Volatility returned to markets with a vengeance in the first half of this year. 2018 started off as an extension of last year when volatility was almost wholly absent. Stocks roared out of the starting gate, up almost every day until January 26th. And then – whoosh. What took nearly a month to gain took just 6 trading days to give back and then some. Since that correction, the S&P 500 has traded in a range with a...

Read More »Bitcoin — when mainstream?

Since the beginning of the year, Bitcoin has seen its price cut in half and beyond. Other crypto assets have fallen even more. Although the king of the crypto world has rebelled from time to time over recent months, Bitcoin’s occasional price increases have always been met with follow-up downturns. The crypto market is still mainly populated by private investors. Institutional investors, especially Wall Street, are not...

Read More »Swiss claim success in international cybercrime case

Experts have warned that international cybercrime needs increased cooperation between cross-border law enforcement agencies Two people suspected of illegally obtaining and using the e-banking data of Swiss bank customers have been arrested in the Netherlands. The Swiss Office of the Attorney General says the suspects were arrested near the city of Rotterdam and premises were searched in the coordinated operation between...

Read More »FX Daily, July 18: Greenback Extends Gains-For Now

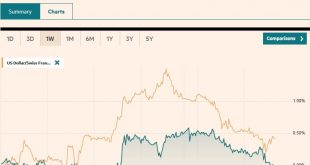

Swiss Franc The Euro has fallen by 0.21% to 1.1635 CHF. EUR/CHF and USD/CHF, July 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is at its best level here in July against the Canadian dollar. The CAD1.3265 area corresponds to a 61.8% retracement of the leg down in late June from almost CAD1.3390 to the recent low near CAD1.3065. The Australian dollar has...

Read More »Great Graphic: Fed Raising Rates, but Yields Still Negative

The yield on the 3-month US Treasury bill is pushing above 2% today for the first time since 2008. The yield had briefly dipped below zero as recently as late 2015. Although today’s yield seems high, this Great Graphic shows the nominal generic three-month yield going back to 1990. Then the three-month bill yielded 8%. The peak in the last cycle (2006-2007) was a little above 5%. It is true that in the past business...

Read More »US Money Supply and Fed Credit – the Liquidity Drain Becomes Serious

US Money Supply Growth Stalls Our good friend Michael Pollaro, who keeps a close eye on global “Austrian” money supply measures and their components, has recently provided us with a very interesting update concerning two particular drivers of money supply growth. But first, here is a chart of our latest update of the y/y growth rate of the US broad true money supply aggregate TMS-2 until the end of June 2018 with a...

Read More »Keith Weiner-Gold Backed Bonds, An Idea Who’s Time Has Come

Keith Weiner provides serious thoughts about an inevitable monetary reset triggered by Keynesian economics that has destroyed capital and currency price discovery.

Read More »Keith Weiner-Gold Backed Bonds, An Idea Who’s Time Has Come

Keith Weiner provides serious thoughts about an inevitable monetary reset triggered by Keynesian economics that has destroyed capital and currency price discovery.

Read More »What will the rest of the year bring?

Risk assets have disappointed this year and global equities were trendless, but as long as fundamentals can re-assert themselves, there could still be some life in risk markets. Global equities were trendless and the overall performance of risk assets lacklustre in the first half of 2018. But while trade tensions have been causing jitters and could continue to do so in the short term, as long as fundamentals are able...

Read More »FX Daily, July 17: Dollar on Back Foot Ahead of Powell

Swiss Franc The Euro has fallen by 0.21% to 1.1645 CHF. EUR/CHF and USD/CHF, July 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar eased in Asia session and the European morning. The greenback had appeared technically vulnerable, and the economic news stream is light. Sterling, unlike most of the other major currencies, remains within yesterday’s range....

Read More » SNB & CHF

SNB & CHF