The Swiss National Bank is not prepared to release any further reserves. Keystone / Martin Ruetschi The Swiss National Bank (SNB) continues to beat off demands to fight inflation by raising interest rates and to distribute more reserves to cantons and other causes. SNB president Barbara Janom Steiner showed signs of frustration in a speech on Friday that defended the policies of the central bank. “There are ever more varied proposals – and indeed, increasingly,...

Read More »Some ‘Core’ ‘Inflation’ Difference(s)

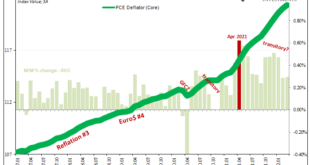

The FOMC meets next week, with everyone everywhere expecting a 50 bps rate hike to be announced on Wednesday. Yesterday’s “unexpected” and “shocking” negative GDP is unlikely to deter anyone on the committee. Most have already dismissed it as nothing more than quirky, temporary factors, not unlike when they did the same to Q1 2014’s similarly negative result. At least that one had the Polar Vortex (uh oh). Jay Powell’s group can’t see beyond the US border, doesn’t...

Read More »What Determines Interest Rates? Comparing Mainstream Economics to the Austrian School

The conventional view among mainstream economists, as presented by Milton Friedman, is that three factors determine market interest rates: liquidity, economic activity, and inflationary expectations. In this viewpoint, whenever the central bank raises the growth rate in the money supply by buying financial assets such as Treasurys, this pushes the prices of Treasurys higher and their yields lower. Note that this is the monetary liquidity effect, which inversely...

Read More »The Fed’s New “Tightening” Plan Is Too Little, Too Late

Since 2008, a key component of Fed policy has been to buy up mortgage-based securities and government debt so as to both prop up asset prices and increase the money supply. Over this time, the Fed has bought nearly $9 trillion in assets, thus augmenting demand and increasing prices for both government bonds and housing assets. Moreover, these purchases were made with newly created money, contributing greatly to liquidity and the easy-money policies that have...

Read More »Erstes Land bietet Steuervorteile für Crypto Mining mit erneuerbarer Energie

Schon ab diesem Monat ist es möglich für Crypto Miner Steuervergünstigungen zu erhalten, wenn sie fürs Mining erneuerbare Energien nutzen – zumindest in Usbekistan. Damit versucht das Land die Miner von Kohleenergie wegzuholen und gleichzeitig grüne Politik zu unterstützen. Crypto News: Erstes Land bietet Steuervorteile für Crypto Mining mit erneuerbarer EnergieVor allem Solarenergieprojekte sollen so in Usbekistan finanziert werden.Länder in Zentralasien sind...

Read More »Keith Weiner: Pound Measure Weight Of Silver

▶︎1000x – Enter your Email ▶︎ https://bit.ly/3rYob5F ▶︎ Subscribe to this YouTube channel ▶︎ https://bit.ly/CompactSilverNews_subscribe ▶︎ Keep your financial education strong with our CompactClub ▶︎ http://bit.ly/CompactClub Keith Weiner is the founder and CEO of Monetary Metals, an investment firm that is unlocking the productivity of gold. Keith also serves as founder and President of the Gold Standard Institute USA. His work was instrumental in the passing of gold legal tender...

Read More »Monetary Metals Completes Latest Capital Raise

Scottsdale, Ariz –May 5, 2022 Monetary Metals® has recently closed a $4.5 million equity capital raise, bringing the total funds raised to over $8.5 million. The goal of the capital raise is to support the company to scale up. This round was oversubscribed, like all previous rounds. The company aimed to raise $3 million. The founder and CEO of Monetary Metals, Keith Weiner commented, “We had strong investor interest in our company during this equity raise, because...

Read More »FIFA Announces Partnership With Blockchain Company Algorand

FIFA has teamed up with Zug based blockchain technology company Algorand to agree a sponsorship and technical partnership deal. The agreement means Algorand will become the official blockchain platform of FIFA and provide the official blockchain-supported wallet solution. As per the sponsorship agreement, Algorand will be a FIFA World Cup Qatar 2022™ Regional Supporter in North America and Europe, and a FIFA Women’s World Cup Australia and New Zealand 2023™ Official...

Read More »Historians trace Elon Musk’s Swiss roots to Emmental

Elon Musk’s maternal side of the family can be traced back to villages in the Emmental region of Switzerland. Keystone / Patrick Pleul Tesla CEO Elon Musk has roots in a small, picturesque farming region in central Switzerland. Using genealogy websites and local archives, historians have been able to connect Musk with the Haldimann name, which is still present in the Emmental region today. There are few images as quintessentially Swiss as the green pastures,...

Read More »Martin Schlegel wird neuer SNB-Vizepräsident

Schlegel (Jahrgang 1976) wird laut Mitteilung vom Mittwoch per Anfang August die Leitung des II. Departements der SNB übernehmen. Der neue Vize-Chef ist ein SNB-Urgestein. Er ist seit knapp zwanzig Jahren in verschiedenen leitenden Positionen für die SNB tätig, zuletzt seit September 2018 als stellvertretendes Mitglied des Direktoriums im I. Departement. Schlegel bringe mit seiner hohen Fachkompetenz und seiner breiten, langjährigen Erfahrung in notenbankpolitischen...

Read More » SNB & CHF

SNB & CHF