A certain meme has become popular among advocates of both gold and cryptocurrencies. This is the “Fix the money, fix the world” meme. This slogan is based on the idea that by switching to some commodity money—be it crypto or metal—and abandoning fiat currency, the world will improve greatly. Taken in its moderate form, of course, this slogan is indisputably correct. State-controlled money is immoral, dangerous, and impoverishing. It paves the way for government theft...

Read More »Gold Price News: Gold Down 1% in Wake of More Hawkish Federal Reserve Meeting Minutes

Gold price fell to $1,808 an ounce in the wake of the release of the minutes of the December Federal Reserve meeting, having hit an intra-day high of $1,829. Silver price fell to $22.72 an ounce from an intra-day high of $23.26. Gold and silver have continued to sell off this morning with gold trading as low as $1,794 and silver trading down to $22.14. The FOMC minutes showed a much more hawkish Fed than markets had been expecting. The minute suggests that the Fed...

Read More »Central Banking is a Confidence Game | The Snider Series | Episode 6 (WiM106)

Jeff Snider joins me for a multi-episode conversation exploring the evolution of money and central banking throughout the 20th and 21st centuries. Be sure to check out NYDIG, one of the most important companies in Bitcoin: https://nydig.com/ GUEST Jeff's twitter: https://twitter.com/JeffSnider_AIP Jeff's writing: https://alhambrapartners.com/author/jsnider/ PODCAST Podcast Website: https://whatismoneypodcast.com/ Apple Podcast:...

Read More »Inflation and Geopolitics in the Week Ahead

The Omicron variant may be less fatal than the earlier versions, but it is disrupting economies. The surge in the Delta variant well into Q4 in the US and Europe was already slowing the recoveries. Investors will likely take the high-frequency real sector data with the proverbial pinch of salt until January data available beginning later this month. While the tribalist approach, exemplified by “team transition” and “team permanent” debates about inflation, the...

Read More »As The Fed Seeks To Justify Raising Rates, Global Growth Rates Have Been Falling Off Uniformly Around The World

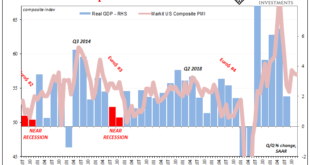

Sentiment indicators like PMI’s are nice and all, but they’re hardly top-tier data. It’s certainly not their fault, these things are made for very times than these (piggy-backing on the ISM Manufacturing’s long history without having the long history). Most of them have come out since 2008, if only because of the heightened professional interest in macroeconomics generated by a global macro economy that can never get itself going. What PMI’s do have going for them is...

Read More »Bitcoin mit schwachem Start ins neue Jahr

Die erste Woche des neuen Jahres nähert sich dem Ende. Und für den BTC lief der Start ins Jahr 2022 nicht zufriedenstellend. Zu Beginn der Woche stieg die Hashrate deutlich an, so dass viele Experten ein Kursplus erwarteten, doch letztlich ging es um weitere 10 Prozent im Wochenvergleich runter. Bitcoin News: Bitcoin mit schwachem Start ins neue Jahr Arcane Research sah einen Anstieg der Hashrate zum Jahresbeginn, der sogar das Allzeithoch aus Mai 2021 überstieg....

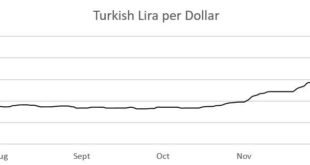

Read More »Turkey’s Economy Is in Big Trouble

Over the years observers of Turkish politics have become somewhat inured to erratic swings in policy coming out of Ankara. Particularly since the political reforms of 2017, his high degree of control over the primary functions of the state mean President Recep Tayyip Erdoğan faces few hurdles to executing abrupt changes he views as correct or necessary. This lack of any effective institutional check to his authority is, at present, leading the country off an economic...

Read More »Zurich court rules Uber drivers are not ‘independent workers’

Taxi or not, employer or not: Uber is a disputed concept in Switzerland. © Keystone / Christian Beutler The latest cantonal ruling on the US ride-hailing firm comes as a national framework to determine the status of gig economy workers in Switzerland is still lacking. The rulingExternal link by the Zurich social insurance court, published on Thursday, says that the “marked subordination” in the relation between Uber and its drivers means that it is one of dependence...

Read More »Swiss National Bank expects annual profit of around CHF 26 billion for 2021

Confederation and cantons to receive distribution of CHF 6 billion According to provisional calculations, the Swiss National Bank will report a profit in the order of around CHF 26 billion for the 2021 financial year. The profit on foreign currency positions amounted to just under CHF 26 billion. A valuation loss of CHF 0.1 billion was recorded on gold holdings. The net result on Swiss franc positions amounted to over CHF 1 billion. The allocation to the provisions...

Read More »The Top 8 Crypto Custodians

As investors increasingly incorporate digital assets into their portfolios, the crypto custody landscape continues to grow and mature. As of late-2021, around US$230 billion worth of digital assets, or about 9% of the total US$2.5 trillion cryptocurrency market, were being stored on the technology solutions of eight crypto custodians, separate research by The Block Research and Blockdata found. Coinbase stood as a leader in the space with some US$100 billion worth of...

Read More » SNB & CHF

SNB & CHF