broadly. Trade remains a significant risk for the Federal Reserve and other central banks. The Fed meets on December 11, which is likely a few days before the US announces whether it will go forward with the tariffs. Say what you will about the Fed’s communication, but it is clear to nearly everyone that the Fed’s midcourse correction is over and that barring a material change, the Fed is on hold.

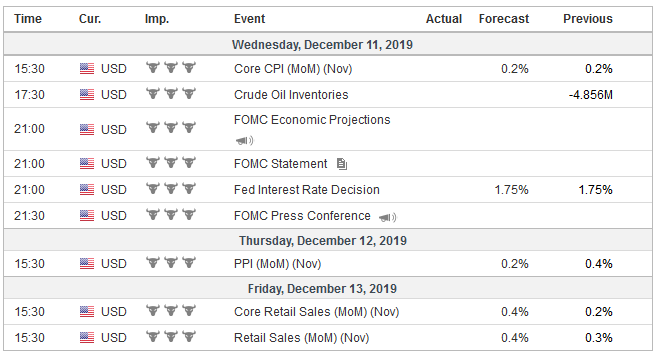

We do think material conditions will change, and the risks are clearly aligned to the downside. In fact, it is difficult to identify a significant upside risk to the economy, though base effects will mean that the CPI is likely to rise in the coming months. The November CPI will be reported a few hours before the FOMC’s decision is formally announced. The year-over-year pace is expected to rise to 2.0%, which would match this year’s high. The core rate is expected to be unchanged at 2.3% after setting the year’s high in August and September at 2.4%. As often takes place over time, the headline is converging with the core rate.

United StatesConsumption, which has been the driver of the US appears to be slowing. The retail sales report picks up about 40% of the personal consumption expenditures. It posted an average monthly gain of 0.9% in Q1, 0.4% in Q2, and 0.2% in Q3. However, retail sales appear to be off to a stronger start in Q4. October retail sales rose by 0.3% and are expected to have gained another 0.4% in November. The US created many more jobs than anticipated in November (266k, the most since January), and average hourly wages were 3.1% higher than a year ago. While there does not seem to be a strong fit between job growth and retail sales, if anything, it warns that the retail sales are more likely to surprise on the upside than the downside. For the week as a whole, the June 2020 fed funds futures implied yield rose a single basis point to 1.45%, 10 bp lower than the current effective average. This is equivalent to about a 40% chance of a cut. Lagarde chairs her first meeting at ECB President. There are few things as certain as the ECB (and the Fed) not changing policy in this week’s meetings. Lagarde’s press conference will likely be more interesting than Powell’s. Her style draws attention. There is a great sense of continuity from Draghi to Lagarde, including the call on countries with scope to use fiscal policy to help overcome the limitations of the over-burdened monetary policy. However, we look for two changes to come from the review that the ECB will conduct. First, the presentation of the inflation target may be tweaked a little give more flexibility. Although the 2% inflation target seems somewhat arbitrary and while most high-income countries have adopted something similar, precisely what they measure is different. Still, once selected, it seems difficult to change. Second, a change in communications is likely. Those that dissent ought to have some official recognition of their views, as the other major central banks do. This would likely reduce the perceived need for those that lost a decision to take their case to the press. Also, it is possible that others, like Vice President de Guindos or Chief Economist Lane, become more visible. In terms of economic substance, little has changed. Germany appears to be barely growing, and the new general strike threatens to hit the French economy, which has expanded by 0.3% for each quarter so this year. EMU October retail sales fell by 0.6%, and the meager growth in September was revised to a decline of 0.2%. It was the third decline in the past fourth months, as the region remains near-stagnation even if not contracting. The base effect suggests EMU inflation is likely to edge higher in the coming months. |

Economic Events: United States, Week December 9 |

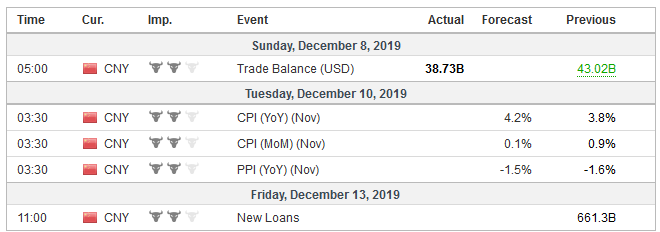

ChinaChina’s November PMIs suggest a modest recovery in business activity. Exports may have risen last month for the first time since July on a year-over-year basis. Imports have been falling since April, but the pace of decline is likely to ease for the second consecutive month. At the same time, lending by banks and non-bank financial institutions like expanded rigorously. New yuan loans (banks) are expected to have nearly doubled to CNY1.2 trillion from CNY660 bln in October. The difference between it and aggregate financing are those non-bank financial institutions. It appears that it was not a lender in October but grew by about CNY250 bln in November (so aggregate financing is ~ CNY1.5 trillion from October’s ~CNY650 bln). Part of the challenge for the central bank is that headline inflation is rising while producer prices are continuing to fall. November consumer prices are expected to have risen above 4% for the first time in seven years. It is being driven by food prices, which rose 11% year-over-year in October. Core prices had increased by 1.5% year-over-year. The deflation in producer prices (-1.6% year-over-year in October) and there has been no inflation since May) speaks to the squeeze the providers of those goods and their ability to service their debt. If the US goes ahead and makes good on its tariff threat, the yuan would likely weaken in a knee-jerk fashion. One does not need to assume any official action whatsoever. China would have to respond and raise tariffs of its own. The combination of less demand (less competitive exports) and more costly imports (taxed) would suggest a new undesirable economic shock. |

Economic Events: China, Week December 9 |

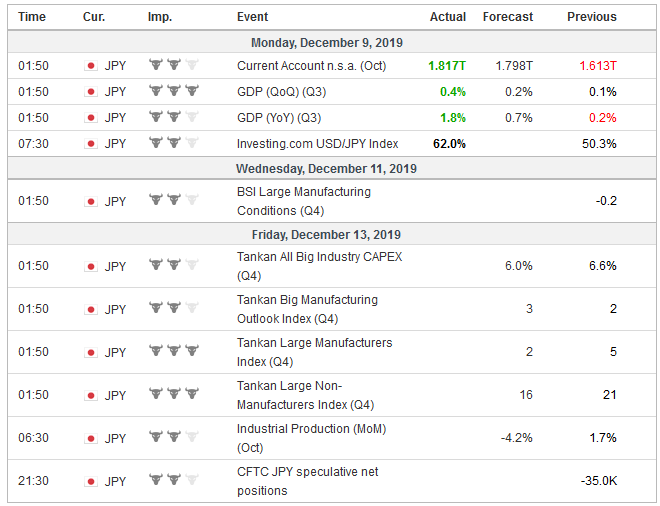

JapanJapan’s economic data are likely to have a marginal impact on the yen’s exchange rate. The yen is typically buffeted by global interest rates and equity market performances. Moreover, the combination of the sales tax increase and typhoon has set into motion forces that are expected to have produced a sharp contraction in the world’s third-largest economy. The government is responding with a substantial fiscal package that is also aimed to help deal with the post-2020 Olympic letdown. Still, the risk to the Q4 Tankan survey due out toward the end of the week is on the downside with the Bloomberg survey only showing expectations for a small amount of softening of sentiment. Capex plans are anticipated to slow for the second consecutive quarter. It the median forecast in the Bloomberg survey is accurate, the four-quarter moving average will fall to around 5.2%, roughly half of the pace in the Q4 18 Tankan survey. |

Economic Events: Japan, Week December 9 |

Lastly, two central banks of note meet next week, Turkey and Russia, on December 12th and 13th, respectively. The jump in Turkey’s CPI to 10.56% in November from 8.55% is not expected to dissuade officials from cutting key interest rates again. The market is looking for a more modest 150 bp cut after October when the key one-week repo rate was cut by 250 bp. It would bring the rate to 12.5%. Without further improvement in inflation, it is difficult to see scope for additional rate cuts that would not weigh on the currency.

While the Turkish lira is one of the worst-performing currencies, having depreciated by about 8% against the dollar this year after losing nearly 40% in 2018, the Russian rouble is the best performing currency this year. It has gained almost 9.4% against the US dollar after losing a little more than 20% last year. The central bank is expected to deliver its fifth 25 bp rate cut that will bring the key rate to 6.25%. Russia’s CPI rose 3.5% year-over-year in November, down from 3.8% in October. It has been trending lower since the spring. Growth in Q3 will be reported the day before the central bank meets. The pace is expected to be steady, with Q2 growth of 1.7%, which also matches the 10-year average.

Tags: China,ECB,Featured,federal-reserve,Japan,newsletter,Russia,tariffs,Turkey,U.K.