The winding down of the North’s summer provides a suitable time to consider not the near-term outlook, which many investors do on a daily basis, but to reflect on where we are heading down the road a bit. What will the next 18-24 months hold? Of course, we harbor no illusions of prescient vision and accept the hazards of the assignment and so should the reader. The effect of monetary tightening and fiscal stimulus running its course, it seems reasonable to expect the end of the US business cycle. The Fed’s cycle will be completed. Allowing a modest gap between the last hike and the first cut could allow for a rate cut ahead of the November 2020 election. In some ways, President Trump’s criticism of the Fed policy

Topics:

Marc Chandler considers the following as important: $CNY, 4) FX Trends, EUR, Featured, GBP, JPY, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The winding down of the North’s summer provides a suitable time to consider not the near-term outlook, which many investors do on a daily basis, but to reflect on where we are heading down the road a bit. What will the next 18-24 months hold? Of course, we harbor no illusions of prescient vision and accept the hazards of the assignment and so should the reader.

The effect of monetary tightening and fiscal stimulus running its course, it seems reasonable to expect the end of the US business cycle. The Fed’s cycle will be completed. Allowing a modest gap between the last hike and the first cut could allow for a rate cut ahead of the November 2020 election. In some ways, President Trump’s criticism of the Fed policy now will deter claims later that that Fed easing is politically-motivated.

Evidence of late cycle behavior should be expected to accumulate. These include the 12-month moving average of non-farm payrolls and auto sales. While rising delinquency rates on credit cards and other debt-stress measures will rise, the end of the business cycle need not mark a credit crisis. In some ways, an important, even if overlooked characteristic of the economy is that after the violent disruptions of the Great Financial Crisis, the Great Moderation, characterized by relative longer and flatter business cycles remains intact.

However, around the time we expected the Federal Reserve to pause (Q2 19 or Q3 19), the European Central Bank may begin to gradually lift its deposit rate that is currently set at minus 40 bp. The expansion cycle will likely prevent a new ECB President (October 2019) from being too aggressive. Three-month EUIBOR may only turn positive in Q1 20.

Over this period, the UK will leave the EU. A risk of a disorderly exit appears to have increased but adjustments will be made, and a new equilibrium is likely to be found. The EU itself will have a new commission, parliament, and heads of several other institutions. This is a pivotal time for Europe. The reliance on the US is less assured. The UK may not be happy with the results, but its victory in securing a broader EU leaves the European project with an uncertain outlook. Many observers do not grasp the moment, though Merkel does.

We have argued that securing German interest and projecting its influence does not require a German at the head of the ECB. Regardless of Draghi’s replacement, the next President of the will begin what will be a thankless job of unwinding extraordinary policy. Our suspicions have been confirmed by recent press report suggest Merkel sees the EC President maybe the European Council as a more important than the central bank.

Tensions between the center-Brussels/Berlin/Paris-and the periphery, Spain, Italy, Greece, Portugal, and the Visegrad Group will ebb and flow. We expect a chronic low-grade fever with potential for occasional hallucinations, and while a full recovery in the period ahead is unlikely, the scar tissue is not terminal.

We expect further adjustments to Japan’s Qualitative and Quantitative Easing and Yield Curve Control policies, but the important takeaway is that these are likely to prove to be part of the new set of quasi-permanent policy tools for the Bank of Japan. Its balance sheet growth may slow (it seems reasonable to expect a reduction in ETF purchases over the next 18 to 24 months), and it may widen the band for the 10-year yield, but a band will persist. The next known unknown is the impact of the sales tax hike due in October 2019. Some of the impacts may be offset by increased government spending and/or incentives. The 2020 Olympics will be a showcase for Prime Minister Abe.

| China can be counted on to report largely steady growth over the next 18-24 months. China appears to have a four-prong strategy. First, prepare for sustained trade conflict with the US over the period. The likes of Lighthizer, Navarro, and Ross dominate the administration’s confrontational thrust. This means China will blunt the headwinds through monetary and fiscal policy and seek trade offsets for both inputs and markets. It is hardly scratched the surface of what is possible to entice foreign capital. Second, it will seek to engage the US in talks when possible, but the US reversal of an agreement in May, under which China would have stepped up its purchases of US goods, has soured the atmosphere.

Third, China will go ahead with its broad strategy and cautious opening up of its economy to foreign producers. This includes the recent easing of foreign ownership rules for banks and asset managers. China’s Belt and Road Initiative will proceed, but poor lending and governing practices that will more uneven and fragmented Fourth, given the trade imbalance, China is not able to match the US escalation in the tit-for-tat tariff moves, but it can be expected to find asymmetrical ways to express its displeasure. Moreover, the extensive use by the US of sanctions and embargos creates opportunities for China to frustrate US aims. |

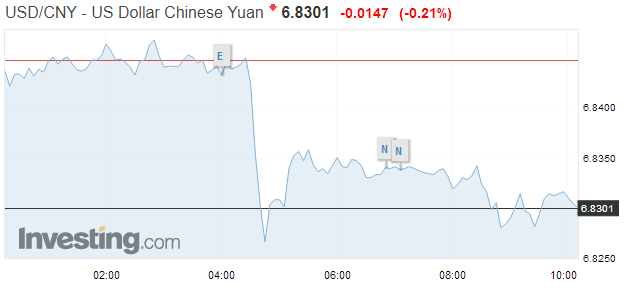

USD/CNY, August 31 |

The environment for many emerging market countries may not change for the better, despite what some see as attractive valuation measures until investors have greater confidence that the policy mix in the US (tighter monetary policy and looser fiscal policy), which is sucking in the world’s savings, is going to change. That may still be a year away. At the same time, the sharp currency depreciations seen in several countries will see produce dramatic improvement in external balances, while the domestic weakness that will ensue reduces demand for foreign goods.

Meanwhile, the US trade deficit is likely to continue to deteriorate despite (and partly because of) the tariffs and threats of more tariffs. The expansionary fiscal policy runs counter to the efforts to reduce the trade deficit as part of the aggregate demand (~15%) will be meet by foreign-generated supply. The tariffs the US imposes boosts the price of those goods in the US, and to the extent that some of the imported goods are used in exports, it lifts their prices, which also makes them less competitive.

To preserve the World Trade Organization, substantial reforms are necessary. Part of the US and, to a less extent, the European argument is that the current WTO rules did not anticipate China’s machinations. Talks to modernize the WTO are underway, and while nothing is imminent, preliminary results are possible over the next couple of years.

The world was torn asunder after the Great Depression. The years after the Great Financial Crisis have challenged the liberal global order that emerged after WWII. That rear-guard action has not been turned back and can be expected to persist in the period ahead. Economic rivalries have supplanted ideological divisions. Geopolitics has may receive less attention, but a new block is forming, with Russia, Iran, Syria, and possibly Turkey.

Tags: #GBP,#USD,$CNY,$EUR,$JPY,Featured,newsletter