Two main developments drove the foreign exchange market in October. First, the market grew more confident that a hard Brexit could be avoided. This drove sterling sharply higher. It rallied from $1.22 on October 10 to a little above $1.30 on October 21 before doubts grew about the likelihood that Parliament will approve the new agreement. The other development was a heavier US dollar after strong gains over the past three months. The prospect that the US-China tariff...

Read More »The Middle Class Is Now The Muddle Class

The net result is the muddle class has the signifiers but not the wealth, power, capital or agency that once defined the middle class. The first use of the phrase The Muddle Class appears to be The rise of the muddle classes (Becky Pugh, telegraph.co.uk) in January 2007. The “muddle” described the complex nature of defining “the middle class,” which includes education, class origins, accents, and many other financial, social and cultural signifiers. Comedian Jason...

Read More »Targeting nGDP Targeting, Report 3 Nov

Not too long ago, we wrote about the so called Modern Monetary so called Theory (MMT). It is not modern, and it is not a theory. We called it a cargo cult. You’d think that everyone would know that donning fake headphones made of coconut shells, and waving tiki torches will not summon airplanes loaded with cargo. At least the people who believe in this have the excuse of being illiterate. You’d think that everyone would know that printing fake money and waving bogus...

Read More »FX Daily, November 4: Investor Optimism Carries into the New Week

Swiss Franc The Euro has risen by 0.16% to 1.1015 EUR/CHF and USD/CHF, November 4(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Investor optimism is reflected by the risk-taking appetite that is lifting equity markets and bond yields. With Japanese markets closed for a national holiday, the MSCI Asia Pacific Index was led higher by more than 1% gains in Hong Kong, Taiwan, South Korea, and Thailand. The...

Read More »Why Nestlé won’t meet its zero-deforestation pledge

Around 20% of Nestlé’s palm oil is sourced from small farmers. When it came under fire from environmental groups over its harvesting of palm oil, Swiss food giant Nestlé committed to eliminating deforestation from its supply chain by next year. But it will take another three years to come close to accomplishing that goal. The year 2010 was a tough one for Nestlé. In March of that year, the environmental activist group Greenpeace uploaded a disturbing videoexternal...

Read More »Gretchen-Parlament: Für Thomas Jordan ein Segen

„Gretchen-Parlament“ – diesen Ausdruck wählte ich in Anlehnung an die grüne Greta und ihre Jünger und Jüngerinnen europaweit. Kann von einem legalen Wahlkampf die Rede sein? Grüne Frauen wurden gewählt aufgrund sexueller Übervorteilung. Ich selber war Ständeratskandidat in Basel, wurde aber an keine einzige Podiumsdiskussion zugelassen. Women only. Keine der Ständeratskandidatinnen hatte den Stolz und forderte, mit den Männern auf Augenhöhe anzutreten – alle...

Read More »USD/CHF technical analysis: Repeated bounces off 50 percent Fibo. keeps bullish bias intact

USD/CHF nears 100-day SMA amid yet another bounce off 50% Fibonacci retracement. 61.8% of Fibonacci retracement adds support to the downside. With its yet another bounce off 50% Fibonacci retracement of August-October advances, USD/CHF nears 100-day Simple Moving Average (SMA) while taking the bids to 0.9865 amid initial trading on Monday. Should prices manage to close beyond a 100-day SMA level of 0.9871, early October lows near 0.9900 and 0.9940/43 resistance...

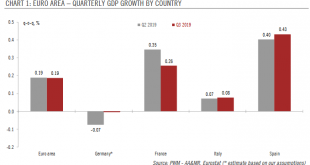

Read More »Steady euro area growth and rise in core inflation

According to Eurostat’s preliminary figures, euro area GDP grew by 0.2% quarter on quarter in Q3, the same pace as in Q2 and in line with our expectations. Country wise, France, Italy and Spain grew at the same pace in Q3 as in Q2. In particular, household and investment spending grew at a solid pace in both France and Spain. The preliminary GDP figure for Germany will not be released until 14 November. But based on the country data released so far and assuming...

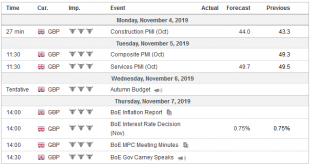

Read More »FX Weekly Preview: Synchonized Emergence from Soft Patch?

There have been plenty of developments warning of a global economic slowdown. Yet, seemingly to justify the continued advance in equity prices, there has begun to be talk of possible cyclical and global rebound. That is the new constellation, connecting the better than expected Japanese, South Korean, and Chinese September industrial output figures, a slightly stronger than expected Q3 GDP reports from the US and the eurozone. Ahead of the weekend, China reported...

Read More »EM Preview for the Week Ahead

EM should continue to benefit from the generalized improvement in the global backdrop. Trade tensions have eased whilst the risks of a hard Brexit have fallen, at least for now. Yet recent developments in some major EM countries underscores how important it is for investors to differentiate between the strong credits and the weak ones. For instance, South Africa, Hong Kong, Argentina, and Chile all come with idiosyncratic risks. AMERICAS Chile reports September GDP...

Read More » SNB & CHF

SNB & CHF