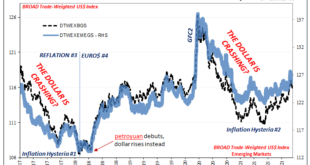

A full part of the inflation hysteria, the first one, was the dollar’s looming crash. The currency was, too many claimed, on the verge of collapse by late 2017, heading downward and besieged on multiple fronts by economics and politics alike. Basically, the Fed had “printed” too much “money” and the Chinese playing some “long game” were purportedly ready at any moment to snatch the role of world reserve by manipulative force from the out-to-lunch Americans. Those...

Read More »Jeff Snider LIVE (SOFR/LIBOR And 10 Year Yield Spike. Should You Be Concerned?)

Check out the Rebel Capitalist Live event June 24th - 26th!! https://rebelcapitalistlive.com

Read More »Base Money and Free Markets | The Snider Series | Episode 7 (WiM109)

Jeff Snider joins me for a multi-episode conversation exploring the evolution of money and central banking throughout the 20th and 21st centuries. Be sure to check out NYDIG, one of the most important companies in Bitcoin: https://nydig.com/ GUEST Jeff's twitter: https://twitter.com/JeffSnider_AIP Jeff's writing: https://alhambrapartners.com/author/jsnider/ PODCAST Podcast Website: https://whatismoneypodcast.com/ Apple Podcast:...

Read More »Bitcoin erholt sich auf niedrigem Niveau

Der Markt erholte sich gestern leicht und liegt sogar im Wochenvergleich wieder im grünen Bereich. Jedoch sieht es nicht so aus, als hätten wir damit die Bärenphase verlassen. Vielmehr deuten einige Indikatoren auf einen zukünftigen Downtrend hin. Bitcoin News: Bitcoin erholt sich auf niedrigem Niveau Der Preisabfall stabilisierte sich in dieser Woche oberhalb von 40.000 US-Dollar. Im Wochenvergleich ging es etwa 2 Prozent nach oben – es waren vor allem die letzten...

Read More »BIS, SNB and SIX successfully test integration of wholesale CBDC settlement with commercial banks

Project Helvetia looks toward a future with more tokenised financial assets based on distributed ledger technology coexisting with today’s systems. Swiss National Bank and five commercial banks integrated wholesale CBDC in their existing back-office systems and processes. Tests covered a wide-range of transactions in Swiss francs – interbank, monetary policy and cross-border. Integrating a wholesale central bank digital currency (CBDC) into existing core banking...

Read More »Sentiment v. Substance: Checking In On Collateral Via, Yes, The Fed

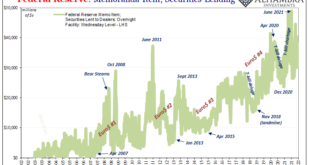

The Federal Reserve, like other central banks around the world, it does lend out the securities it owns and holds. Sophisticated modern wholesale money markets are highly collateralized, so much so that collateral itself takes on the properties of currency. Elasticity of collateral is as much – if not more – important as elasticity of other forms of wholesale money (therefore excluding bank reserves). Dealers, however, they don’t much like using the Fed’s Securities...

Read More »Reflections Over 2021

In March, I flew for the first time since the start of Covid health theater. I was invited to speak at the Austrian Economics Research Conference in Auburn, AL. My talk covered Jimi Hendrix, and an infamous bridge collapse. In other words, I discussed my theory of interest and prices. At the end of November, I flew to London for two weeks of business meetings. This was my first international trip since the Covid lockdown. I offer three comments. One, the UK...

Read More »How Easy Money Inflated Corporate Profits

In the incessant media discussion about whether inflation is transitory there is a big elephant in the room about which all are silent. Perhaps strangely some do not see it. Others for whatever reason pretend it is not there. The elephant is the fantastic surge in US corporate profits that monetary inflation has fueled during the second year of the pandemic. This elephant’s unremarked appearance is likely transitory, unlike the simultaneous jump in US consumer...

Read More »How the Market Responds to US CPI may set the Near-Term Course

Overview: US stocks built on the recovery started on Monday and Powell’s suggestion of letting the balance sheet shrink later this year eased some speculation of a fourth hike this year, which seemed to allow the Treasury market to stabilize. What amounts to a greater appetite for risk is carrying over into Asia Pacific activity today. Many of the large bourses advanced more than 1%, with the Hang Seng up almost 2.8% and the Nikkei up nearly as much. Bond...

Read More »Abolish NATO

The New York Times published an article yesterday that denied that U.S. officials promised Russia at the end of the Cold War that NATO would not expand membership to Warsaw Pact countries. Unfortunately, the article misses the point. The point is that NATO should have been abolished when the Cold War ended, which would, needless to say, have meant that it would not have absorbed those former Warsaw Pact countries and would not have moved U.S. bases, missiles, and...

Read More » SNB & CHF

SNB & CHF