Under any remotely sound money regime the aftermath of war and/or pandemic is highly likely to feature a sharp decline in the prices of goods and services on average. Even under unsound money regimes there are powerful forces operating towards lower prices once the war/pandemic recedes. Strong injections of monetary inflation, however, can overpower them. The Fed and all the foreign central banks which follow its lead and/or doctrines are apparently of the intention...

Read More »Curve Inversion 101: US CPI Politics Up Front, China PPI Down(ing) The Back

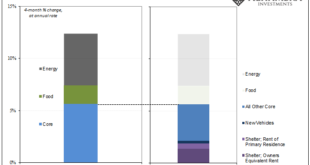

While the world fixated on the US CPI, it was other “inflation” data from across the Pacific that is telling the real economic story. Having conflated the former with a red-hot economy, the fact American consumer prices aren’t tied to the actual economic situation has been lost in the shuffle of the FOMC’s hawkishness, with markets obliged to price wrong-way Jay. The short end of the yield curve (USTs and elsewhere) is plotting like FOMC dots, whenever oil and crude...

Read More »Is a 0.3% Miss on Headline CPI Really Worth a 77 bp Rise in the December Fed Funds Yield?

Overview: Better than expected Chinese data and an unscheduled ECB meeting are the highlights ahead of the North American session that features the May US retail sales report and other high frequency data before the outcome of the FOMC meeting. Asia Pacific equities outside of Hong Kong and China fell. Europe’s Stoxx 600 is up almost 1% as it tries to snap a six-day slide. US futures are posting modest gains. Bond markets in Europe and the US are rallying. The ECB...

Read More »Crash of 1907 – Lessons for Today [Eurodollar University, Ep. 248]

The Crash of 1907 'convinced' Washington DC that a central bank was needed. Or, perhaps more likely, the Crash of 1907 was used as an excuse for a national central bank. ----EP. 248 REFERENCES---- The Premium For Cash Is Presently Enormous: https://bit.ly/3xr0G7l Alhambra Investments Blog: https://bit.ly/3wh01G2 RealClear Markets Essays: https://bit.ly/38tL5a7 Epoch Times Columns: https://bit.ly/39ESkRf -------THE EPISODES------- YouTube: https://bit.ly/310yisL Vurbl:...

Read More »Klimamassnahmen: Verletzung elementarer Rechtsprinzipien

Die Klimapolitik basiert nicht auf solider Wissenschaft und bricht mit elementaren juristischen Grundsätzen. Weltweit greifen Staaten immer massiver in Freiheitsrechte ein, um den Klimawandel zu bekämpfen. Dennoch ertönen täglich Stimmen, die meinen, die jetzigen Massnahmen gingen zu wenig weit. Sie fordern noch mehr Kompetenzen für die Politik und folglich eine noch weitergehende Einengung der Bürger und Unternehmen. Die These, wonach der Klimawandel hauptsächlich...

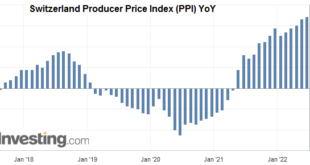

Read More »Swiss Producer and Import Price Index in May 2022: +6.9 percent YoY, +0.9 percent MoM

15.06.2022 – The Producer and Import Price Index rose in May 2022 by 0.9% compared with the previous month, reaching 109.4 points (December 2020 = 100). In particular, petroleum products, petroleum and natural gas as well as chemical products saw higher prices. Compared with May 2021, the price level of the whole range of domestic and imported products rose by 6.9%. These are the results from the Federal Statistical Office (FSO). In particular, higher prices for...

Read More »Aktien Schweiz Schluss – SMI fällt auf tiefsten Stand seit März 2021

Am Schweizer Aktienmarkt ist es auch am Dienstag weiter abwärts gegangen. Die Angst vor einem Abgleiten der Weltwirtschaft in eine Rezession hatte die Anleger fest im Griff. Niedriger war das Barometer der 20 grössten börsennotierten Unternehmen letztmals im März vergangenen Jahres. Weiterhin litten die Börsen unter einem “Cocktail aus Inflation, steigenden Zinsen und daraus resultierender Rezessionsangst”, so ein Marktanalyst. Zumindest bis zur Bekanntgabe des...

Read More »Foreign suitors for Credit Suisse face high hurdles

State Street denied the Credit Suisse takeover rumours last week. © Keystone / Walter Bieri Switzerland’s typically liberal mergers and acquisitions market might make an exception for such a national institution. There are few statues of heroes in downtown Zurich. But of those that exist, by far the grandest is that of Credit Suisse’s founder, Alfred Escher. It is hard to imagine a foreign acquirer buying such a national institution, though Credit Suisse’s shares...

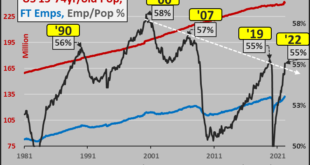

Read More »What Happens When the Workforce No Longer Wants to Work?

Workers are voting with their feet, and that’s difficult to control. When values and expectations change, everything else eventually changes, too. What happens when the workforce no longer wants to work? We’re about to find out. As with all cultural sea changes, macro statistics don’t tell the full story. The sea change is better illuminated by anecdotal evidence: workers constantly quitting to take better jobs; zero loyalty to corporate employers; workers cutting...

Read More »US tax authority asks Switzerland for client data from 26 institutions

The requests for administrative assistance concern bank accounts of US clients who had not previously given their consent to the handing over of their account data © Keystone / Gaetan Bally The US tax authority IRS wants further information from the Swiss authorities on account data at 26 financial institutions. The IRS has made numerous requests for information in the past. The requests for administrative assistance concern bank accounts of US clients who had not...

Read More » SNB & CHF

SNB & CHF