The defaults and currency crises in the periphery will then move into the core. It’s funny how unintended consequences so rarely turn out to be good. The intended consequences of central banks’ unprecedented tsunami of stimulus (quantitative easing, super-low interest rates and easy credit / abundant liquidity) over the past decade were: 1. Save the banks by giving them credit-money at near-zero interest that they...

Read More »Swiss take the Train more often, and further, than European Neighbours

On time, but increasingly crowded; trains in Switzerland. (© KEYSTONE / ENNIO LEANZA) The latest Europe-wide figures confirm Switzerland’s reputation as a country of trains, with average trips and kilometres covered per habitant far higher than elsewhere. Some 72 trips and 2,463 kilometres: this was the average train time for each Swiss resident in 2016, according to Eurostat figures reported Tuesday by Litraexternal...

Read More »Switzerland, Model of Freedom & Wealth Moving East – Interviews with Claudio Grass

Sarah Westall Interviews Claudio Grass Last month our friend Claudio Grass, roving Mises Institute Ambassador and a Switzerland-based investment advisor specializing in precious metals, was interviewed by Sarah Westall for her Business Game Changers channel. Sarah Westall and Claudio Grass There are two interviews, both of which are probably of interest to our readers. The first one focuses on Switzerland with its...

Read More »MACRO ANALYTICS – 10 04 18 – A Distorted Global Supply Chain w/Charles Hugh Smith

VIDEO NOTIFICATION SIGN-UP: http://bit.ly/2y63PvX-Sign-Up Thank you to all Macro Analytics/Gordon T Long YouTube followers. I will continue to add the following message to each video, which many have already seen to help all of those that haven’t learned of the new update. Thank you again for your support! To all Macro Analytics/Gordon T Long subscribers: YouTube recently made an update that can cause you not to receive notifications when a new video is published, even if you...

Read More »Swiss justice: Art collector must pay CHF11.4 million arrears on VAT

Swiss billionnaire and art collector Urs Schwarzenbach owns the most luxurious hotel in Zurich. Switzerland’s highest judicial authority has dismissed an appeal by the financier and art collector Urs Schwarzenbach who had been found guilty of tax evasion by lower courts. The Wednesday ruling by the Supreme Court obliges the 69-year-old billionaire – owner of The Dolder Grand Hotelexternal link in Zurich – to pay CHF11.4...

Read More »Perth Mint’s Gold and Silver Bullion Coin Sales Soar In September

Sales of gold products by the Perth Mint surged in September to their highest since January 2017, while silver sales more than doubled from August to mark an over two-year peak, boosted by lower bullion prices, the mint said on Wednesday. Sales of gold coins and minted bars surged 61 percent from August to 62,552 ounces last month, the mint said in a blog post. Gold sales in September rose about 35 percent from a...

Read More »FX Daily, October 05: US Jobs Data will Test Dollar Bulls and Bond Bears

Swiss Franc The Euro has risen by 0.11% at 1.1429 EUR/CHF and USD/CHF, October 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is firmer against most of the major and emerging market currencies. The yen and sterling are resisting the pressure, while the South African rand and Russian rouble are paring some of this week’s declines. US equity losses...

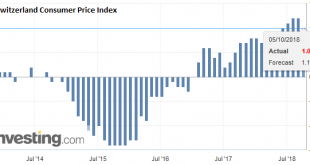

Read More »Swiss Consumer Price Index in September 2018: +1.0 percent YoY, +0.1 percent MoM

Neuchâtel, 5 October 2018 (FSO) – The consumer price index (CPI) increased by 0.1% in September 2018 compared with the previous month, reaching 101.9 points (December 2015 = 100). Inflation was 1.0% compared with the same month of the previous year. These are the results of the Federal Statistical Office (FSO). The 0.1% increase compared with the previous month can be explained by several factors including rising prices...

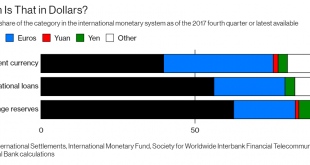

Read More »Great Graphic: The Dollar’s Role

This Great Graphic comes from Peter Coy and team’s article in Business Week. It succinctly shows three metrics for the internationalization of domestic currencies: global payments, international bonds, and foreign exchange reserves. It does not strike me as surprising, and the role of the euro as a payments currency reflects its role in intra-European trade. The substance of the article bears little relation to the...

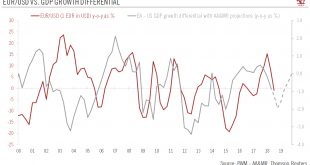

Read More »Further consolidation of EUR/USD rate likely

Short-term noise means we are neutral on the euro over the next three months, but see potential for its gradual appreciation against the dollar thereafter We have long argued that growth and interest rate differentials are two key components for the direction of the US dollar. Both these drivers should continue to support the dollar over the short term. Indeed, economic growth in the US is likely to be strong thanks...

Read More » SNB & CHF

SNB & CHF