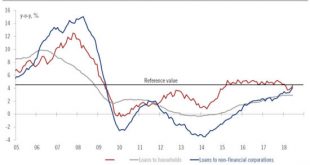

Rising bank credit flows confirm that domestic fundamentals remain solid across most of the euro area. The ECB’s M3 and credit report for June just published confirms that lending dynamics continue to be in a good shape in the euro area, boding well for private investment. Bank credit flows to non-financial corporations (adjusted for seasonal effects and securitisations) amounted to €10bn in June, down from €25bn in...

Read More »FX Daily, July 25: Narrow Ranges Prevail

Swiss Franc The Euro has risen by 0.04% to 1.1613 CHF. EUR/CHF and USD/CHF, July 25(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is trapped in narrow trading ranges. That itself is news. At the end of last week ago, the US President seemed to have opened another front in his campaign to re-orient US relationships by appearing to talk the dollar down....

Read More »Zurich Airport to Limit Night-Time Flight Traffic

Federal aviation authorities have decided to limit the number of time slots for planes at Switzerland’s main airport in Zurich. The Federal Office of Civil Aviationexternal link said it has ordered a freeze on landings after 9pm and for take-offs after 10:20pm to reduce the noise for residents living near the airport. - Click to enlarge Federal aviation authorities have decided to limit the number of time slots for...

Read More »Physical Gold Is The “Best Defence” Against “Escalating Currency Wars”

Physical Gold Is The “Best Defence” Against “Escalating Currency Wars” As governments around the world debase their currencies, you need an asset that can ride out the hard times. And nothing fits the bill like gold writes John Stepek of Money Week We’ve always said that you should have a bit of physical gold in your portfolio (about 5%-10%, depending). And note that, by gold, we do mean gold, not gold miners. If you...

Read More »Great Graphic: Is the Euro’s Consolidation a Base?

Speculators in the futures market are still net long the euro. They have not been net short since May 2017. In the spot market, the euro approached $1.15 in late-May and again in mid-June. Last week’s it dipped below $1.16 for the first time in July and Trump’s criticism of Fed policy saw it recover. Yesterday it reached $1.1750 before retreating. On the pullback, it held the 61.8% retracement of the recovery...

Read More »Mid-Year Global Update

[embedded content] Economic thoughts and analysis from Alhambra Investments CEO Joe Calhoun. Related posts: Mid-Year Global Markets Update Bi-Weekly Economic Review – (VIDEO) What will the rest of the year bring? Bi-Weekly Economic Review (VIDEO) Great Graphic: Two-year Rate Differentials Bi-Weekly Economic Review Bi-Weekly Economic Review...

Read More »FX Daily, July 24: China Turns To Domestic Stimulus, Weighs on Yuan but Lifts Stocks

Swiss Franc The Euro has risen by 0.22% to 1.1626 CHF. EUR/CHF and USD/CHF, July 24(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Following a record injection via the medium-term lending facility yesterday, China’s officials unveiled a set of policies designed to support the weakening economy that soon could face a substantial drag from US tariffs. The effort...

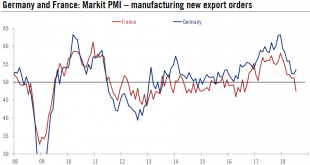

Read More »Euro area PMIs on the soft side

Fundamentals remain solid but the decline in some forward-looking indicators in July signal downside risk in the coming months. Markit’s euro area flash PMI surveys for July came in on the soft side. The composite PMI for the euro area fell to 54.3 in July from 54.9 in June, below consensus expectations. At the sector level, the manufacturing PMI index rose marginally, putting a halt to six consecutive months of...

Read More »Crying Wolf – Precious Metals Supply and Demand

Quantity Theory Revisited The price of gold fell another ten bucks and that of silver another 28 cents last week. Perspective: if you are waiting for the right moment to buy, the market is offering you a better deal than it did last week (literally, the market price of gold is at a 7.2% discount to the fundamental price vs. 4.6% last week). If you wanted to sell, this wasn’t a good week to wait. Which is your...

Read More »Legalization of cannabis soon to be tested in Switzerland?

First steps towards a legalization of cannabis in Switzerland? The Federal Council wants to allow life-size tests. --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or subscribe to our YouTube channel: Website: http://www.swissinfo.ch Channel: http://www.youtube.com/swissinfovideos Subscribe:...

Read More » SNB & CHF

SNB & CHF