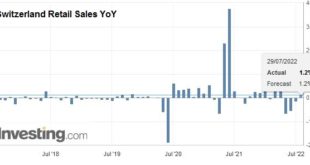

29.07.2022 – Turnover adjusted for sales days and holidays rose in the retail sector by 3.2% in nominal terms in June 2022 compared with the previous year. Seasonally adjusted, nominal turnover rose by 0.1% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO). Real turnover adjusted for sales days and holidays rose in the retail sector by 1.2% in June 2022 compared with the previous year. Real growth takes...

Read More »The Government Runs the Ultimate Racket

“Seniors hurt in Ponzi scam” headlined the story of elderly Southern Californians bilked in a pyramid scheme. While sad, the story reminded me of Social Security, since it is also a Ponzi scheme involving those older, with high payoffs to early recipients coming from pockets of later participants. With Social Security, however, it benefits those older at others’ expense. Pyramid scams collapse when they run out of enough new “investors” to pay earlier promises. Some...

Read More »Inflation Takings Require Just Compensation: Slash Governments!

“If you don’t expect too much from me You might not be let down.” — Gin Blossoms, “Hey Jealousy” Inflation is a mechanism that government people use to fund wars, tyrannical governments, and favors to cronies. Inflation takes away significant fractions of the real value of savings. Savings are accumulated slowly. People add value, earn income, and defer purchases. Inflation depletes savings’ real value quickly. People then have to spend more to satisfy even their...

Read More »Jeff Snider & Emil Kalinowski: Bank Reserves and the Eurodollar

Taken from "ReSolve Riffs with Jeff Snider & Emil Kalinowski of Eurodollar University on Inflationary Market Signals" https://youtu.be/Zo1w5Xofw-E ============================================================= For the transcript of this video visit: https://investresolve.com/podcasts/resolve-riffs-with-jeff-snider-emil-kalinowski-of-eurodollar-university-on-inflationary-market-signals/ ============================================================= For our latest research...

Read More »Attention Turns to US GDP, Ahead of Tomorrow’s EMU GDP and CPI

Overview: The Federal Reserve delivered its second consecutive 75 bp rate hike, and Chair Powell left the door open for another large hike at the next meeting in September. Yet, the market took away a dovish message and the dollar suffered, rates slipped, and equities rallied. Central banks with currencies pegged to the dollar had to hike too. This includes Hong Kong, Saudi Arabia, Bahrain, and UAE, which matched the move in full. Kuwait and Qatar hiked by 25 bp and...

Read More »Receivables Roundtable Ep. 89 – Nic D’Amore with Keith Weiner & Associates: RMAI DEI Scholarship

Would you or an employee benefit from the opportunity to be a sponsored first-time attendee at the 2023 RMAI Annual Conference? Hear from the first recipient of the Diversity, Equity, & Inclusion (DEI) RMAI Scholarship, Nic D’Amore—Client Relations & Portfolio Manager at Keith D. Weiner & Associates Co., L.P.A. as Receivables Roundtable Founder, Adam Parks talks with him about his experience attending the 2022 Annual Conference. For information about applying for or...

Read More »US-Zentralbank kündigt Zinserhöhung an und Bitcoin steigt über 23.000 US-Dollar

Das Federal Reserve Banking System (kurz: Fed) hat angekündigt, den Leitzins weiter zu erhöhen. Damit ist der Zins in den USA zwischen 2,25 und 2,5 Prozent angestiegen. Auch in Deutschland wurde eine Anhebung des Zinses durch die Zentralbanken angekündigt. Bitcoin News: US-Zentralbank kündigt Zinserhöhung an und Bitcoin steigt über 23.000 US-DollarMit der Erhöhung wird es jetzt sogar wieder Zinsen aufs Tagesgeld bei vielen Sparkassen und Banken geben. Der Schritt...

Read More »There Won’t Be Any Winners Because The Status Quo Is Corrupt Everywhere

Systemic corruption on this vast scale optimizes failure and collapse. Debating which nations will “win” as the global economy unravels is a popular but pointless parlor game.Since the status quo in every nation is deeply, profoundly, systemically corrupt, there won’t be any “winners,” there will only be losers. Apologists love to say that corruption has always come hand-in-hand with power, and this is superficially true.Once a centralized hierarchy takes power,...

Read More »If Government Can Take from One Group, It Can and Will Take from Everyone

While governments have been assaulting private property rights for many years, they now are ramping up the pressure. Nothing less than our civilization is at stake. Original Article: “If Government Can Take from One Group, It Can and Will Take from Everyone” It wouldn’t be an exaggeration to argue that private property rights, as understood by classic liberal thinkers, by those who embrace Austrian economic theory, and by all members of an enlightened society, are...

Read More »The Economy Needs a Volcker Moment

Readers of the Mises Wire are most likely familiar with the Volcker moment. This was when former Fed chair Paul Volcker, in the face of steep price inflation, skyrocketed rates to nearly 20 percent. While critics of the Volcker moment complain that such a move also skyrocketed unemployment to almost 11 percent, it cannot be ignored that the price inflation was finally reined in. Not only did we see the benefit in reduced inflation, but Austrians have an answer...

Read More » SNB & CHF

SNB & CHF