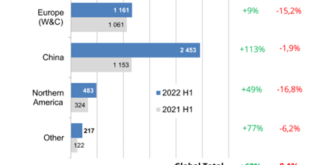

China has become a global leader in the electric vehicles (EVs) sector, and Western governments are worried that its comparative advantage will become entrenched. Once again, mainstream pundits blame China’s success on government subsidies and unfair competition. This is just a pretext to argue for more government support in a sector which, from the very beginning, has not been driven by genuine consumer demand but by a political green agenda. China Leads in the...

Read More »The Economics of National Divorce, Part II

Tom Woods joins the show for a look at the hottest political topic of the day, namely national divorce. This is a spirited discussion of the politics, economics, and mechanics of how America might break up. Watch "The Economics of National Divorce, Part I" with Ryan McMaken: Mises.org/HAP352 [embedded content] [embedded content]...

Read More »Mill at a Loss

On John Stuart Millby Philip KitcherColumbia University Press, 2023; 152 pp. John Stuart Mill wasn’t Murray Rothbard’s favorite philosopher, and Philip Kitcher’s short book would confirm this dislike. Rothbard viewed Mill as a fuzzy thinker, overly prone to compromise and averse to firm principles. These qualities are among those that lead Kitcher to praise Mill, but Rothbardians nevertheless have much to learn from Kitcher, who is a leading analytic philosopher,...

Read More »Why Libertarians Should Support the Multipolar World

Western intellectuals and their political allies are pushing relentlessly toward a unipolar world. Freedom lies in the multipolar direction. Original Article: "Why Libertarians Should Support the Multipolar World" This Audio Mises Wire is generously sponsored by Christopher Condon. [embedded content] Tags:...

Read More »Artificial Intelligence Can Serve Entrepreneurs and Markets

Marketplace competition is reaching a new high with the era of artificial intelligence—deep machine learning capabilities offered to the entrepreneur as specialized services. AI tools as services spanning the marketplace are popping up at a rate that is seemingly increasing firms’ productivity and competitiveness. However, what implications do offering AI and deep learning as a service have for market operations, buyers, and sellers? When AI services and custom...

Read More »Ueda Day

Overview: Rising rates and falling stocks provided the backdrop for the foreign exchange market this week. The dollar appreciated against all the G10 currencies but the Swedish krona, which is still correcting higher after the hawkish pivot by the central bank. The market looks for a later and higher peak in the Fed funds rate. This coupled with the risk-off sentiment helped the dollar extend its recovery after falling since last September-October. The yen's...

Read More »No, Red State Economies Don’t Depend on a “Gravy Train” from Blue States

When Congresswoman Marjorie Taylor Greene called (again) for "national divorce" this week, a common retort among her detractors on Twitter was to claim that so-called red states are heavily dependent on so-called blue states to pay for pretty much everything. Reporter Molly Knight claimed, for example, that "Red states get their money for roads and cops and schools from blue states. You cut off that gravy train and you e [sic] got a third world country."...

Read More »The Forgotten Lessons of Government-Enforced Race Relations

Judge Andrew Napolitano looks at the history of government and race relations in our nation's history. It's not a pleasant or uplifting story. Original Article: "The Forgotten Lessons of Government-Enforced Race Relations" This Audio Mises Wire is generously sponsored by Christopher Condon. [embedded content] Tags:...

Read More »Saint Augustine, Proto-Austrian

In a past Mises Wire article, I’ve written about how Saint Thomas Aquinas’s definition of hope correlates incredibly well with what Carl Menger would describe in his definition a good six centuries later. This trend of religious figures like Aquinas and his later followers, the late Spanish scholastics, discovering economic truths despite studying theology, not economics, can be found often throughout the course of history. Tom Woods has explained this by stating:...

Read More »Why MTG Is Right About National Divorce

On this episode of Radio Rothbard, Ryan McMaken and Tho Bishop discuss this week's Twitter and media campaign by Congresswoman Marjorie Taylor Greene promoting the idea of national divorce. Ryan and Tho read through some of the tweets that the Representative from Georgia made about the practical advantages of a soft secession, as well as comments made by "Very Serious People" deeply offended at the suggestion. Is Marjorie Taylor Greene guilty of unforgivable high...

Read More » SNB & CHF

SNB & CHF