© Christin Millhill | Dreamstime.com From 1 January 2022, the cost of posting a standard letter for next day delivery (A-class) is 10% higher and a B-class letter 6% higher. These price hikes are the first of their kind in 18 years, reported RTS. The cost of posting a standard A-class letter is now CHF 1.10, up from CHF 1.00, the cost until 31 December 2021. Theprice of posting a standard B-class letter is now CHF 0.90, up from CHF 0.85. The price rise, announced in...

Read More »Gold Under the Mattress vs Gold Investments

“If you can’t hold it in your hand, you don’t own it.” That’s one of the most common refrains we hear from gold and silver investors. And while there is a kernel of truth in this saying, investing by these words alone could prove a costly mistake. This popular phrase conflates and entangles two different concepts. Gold owned for emergency use or as a financial insurance policy Gold owned for investment purposes In this article, we’ll untangle those ideas and offer a...

Read More »How GDP Stats Create the Illusion of Fed-Fueled Economic Growth

Most experts tend to assess the strength of an economy in terms of real gross domestic product (GDP). The GDP framework looks at the value of final goods and services produced during a particular time interval, usually a quarter or a year. The GDP is formed as the summation of consumer outlays on goods and services; outlays by businesses on plants, machinery, and inventories; outlays by government; and exports less imports. An increase in consumer outlays, businesses...

Read More »Conflict Of Interest (rates): 10-year Treasury Yield Highest in Almost Two Years

The dollar was high and going higher. Emerging markets had been seriously complaining. In one, the top central banker for India outright warned, “dollar funding has evaporated.” The TIC data supported his view, with full-blown negative months, net selling from afar that’s historically akin to what was coming out of India and the rest of the world. China was cutting its RRR multiple times. This was all following May 29, 2018, too, a day in the global “bond market”...

Read More »Internet campaigner fights for more data awareness

Nikki Böhler is a young Swiss internet campaigner who is part of a growing community seeking to shape the digital transformation of society. The 29-year-old wants people to become more aware of the importance of their personal online data and of the traces they leave behind on the internet. But she also wants to improve data transparency so that existing, anonymised data can be used for the common good. Her video portrait is the first in the “Digital offensive” series by...

Read More »Alabama to Consider Extending Sales Tax Exemption on Sound Money

. (Birmingham, AL, USA – January 10, 2022) – Alabama currently exempts precious metals from state sales tax, however this exemption is set to expire in 2022. A senator in the Yellowhammer State hopes to extend this popular exemption. Introduced by Senator Tim Melson (1-R), and supported by the Sound Money Defense League, Senate Bill 13 maintains current law by extending the existing sales tax exemption on the purchases of precious metals purchases If Senate Bill 13...

Read More »Banks risk becoming new fossil fuel villains in 2022

Major banks, like UBS, are coming under increasing pressure to clean up their investments. Keystone / Ennio Leanza As businesses were gearing up for the COP26 climate summit in Glasgow last year, one of Europe’s larger banks released an update on how it planned to do its bit to combat global warming. Switzerland’s UBS group said it had become a founding member of the new Net Zero Banking Alliance, a UN-convened club of mostly western banks committed to decarbonising...

Read More »PayPal arbeitet an eigenem Stablecoin

PayPal arbeitet weiter an seinem Vorstoß in den Cryptomarkt. Vor allem in den USA ist man mit der Implementierung von Cryptocoins in das gesamte Online-Zahlungssystem weit fortgeschritten. Somit war es wohl nur eine Frage der Zeit, bis man seinen eigenen Cryptocoin in Betracht ziehen würde. Crypto News: PayPal arbeitet an eigenem Stablecoin PayPal wird es vielen Cryptobörsen gleichtun und einen eigenen Utility Token kreieren. Dieser wird ein Stablecoin sein, der...

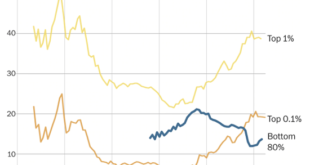

Read More »The Real Threat to Democracy is Corrupting Wealth Inequality

Try to find a developing-world kleptocracy in which the top few collect more than 97% of the income from capital. There aren’t any that top the USA, the world’s most extreme kleptocracy. We’re Number 1. Imagine a town of 1,000 adults and their dependents in which one person holds the vast majority of wealth and political influence. Would that qualify as a democracy? Now imagine that 100 of the 1,000 adults own 90% of all the wealth, collect 97% of all the income from...

Read More »Swiss Retail Sales, June 2021: +5.4 percent Nominal and +5.8 percent Real

Turnover adjusted for sales days and holidays rose in the retail sector by 5.4% in nominal terms in November 2021 compared with the previous year. Seasonally adjusted, nominal turnover rose by 1.4% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO). Real turnover adjusted for sales days and holidays rose in the retail sector by 5.8% in November 2021 compared with the previous year. Real growth takes inflation...

Read More » SNB & CHF

SNB & CHF