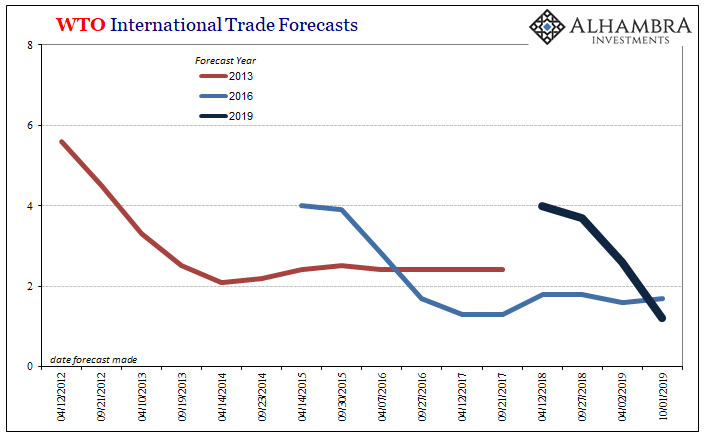

The WTO today downgraded its estimates for global trade growth. In April, the international organization had figured the total volume of world merchandise trade would expand by about 2.6% in all of 2019 once the year closed out on the anticipated second half rebound. Everyone took their lumps in H1 and the WTO like central bankers everywhere were thinking “transitory” factors. Last September, the same outfit was still forecasting trade growth would nearly reach 4% in 2019 as first believed back in April 2018. The arrival of “trade wars” into mainstream attention wasn’t originally figured to be a substantial pressure on total global trade, let alone the whole global economy. A minor nuisance at first, it’s only been as actual activity has died off that officials

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, 5) Global Macro, currencies, economy, EuroDollar, Featured, Federal Reserve/Monetary Policy, global dollar shortage, global trade, Markets, newsletter, trade sentiment, Trade Wars, WTO

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

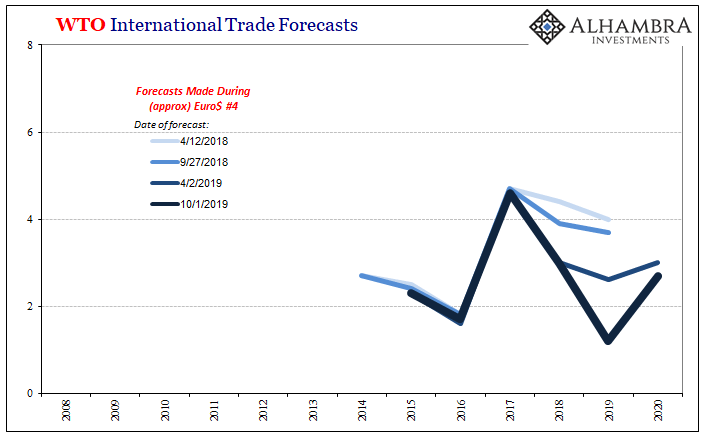

The WTO today downgraded its estimates for global trade growth. In April, the international organization had figured the total volume of world merchandise trade would expand by about 2.6% in all of 2019 once the year closed out on the anticipated second half rebound. Everyone took their lumps in H1 and the WTO like central bankers everywhere were thinking “transitory” factors.

Last September, the same outfit was still forecasting trade growth would nearly reach 4% in 2019 as first believed back in April 2018. The arrival of “trade wars” into mainstream attention wasn’t originally figured to be a substantial pressure on total global trade, let alone the whole global economy.

| A minor nuisance at first, it’s only been as actual activity has died off that officials and Economists are having to go back and rethink.

In the latest set of estimates, October 2019, trade is now forecast to grow by just 1.6% this year. That’s the lowest level since the Great “Recession” – and there is plenty of time for that number to be marked down even more. To try to explain why such crucial economic activity keeps falling off far more than anyone thought was possible, “trade wars” is stretched further and further into “trade sentiment.” According to WTO Director-General Roberto Azevêdo he says they knew this would happen. Seriously:

|

WTO International Trade Forecasts, 2008-2020 |

| Sorry, Mr. Azevêdo, the history of your forecasts shows otherwise. You had no idea this was coming and now that you are finally taking it seriously we have to ask why we should take you seriously about why it has happened.

Today’s press release basically calls everything into question.

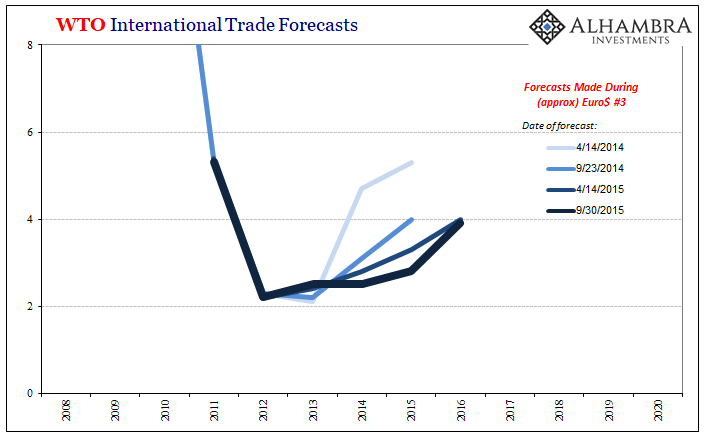

They don’t know what’s really going on, bad things are more likely to happen even if the WTO can’t really specify exactly what they might be. According to their view, which is only now catching up to reality, the downside risks are real and due to pretty much any reason you can think of. Something is wrong, that’s all they really know. But this is nothing new, nothing new at all – even at the WTO. As I have to point out each and every time, we’ve been through this exact same exercise three times before 2018. And it unfolds in exactly the same way every time. |

WTO International Trade Forecasts, 2008-2020 |

| Economists see a reflationary outline in the global economy and rather than being skeptical as to its meaningfulness they immediately assign it into the recovery bucket – simply because they are overeager to pin success on especially what they see as the brilliant monetary policies of their Economist colleagues at each central bank. |

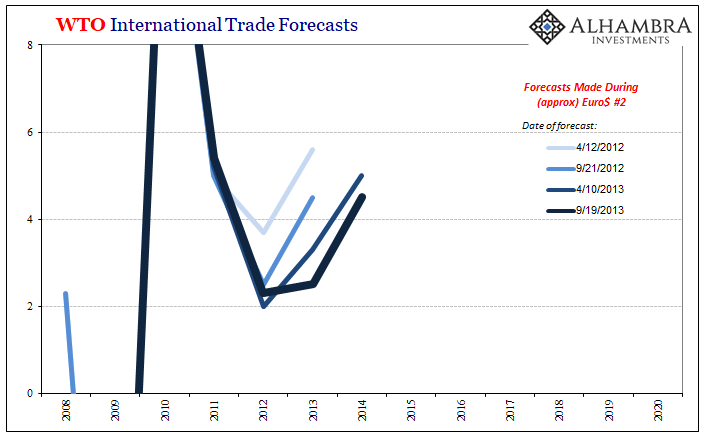

WTO International Trade Forecasts, 2008-2015 |

| They fail to account for any other possible underlying influences, especially global money, and therefore improperly discount the risks embedded within the substantial differences reflation versus recovery. In the former, the global economy can be (and has been) turned around by the arrival of the next global monetary problem in what has been an ominous (and obvious) series of them. |

WTO International Trade Forecasts, 2012-2019 |

| What was supposed to be sustained recovery devolves predictably into…something. It’s only the latest iteration that is being blamed on trade wars, but if you recognize how the pattern has repeated then you can’t consider that as the underlying cause. Trade wars may not help, and may be harmful, but the original estimates show how Economists were thinking they wouldn’t have much impact globally and that’s probably the only thing they’ve gotten right here.

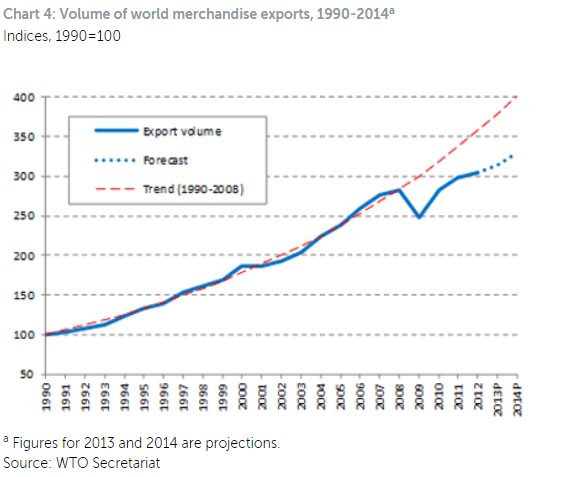

Which is a very real shame. It wasn’t all that long ago when the WTO had realized a scenario much closer to the truth; how there was some structural reasons to doubt the “recovery” and those being passed right through the global trade channel. In their April 2013 forecast release, for example, the following chart shows up for the first time. |

Volume of world merchandise exports, 1990-2014 |

| It is pretty recognizable given how it shows up the same way pretty much everywhere around the world. |

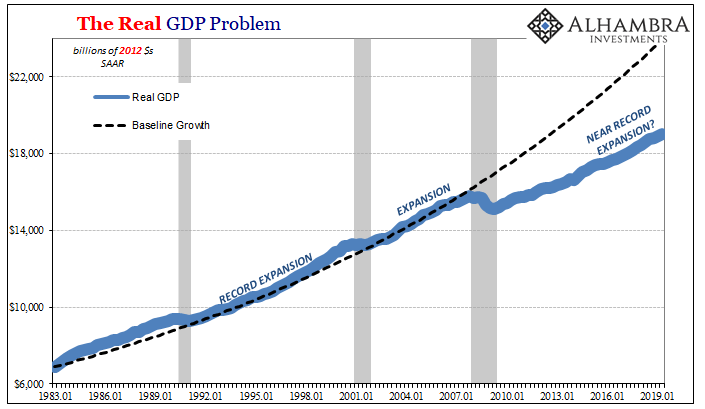

The Real GDP Problem, 1983-2019 |

| The severity of the Great “Recession” had Economists expecting full and complete recovery would be somewhat delayed because of its depth, broadness, and severity. But then in 2011 and 2012 the global economy was hit (what we call around here Euro$ #2) and it left all these mainstream parties to wonder about how something else must’ve happened instead. Not quite recovery, always just short of one. |

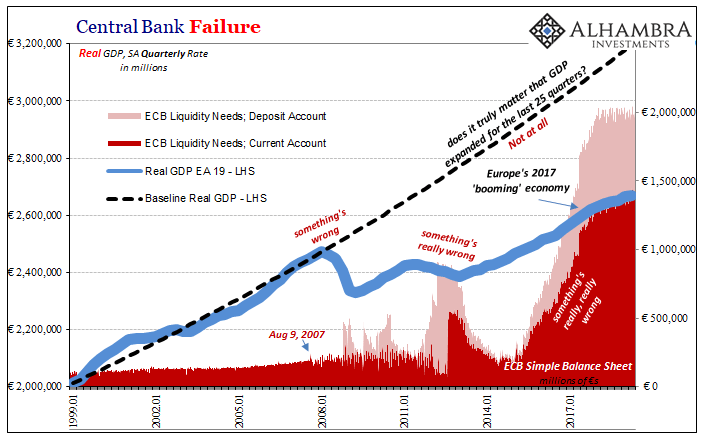

Central Bank Failure, 1999-2017 |

At that time, in April 2013, they tried to maintain the recovery expectation but couldn’t help but wonder:

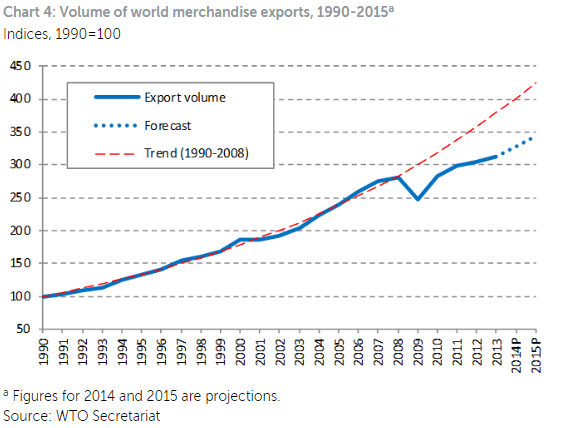

When or if it will manage to bridge the gap with its pre-crisis trend remains to be seen. In other words, they kept forecasting how trade would flip into a more recognizable acceleration (and why not? Ben Bernanke and Mario Draghi kept telling the world to expect this and everyone just follows along) but also realizing something was different about it One year later, in April 2014, Euro$ #3 had already begun (especially CNY) and the WTO began to revisit and even revise this weird baseline. By then, they were no longer so sure about even the mean reversion they had been predicting just one year earlier:

|

Volume of world merchandise exports, 1990-2015 |

The WTO had back then no choice but to recognize the very real possibility of a permanent shift in global circumstances.

Long before there was ever “trade wars”, “trade sentiment” or whatever excuse of the day, the WTO had made the stunning realization that 2008 had been a paradigm shift. What had been a durable global trend (globalization) came to a screeching halt and despite every expectation it would just go back to the way things were it never did.

Why?

You would think an organization dedicated to global trade of all things would be hellbent to figure it out. That’s their entire purpose.

Instead, they’ve just moved on in concert with every central banker. If 2014 and 2015 wasn’t the time for global acceleration, and it wasn’t (Euro$ #3), then 2017 and globally synchronized growth would have to be. One stupid little bumper sticker slogan and everything that had been realized before that point was thrown out the window because Economists wanted only to declare success. Forget everything else, the world’s all good now.

They weren’t interested in the truth; they were interested in pre-validating their preexisting notions and the models based on them. They wanted their damn parade and worldwide thank yous.

That’s really all “trade wars” are. For Economists like those at the WTO, 2018 is rewritten as some kind of Year Zero; a new starting point for all interpretations, an opportunity to just forget about the past and all the questions raised during it. What was written and digested years ago no longer registers. If it did, and it should, nobody would still be taking tariffs and protectionism so seriously.

Their initial instincts last year were right – trade wars weren’t anything to be concerned about. It’s all the other stuff they’ve now forgotten and left criminally uninvestigated. That’s what’s really going on here. And at one time half a decade the WTO was at least thinking about the big picture. They need to go back to it.

Otherwise, following the increasingly nasty prospects for Euro$ #4 it will only be a Reflation #4 rather than the badly needed Recovery #1. And in a few years’ time everyone will be right back here downgrading forecasts all over again – while the global economic gap only grows wider and wider and wider, and all the non-economic dangers that entails.

Tags: currencies,economy,EuroDollar,Featured,Federal Reserve/Monetary Policy,global dollar shortage,global trade,Markets,newsletter,trade sentiment,Trade Wars,WTO