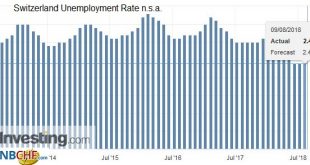

Unemployment Rate (not seasonally adjusted) Registered unemployment in July 2018 – According to SECO surveys, at the end of July 2018, 106,052 unemployed people were enrolled in the Regional Employment Centers (RAV), 527 less than in the previous month. The unemployment rate remained at 2.4% in the month under review. Compared to the same month of the previous year, unemployment fell by 27,874 (-20.8%). Switzerland...

Read More »Where have all the birds gone

Swiss ornithologists are alarmed: They have noticed a dramatic decline in bird populations in recent years. Since 2000 the number of skylarks in Switzerland has fallen by a third. Experts say it's a consequence of a general decline in biodiversity. (SRF/swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos...

Read More »FX Daily, August 09: Sterling Remains Under Pressure, while the Greenback Firms Broadly

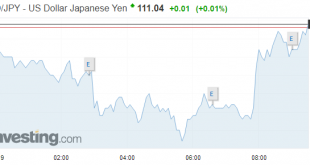

Swiss Franc The Euro has fallen by 0.48% to 1.1476 CHF. EUR/CHF and USD/CHF, August 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The global capital markets are mostly quiet. US sanctions on Turkey and Russia are pressuring their respective currencies, and the New Zealand dollar has slumped nearly 1.5% on the back of a dovish hold by the central bank. The Kiwi is...

Read More »US-Japan Trade Talks

The withdrawal of the US from the Trans-Pacific Partnership trade agreement lift it exposed on two fronts. First, the TPP was going to modernize the NAFTA. Without, the US remains locked in protracted negotiations. A breakthrough in talks with Mexico has been reportedly imminent for weeks. Talks with Canada have apparently not progressed very far in recently, and the US insistence on a sunset clause remains a...

Read More »Swiss Trade Unions to Boycott Talks on EU Labour Negotiations

Swiss Trade Union Federation President Paul Rechsteiner, pictured, said unions would go as far as forcing a referendum to ensure that Switzerland protects wages autonomously. (Keystone) Switzerland’s largest national trade union centre has refused to participate in discussions led by Swiss Economics Minister Johann Schneider-Ammann on easing measures for wages and working conditions as part of framework negotiations...

Read More »FGM abroad: prison sentence in Switzerland

Female Genital Mutilation (FGM): A mother in Switzerland has been given an 8-month suspended prison sentence. She had her two daughters genitally ... Nouvo brings you short videos about Switzerland, Swiss current affairs and the wider world. Keep up to date and watch the videos wherever you are, whenever you like. --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international...

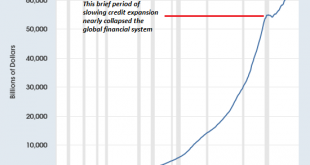

Read More »The Fantasy of “Balanced Returns” Funding Retirement

Consider how a “balanced portfolio” yielding “balanced returns” worked out for middle class retirees in Venezuela. The fantasy that a “balanced portfolio” yielding “balanced returns” will fund a stable retirement for decades to come is widely accepted as a sure thing: inflation will stay near-zero essentially forever, assets such as stocks and bonds will continue yielding hefty income and capital gains, and all the...

Read More »FX Daily, August 08: Sterling Can’t Get Out of Its Own Way, While Dollar and Yen Catch a Bid

Fears that the UK could leave the EU in a little over six months without an agreement continues to drag sterling lower. Recall that over the weekend, the UK’s International Trade Minister Fox suggested there was a 60% chance of a no-deal Brexit. A few days earlier BOE Carney said that although it was not the most likely scenario, the risks such a departure were “higher than comfort.” Sterling is lower for a fifth...

Read More »Gold—Even at its Lowest Levels in 2018—is Behaving Just as Prescribed

By: Rachel Koning Beals – News Editor Marketwatch Gold’s sharp decline over the past month serves as little surprise to the investors who want the asset to perform in just this fashion—that is, as an alternative to assets perceived as risky, like stocks. They’re betting that the opposite will be true as well, that gold will resume its role as protector and diversifier, even inflation hedge, when what they see as bloated...

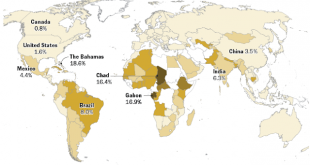

Read More »Some Initial Consequences of Trade Tensions

The Trump Administration argues that other countries have been taking unfair advantage of the US on trade for years, and what many are calling a trade war is really only the US finally saying enough. The US has taken many several countries, including China, to the WTO for trade violations and wins the vast majority of cases it has brought. It has become fashionable to talk about reciprocity and intuitively has much...

Read More » SNB & CHF

SNB & CHF