--- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or subscribe to our YouTube channel: Website: http://www.swissinfo.ch Channel: http://www.youtube.com/swissinfovideos Subscribe: http://www.youtube.com/subscription_center?add_user=swissinfovideos

Read More »Poor Chinese and Japanese Data Are Not Deterring Euphoria

Overview: Recent developments have spurred a euphoria that is exciting the animal spirits. Greater confidence that US inflation has peaked, and new initiatives from China, and yesterday’s Biden-Xi meeting are all feeding this narrative. The dollar, which slumped last week, is sliding anew today. Strategically, we anticipated the turn, but tactically, we thought last week’s move had stretched the near-term technical condition. The dollar is sharply lower (~-1%)...

Read More »2023 Retirement Plan Contribution Limits

Worried about saving enough for retirement? You can put away more next year. The IRS has just announced the new retirement plan contribution limits for 2023. The contribution limit for employees who participate in 401(k), 403(b), most 457 plans, and the federal government’s Thrift Savings Plan increases to $22,500, up from $20,500. For individuals 50 and older, the catch-up contribution limit goes to $7,500, up from $6,500. So, if you qualify for catch-up...

Read More »Swiss Producer and Import Price Index in October 2022: +4.9 percent YoY, 0.0 percent MoM

14.11.2022 – The Producer and Import Price Index remained unchanged in October 2022 compared with the previous month. The index stood at 109.8 points (December 2020 = 100). Natural gas in particular became more expensive. In contrast, petroleum products showed falling prices. Compared with October 2021, the price level of the whole range of domestic and imported products rose by 4.9%. These are the results from the Federal Statistical Office (FSO). In particular,...

Read More »Where Crypto Went Wrong

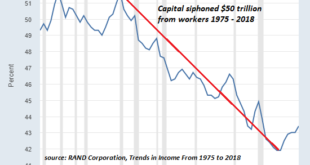

You want to fix the world with finance? Then fix this: wages’ share of a financialized, globalized, speculative-bubble dependent economy have been falling for decades. Fix this and you really will change the world. Anything less changes nothing. Let’s start by stipulating my perspective on cryptocurrencies is neither positive nor negative in the usual context of “to the moon” or “worthless,” nor does it track any of the conventional narratives (decentralized finance...

Read More »SNBs Jordan: IN 2023, sees Swiss growth weaker than this year. USDCHF trades near lows.

SNB’s Jordan is on the wires saying that: He sees weaker growth in 2023 than this year. SNB still has credibility that inflation will moderate Inflation has broadened Sees limited 2nd round wage effects in Switzerland There is a great probablility that SNB will need to further tighten monetary policy. Nominal appreciation of the franc helps guard against inflation The SNB stands ready to BUY OR SELL the keep the franc fx rate appropriate to steer inflation to target...

Read More »Here come the central bank empire’s hawks, right on cue.

Markets reacted to last week's US CPI with a degree of confidence that predictably unsettled policymakers. They opened this week attempting to hawkishly walk back those conclusions - to little effect. Why so much insistence on taking such a hardline position? The same reason markets have doubted it all this time. Also, bonus clip at the end illustrating exactly why central bankers can never really answer the inflation question. Eurodollar University's Money & Macro Analysis Twitter:...

Read More »The Dollar Posts Corrective Upticks, while the Market Digests China’s Initiatives

Overview: China’s new initiatives to support the property sector helped lift the Hang Seng. And while the China’s CSI 300 edged higher both the Shanghai and Shenzhen composites fell. Most Asia Pacific markets fell, while Europe’s Stoxx 600 is posting a small gain. US futures are sporting modest losses. European benchmark 10-year yields are 3-5 bp lower, including UK Gilts ahead of Thursday’s budget that is expected to confirm new borrowing (Office for Budget...

Read More »Can Increases in the Supply of Gold Lead to Boom-Bust Cycles?

According to the Austrian business cycle theory, the boom-bust cycle emerges in response to a deviation in the market interest rate from the natural interest rate, or the equilibrium interest rate. As a rule, it is held, the tampering with market interest rates by the central bank sets the boom-bust cycle in motion. Given this viewpoint, one might suggest that even with a gold standard without a central bank, an increase in the supply of gold money will lead to the...

Read More »Joe Biden and the “Transformational” Presidency

Much is made of the failure of Republicans to make predicted gains in the recent midterm elections, but, as Ryan McMaken has pointed out, Congress plays a much-diminished role in national governance to the point that even had the so-called Red Wave actually occurred, it is doubtful that much would have changed regarding Joe Biden’s presidency. In fact, most of what Biden has done in his two years in office has been outside of Congressional legislative matters....

Read More » SNB & CHF

SNB & CHF