A Selection from The Historical Setting of the Austrian School of Economics. 1. The Beginnings What is known as the Austrian School of Economics started in 1871 when Carl Menger published a slender volume under the title Grundsätze der Volkswirtschaftslehre. It is customary to trace the influence that the milieu exerted upon the achievements of genius. People like to ascribe the exploits of a man of genius, at least to some extent, to the operation of his environment...

Read More »Crypto Bullpen: The Ponzinomics of Stablecoins with Emil Kalinowski & Jeff Snider!

In this Video we discuss... the obvious PONZI-nomics of Stablecoins. This was filmed a week prior to the Decimation of LUNA/UST and all of the Do Kwon carnage that has followed. * This Video originally released on Emil Kalinowski & Jeff Snider's "Making Sense" Youtube Channel which is the best in the business of Macroeconomics and Fed-speak. https://www.youtube.com/c/EmilKalinowski News - Research - Prices - ICO's - Check us out on Money Map Press for Money Morning Live:...

Read More »Shiba Inu Gründer verschwindet aus dem Internet

Der als Dogecoin-Clone gestartete Meme-Coin Shiba Inu (SHIB) sorgte zum Beginn der Woche für Aufsehen. Allerdings ging es diesmal nicht um eine Preis-Rallye, es ging um den Gründer des Cryptocoins. Denn dieser verschwand am Montag aus dem Internet. Crypto News: Shiba Inu Gründer verschwindet aus dem InternetDer Gründer hatte am Montag seine Tweets und Posts im Zusammenhang mit SHIB gelöscht, so dass sich viele Nutzer fragten, was gerade hinter den Kulissen passiert....

Read More »Weekly Market Pulse: Is The Bear Market Over?

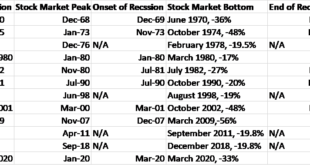

Stocks had a rip snorter of a rally last week and a lot of people are pondering the question in the title over this long weekend. The S&P 500 was down 20.9% from intraday high (4818.62, January 4th) to intraday low (3810.32, May 20th). From that intraday low the market has risen 9.1% in just six trading days. That still leaves the market 13.7% from the intraday high and most investors still down double digits on the year (-11.5% for the standard 60/40 portfolio)....

Read More »China stalling on trade talks with Switzerland, say papers

Switzerland wants to update its 2014 free trade agreement with China, but Beijing refuses to talk, owing to criticism of its human rights record, report the NZZ am Sonntag and SonntagsBlick newspapers. Bern wants to reduce customs duties for more Swiss products and introduce sustainability aspects into the agreement, but Beijing has been refusing to talk since 2018, writes the NZZ am Sonntag. The State Secretariat for Economic Affairs (SECO) confirmed to the paper...

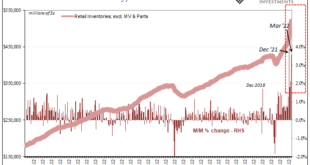

Read More »Inventory Flood Continues Just As Consumers Tap Out

If it continues to play out the same way, it would be all the worst scenarios lumped together all at the same time. A real unfortunate convergence, yet one that has been entirely predictable. Consumers reaching their absolute spending limits. Warehouse and storage capacity nationwide dwindling to long-time lows, leaving firms no options to store inbound goods. And, of course, the stream of goods into inventory that shows no signs (yet) of letting up. Taking the last...

Read More »Inflation, War, and Oil: How Today’s Crises Are Rehashing the 1970s

Persistently loose monetary policies always have negative growth and distributional effects that impair political stability. In extreme cases, there are civil wars and armed conflicts between countries. Original Article: “Inflation, War, and Oil: How Today’s Crises Are Rehashing the 1970s” Consumer price inflation has risen to 8.3 percent in April 2022 in the United States and 7.5 percent in the euro area. This raises the question of who is responsible. In the US,...

Read More »The Backstory of the Great Reset, or How to Destroy Classical Liberalism

As should be clear by now, Francis Fukuyama’s declaration in The End of History: The Last Man (1992) that we had arrived at “the end of history” did not mean that classical liberalism, or laissez-faire economics, had emerged victorious over communism and fascism, or that the final ideological hegemony signaled the end of socialism. In fact, for Fukuyama, the terminus of history was always democratic socialism or social democracy. As Hans-Hermann Hoppe noted in...

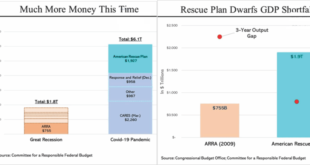

Read More »High Inflation May Already Be Behind Us

High inflation has captured the headlines as of late particularly as CPI recently hit the highest levels since 1981. Some are even suggesting we will face hyperinflation. However, while inflation is certainly present, the question to be answered is whether it will remain that way, or if the worst may already be behind us? To answer that question, let’s define the difference between an inflationary increase and hyperinflation. Not surprisingly, as Milton Friedman...

Read More »Swiss supermarket products for children have too much sugar

The overwhelming majority of products with packaging designed to appeal to children contain too much sugar, salt or fat, report Le Matin Dimanche and SonntagsZeitung newspapers. This is according to a survey conducted around Easter by the consumer organisation Fédération romande de consommateurs (FRC) and its counterparts in the German and Italian-speaking parts of Switzerland. These consumer groups analysed 344 goods targeting children aged over three years sold in...

Read More » SNB & CHF

SNB & CHF