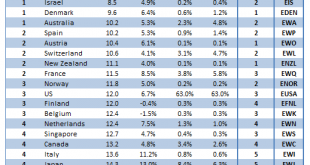

Global equity markets continue to power higher US-China trade tensions have eased MSCI World made a new all-time high today near 2290 and is up 23% YTD Our 1-rated grouping (outperformers) for Q4 2019 consists of Ireland, Sweden, Israel, Denmark, and Australia Our 5-rated grouping (underperformers) for Q4 2019 consists of the UK, Hong Kong, Greece, Germany, and Portugal Since our last update on August 21, our proprietary DM equity portfolio has risen 6.7%, slightly...

Read More »CNBC is careful to admit that owning GLD is not owning gold

Chris Powell of GATA writes today about how he finds it interesting that CNBC are careful to admit that owning the GLD ETF is not the same thing as owning physical gold, a theme that has run strongly throughout our market commentaries for many years. He writes… Two cheers for today’s CNBC report celebrating the 15th anniversary of the gold exchange-traded fund GLD, since the report does not pretend that owning GLD is the same as owning the monetary metal itself....

Read More »Does Economic Theory Work in Business?

Marketing guru and fund investor Hunter Hastings joins the Human Action podcast for a look at Economics for Entrepreneurs, a new platform which uses Austrian theory to teach actionable entrepreneurship. Can business acumen be taught, or is it innate? Hunter and Jeff examine consumer sovereignty, value creation, and the theory of the firm, all from a unique Austrian perspective. Austrians have a lot to say about how entrepreneurs ought to think, while business...

Read More »FX Daily, November 20: Dollar Snaps Back

Swiss Franc The Euro has risen by 0.14% to 1.0984 EUR/CHF and USD/CHF, November 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The idea that a US-China trade deal is proving more elusive than the agreement in principle on October 11 implied is being seized upon to spur what we suspect is an overdue round of profit-taking in global equities. The MSCI Asia Pacific Index snapped a three-advance, with over 1%...

Read More »Switzerland excels at attracting talent, but can do better

The high cost of living, especially accommodation, was a deterrent but not enough to cost Switzerland the top spot. (Keystone / Salvatore Di Nolfi) For the sixth consecutive year, Switzerland clinched the top spot in the annual global ranking of the Lausanne-based IMD business school. The 2019 editionexternal link of the IMD World Talent Ranking ranked Switzerland highly in the three areas assessed. It came first in appeal, second in investment and development...

Read More »Julius Bär takes CHF99 million hit on ailing Italian unit

Julius Bär has fallen short of expectations for new assets it can attract from the wealthy. Swiss wealth manager Julius Bär has downgraded its expectations for attracting new assets from rich clients and announced a CHF99 million ($100 million) write-down on its troubled Italian subsidiary Kairos. Julius Bär issued the warning on Tuesday, less than three months into the tenure of new CEO Philipp Rickenbacher. Although assets under management have grown 10% so far...

Read More »Political and Social Conflict Is Accelerating: Here’s Why

All the status quo “fixes” only hasten the collapse of the status quo. That economic, social and political conflict is accelerating is self-evident. What’s open to debate are the core drivers of conflict / disorder /unraveling. Here’s the core self-reinforcing dynamic in my view: 1. The status quo elites can no longer mask soaring costs of essentials nor soaring wealth / income inequality between the top .01% (Oligarchs), the top 9.99% who enrich the Oligarchs with...

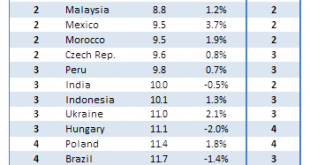

Read More »EM FX Model for Q4 2019

EM FX has rallied sharply in recent weeks, helped by growing optimism that we’ve seen the worst of the US-China trade war Given our more constructive outlook on EM, we believe MSCI EM FX should eventually test the 1657.50 high from July We see continued divergences within the asset class Our 1-rated (strongest fundamentals) grouping for Q4 2019 consists of TWD, THB, PHP, CNY, and KRW Our 5-rated (weakest fundamentals) grouping for Q4 2019 consists of ZAR, TRY, LKR,...

Read More »Swiss company shares traded as digital tokens

DLT promises to make trading securities faster and cheaper. (Keystone / Patrick Sinkel) A Swiss-German consortium has successful traded company shares on a blockchain-style digital platform using a Swiss franc-backed stablecoin to instantly settle the transaction. The trade marked a significant step towards creating a new breed of stock exchange. Germany’s largest stock exchange Deutsche Börse teamed up with telecommunications company Swisscom, three Swiss banks and...

Read More »Don’t Want a Liquidity Trap? More Saving Is the Answer

With interest rates in many countries close to zero or even negative, some commentators are of the view that monetary policy of the central banks are likely to become less effective in navigating the economy. In fact it is held that we have most likely reached a situation that the economy is approaching a liquidity trap. But what does this mean? In the popular framework of thinking that originates from the writings of John Maynard Keynes, economic activity is...

Read More » SNB & CHF

SNB & CHF