Fourth quarter of 2023

Report submitted to the Governing Board of the Swiss National Bank for its quarterly monetary policy assessment The appraisals presented here are based on discussions between the SNB’s delegates for regional economic relations and members of management at companies throughout Switzerland. In its evaluation, the SNB aggregates and interprets the information received. A total of 239 company talks were conducted between 10 October and 28 November.

Key points

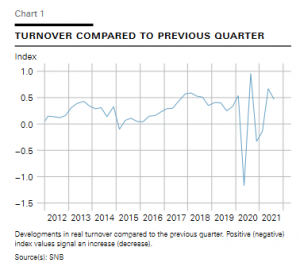

• Growth in the Swiss economy was modest in the fourth quarter. There were moderate increases in turnover in the services sector and construction. Manufacturing, by contrast, saw business activity stagnate.

• Utilisation of technical capacity in manufacturing declined markedly. In many

Articles by Monetary policy

Quarterly Bulletin Q4/2022

December 22, 2022Monetary policy report

Report for the attention of the Governing Board of the Swiss National Bank for its quarterly assessment of December 2022

The report describes economic and monetary developments in Switzerland and explains the inflation forecast. It shows how the SNB views the economic situation and the implications for monetary policy it draws from this assessment. The first section (‘Monetary policy decision of 15 December 2022’) is an excerpt from the press release published following the assessment.

This report is based on the data and information available as at 15 December 2022. Unless otherwise stated, all rates of change from the previous period are based on seasonally adjusted data and are annualised.

Key points

On 15 December 2022, the SNB decided

Monetary policy report Quarterly Bulletin 3/2022

September 29, 2022Monetary policy report

Report for the attention of the Governing Board of the Swiss National Bank for its quarterly assessment of September 2022

The report describes economic and monetary developments in Switzerland and explains the inflation forecast. It shows how the SNB views the economic situation and the implications for monetary policy it draws from this assessment. The first section (‘Monetary policy decision of 22 September 2022’) is an excerpt from the press release published following the assessment.

This report is based on the data and information available as at 22 September 2022. Unless otherwise stated, all rates of change from the previous period are based on seasonally adjusted data and are annualised.

Key points

On 22 September 2022, the SNB

Business cycle signals: SNB regional network – Q3/2022

September 28, 2022Third quarter of 2022

Report submitted to the Governing Board of the Swiss National Bank for its quarterly monetary policy assessment.

The appraisals presented here are based on discussions between the SNB’s delegates for regional economic relations and company managers throughout Switzerland. In its evaluation, the SNB aggregates and interprets the information received. A total of 209 company talks were conducted between 19 July and 6 September.

Key points

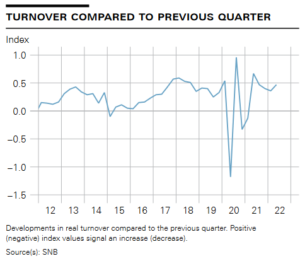

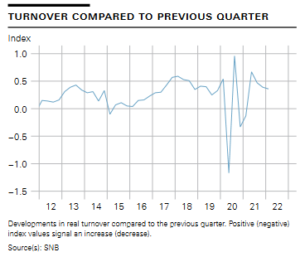

Turnover growth weakened in the third quarter but remained positive. Momentum slowed primarily in the services sector, which in the previous quarter had still been benefiting from catch-up effects following the lifting of coronavirus measures. A slight weakening in growth has also been evident in the

Business cycle signals: SNB regional network

June 26, 2022Second quarter of 2022

Report submitted to the Governing Board of the Swiss National Bank for its quarterly monetary policy assessment.

The appraisals presented here are based on discussions between the SNB’s delegates for regional economic relations and company managers throughout Switzerland. In its evaluation, the SNB aggregates and interprets the information received. A total of 241 company talks were conducted between 12 April and 30 May.

.

Key points

• Companies saw continued turnover growth in the second quarter. Growth is increasing in the services sector now that the measures to contain the pandemic have ended. In manufacturing, by contrast, the strong pace of growth has slowed somewhat. Overall, companies expect further increases in turnover though

Quarterly Bulletin 2/2022

June 25, 2022Report for the attention of the Governing Board of the Swiss National Bank for its quarterly assessment of June 2022.

The report describes economic and monetary developments in Switzerland and explains the inflation forecast. It shows how the SNB views the economic situation and the implications for monetary policy it draws from this assessment. The first section (‘Monetary policy decision of 16 June 2022’) is an excerpt from the press release published following the assessment.

This report is based on the data and information available as at 16 June 2022. Unless otherwise stated, all rates of change from the previous period are based on seasonally adjusted data and are annualised.

Download PDF

[embedded content]

Read More »Quarterly Bulletin 1/2022 – Monetary policy report

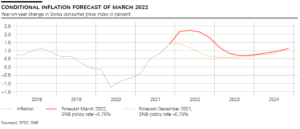

March 31, 2022Report for the attention of the Governing Board of the Swiss National Bank for its quarterly assessment of March 2022

The report describes economic and monetary developments in Switzerland and explains the inflation forecast. It shows how the SNB views the economic situation and the implications for monetary policy it draws from this assessment. The first section (‘Monetary policy decision of 24 March 2022’) is an excerpt from the press release published following the assessment.

This report is based on the data and information available as at 24 March 2022. Unless otherwise stated, all rates of change from the previous period are based on seasonally adjusted data and are annualised.

Swiss National Bank retains expansionary monetary policy

The SNB is retaining its

2022-03-30 – 1/2022 – Business cycle signals: SNB regional network

March 31, 2022First quarter of 2022

Report submitted to the Governing Board of the Swiss National Bank for its quarterly assessment.

The appraisals presented here are based on discussions between the SNB’s delegates for regional economic relations and company managers throughout Switzerland. In its evaluation, the SNB aggregates and interprets the information received. A total of 241 company talks were conducted between 18 January and 8 March.

Key points

• Companies saw turnover growth continue in the first quarter at only slightly slower pace. The slight weakening was primarily due to those companies in the services sector directly affected by the consequences of the spread of the Omicron variant. The robust increases in turnover in manufacturing continued.

• Only a few

Q3/2021 – Business cycle signals: SNB regional network

September 29, 2021The Swiss economy continued to recover in the third quarter. Turnover increased both in the services sector and in manufacturing and construction.

• Despite the positive development, infrastructure utilisation remains low, especially in the services sector. The fact that international travel is still subject to major restrictions is having a hindering effect. Utilisation in manufacturing, on the other hand, is slightly higher than average, underpinned by robust global economic demand. Utilisation in the construction sector is described as normal.

• Procurement bottlenecks, already seen as a major challenge last quarter, have continued to become more pronounced, becoming more widespread and increasingly leading to restrictions and delays in production.

• The margin