"True Talk" puts people in front of the camera who are fighting prejudice or discrimination. They answer questions that nobody would normally dare to ask directly. --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or subscribe to our YouTube channel: Website: http://www.swissinfo.ch Channel:...

Read More »Stock Market Manias of the Past vs the Echo Bubble

The Big Picture The diverging performance of major US stock market indexes which has been in place since the late January peak in DJIA and SPX has become even more extreme in recent months. In terms of duration and extent it is one of the most pronounced such divergences in history. It also happens to be accompanied by weakening market internals, some of the most extreme sentiment and positioning readings ever seen...

Read More »FX Weekly Preview: Dog Days of August Begin

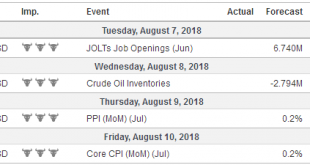

United States With most of the major central bank meetings and important economic data out of the way, the dog days of August are upon us. In terms of drivers, it means that players will have to look elsewhere for inspiration and it means that market liquidy is likely not at its best. That said, there are a few economic reports that will grab investors’ attention, even if briefly. Among them will be the US July CPI....

Read More »Emerging Markets: Preview of the Week Ahead

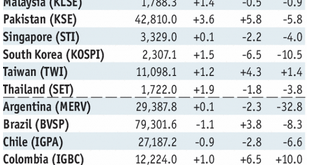

Stock Markets EM FX has come under pressure again due to ongoing trade tensions and rising US rates but saw some modest relief Friday after the PBOC announcement on FX forwards. This helped EM FX stabilize, but we do not think the negative fundamental backdrop has changed. Best performers last week were MXN, PHP, and PEN while the worst were TRY, ZAR, and KRW. Stock Markets Emerging Markets, August 01 - Click...

Read More »CEO of Baselworld steps down

Kamm was director of the MCH Group which organises the world’s largest watch fair in Basel since 2003. (Keystone) The head of the world’s largest watch and jewellery trade show, the Swiss-based Baselworld, has handed in his resignation amid a row over the departure of several exhibitors. The MCH Group announced that CEO Peter Kamm would resign from his position “in view of the fundamental transformation phase in...

Read More »#NewtonInterviews — Keith Weiner & Mickey Fulp on Monetary Matters

Enjoy this entertaining conversation on monetary matters with my special guest Keith Weiner, PhD. Thanks very much Mickey Fulp, the Mercenary Geologist, for suggesting. I can't believe we discussed monetary econmoics for 45 minutes and I wasn't triggered once! Got #gold? Read more from Keith here: https://monetary-metals.com/open-letter-to-the-banks/ Visit Mickey's website: http://www.goldgeologist.com/ Thanks for watching! #PatientSpeculator

Read More »#NewtonInterviews — Keith Weiner & Mickey Fulp on Monetary Matters

Enjoy this entertaining conversation on monetary matters with my special guest Keith Weiner, PhD. Thanks very much Mickey Fulp, the Mercenary Geologist, for suggesting. I can't believe we discussed monetary econmoics for 45 minutes and I wasn't triggered once! Got #gold? Read more from Keith here: https://monetary-metals.com/open-letter-to-the-banks/ Visit Mickey's website: http://www.goldgeologist.com/ Thanks for watching! #PatientSpeculator

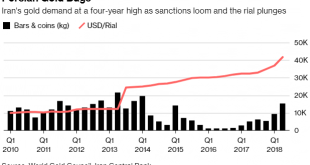

Read More »Gold to Enter New Bull Market – Charles Nenner

Gold to Enter New Bull Market – Charles Nenner “Gold is going to enter a new bull market” “The first cycle will bottom after the summer” “$1,212 per ounce is our downside target” “It’s going to top $2,500 per ounce . . . in about two years or so” “Gold is in a bull market even though it came down from $1,900 per ounce” In our featured video today, Greg Hunter interviews Charles Nenner, President of The Charles Nenner...

Read More »Swiss court blocks French request for UBS banking data

“It’s not concrete enough to suspect all French with a UBS account” when looking for tax evaders. Pictured here: UBS on Bahnhofstrasse in Zurich (Keystone) Switzerland’s Federal Administrative Court has ordered the Federal Tax Administration (FTA) not to provide France with details about 40,000 UBS bank clients with French addresses. In May 2016, the French tax authorities requested administrative assistance from the...

Read More »Great Graphic: Is Something Important Happening to Oil Prices?

Oil prices are weaker for the third straight day and are off in four of the past five sessions, the poorest run in two months. Supply considerations may threaten a year-old trend line. OPEC and non-OPEC, essentially Saudi Arabia and Russia are making good on their commitment to boost output, and US oil inventories unexpectedly rose. Saudi output appears to have risen by about 230k barrels per day. Production in Nigeria...

Read More » SNB & CHF

SNB & CHF