Bank shares rose in Japan and Europe for the second consecutive week, but the KBW US bank index fell nearly 2% after increasing 4.6% in the last week of March. Emergency borrowing from the Fed remains elevated ($149 bln vs. $153 bln). Bank lending has fallen sharply (~$105 bln) in the two weeks through March 29. This appears to be a record two-week decline. Commercial and industrial loans had fallen a little in the first two months of the year (before the bank...

Read More »Boeing 737 MAX Disasters’ Root Cause Was Government Regulation

On October 29, 2018, on Lion Air Flight 610 out of Jakarta, Indonesia, a Boeing 737 MAX’s safety control pushed the plane’s nose down hard, paused for five seconds, then repeated this cycle, over and over. The pilots fought to pull the nose back up, only to get overpowered again and again. The passengers fell back against their seats, then fell forward, over and over. The seconds stretched on across all these souls’ last moments alive. On March 10, 2019, on Ethiopian...

Read More »Were Recent Bank Failures the Result of Lax Regulation? In a Word, No

With the recent collapse of Silicon Valley Bank and Signature Bank, financial markets all around the world are on edge. Despite promises from the Federal Reserve that a “soft landing” of the economy is on the way, all signs point to an imminent “crash landing”! While the full consequences of these bank failures are yet to fully play out, a prized and popular scapegoat has already been trotted out to explain the current crisis: deregulation of financial markets....

Read More »Low Rates of Military Enlistment May Portend Prosperity Ahead

A century ago, the US coal industry was at its peak employing 883,000, and today, coal employs fewer than 41,000. Is that a bad thing? Is the US worse off because of this? Though it’s remarkable––that 95 percent fewer coal miners are needed to power a population that’s now 2.9 times larger––can you name someone who cares? Is declining employment in the coal industry a threat to “national security”? Do the majority bemoan the rapidly declining prevalence of black...

Read More »Central Banks Are Creating the Return of Mugabenomics

Robert Mugabe, once president for life of Zimbabwe, became infamous for hyperinflation and political repression. Today, he is becoming the patron saint of central banking. Original Article: "Central Banks Are Creating the Return of Mugabenomics" This Audio Mises Wire is generously sponsored by Christopher Condon. [embedded content]...

Read More »The Fed Is Fixated On Jobs Numbers, and That May Be a Good Thing

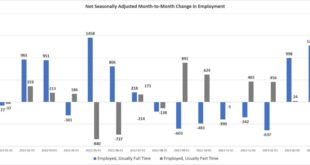

The Bureau of Labor Statistic (BLS) released new jobs data on Friday. According to the report, seasonally adjusted total nonfarm jobs rose 236,000 jobs (seasonally adjusted) in March, the smallest month-over-month jobs gain since December 2020. The unemployment rate fell slightly from from 3.6 percent to 3.5 percent (month over month). This has changed little since December 2022, and this reflects rising numbers in workforce participation as total employment...

Read More »If at First You Don’t Secede . . .

A Nation So Conceived: Abraham Lincoln and the Paradox of Democratic Sovereigntyby Michael P. ZuckertUniversity Press of Kansas, 2023; 416 pp. Michael Zuckert, a political philosopher who teaches at the University of Notre Dame, tries to make the best case he can for Abraham Lincoln, but in doing so he offers substantial material that supports those critical of the Great Emancipator. The book analyzes a number of speeches Lincoln gave, beginning with an early talk...

Read More »Wisdom from a Yenta

Philosopher Susan Neiman may be a leftist, but she recognizes the dangers of woke progressivism. Original Article: "Wisdom from a Yenta" This Audio Mises Wire is generously sponsored by Christopher Condon. [embedded content] Tags: Featured,newsletter

Read More »Presidents Are Legally Immune for Their Most Dangerous Crimes

Manhattan district attorney Alvin Bragg has charged former president Donald Trump with thirty-four felonies tied to his payments to two women prior to the 2016 election. Some pundits are outraged that a former president is facing charges, and others are jubilant that Trump now has a mug shot. But this case will do nothing to curtail the most dangerous immunities that presidents possess. Neither presidents nor any federal officials were entitled to break the law when...

Read More »Role Reversal: The Collapse of the Dollar-Enforced Empire

The Soviet empire started to crumble around 1989. The time period between the forming of the North Atlantic Treaty Organization (NATO) in the late 1940s and the retreat of Russia from Eastern Europe with the eventual collapse of communism in Russia is known as the Cold War. There was a great power confrontation in Europe that did not result in war. Essentially, US-led NATO stood its ground to prevent further Soviet expansion from the territory it occupied at the end...

Read More » SNB & CHF

SNB & CHF